Over the years, the online commerce sector in India has undergone multiple watershed events.

Aadit Palicha (left) and Kaivalya Vohra, cofounders, Zepto

Walmart’s $16 billion acquisition of Flipkart in 2018 took the ecommerce marketplace off the fundraising treadmill and strengthened its position against US major Amazon.

Two years later, the Covid-19 pandemic led to a surge in online consumption, including segments such as online shopping, grocery, payments and even education. While some sectors lost steam after the pandemic receded, the commerce story was again undergoing a shift.

Close on the heels of the pandemic, a new form of commerce emerged with platforms delivering groceries to their customers within 10 minutes. While novel and untested at the time, the sector quickly started gaining traction.

The next milestone for the sector happened when SoftBank and Tiger Global-backed Blinkit, formerly Grofers, was acquired by food delivery giant Zomato in 2022. The $570-million bet by the Gurgaon-based company sent a signal that quick commerce was primed for a serious play.

Earlier, Zomato’s chief rival Swiggy had also started delivering groceries through its Instamart vertical.

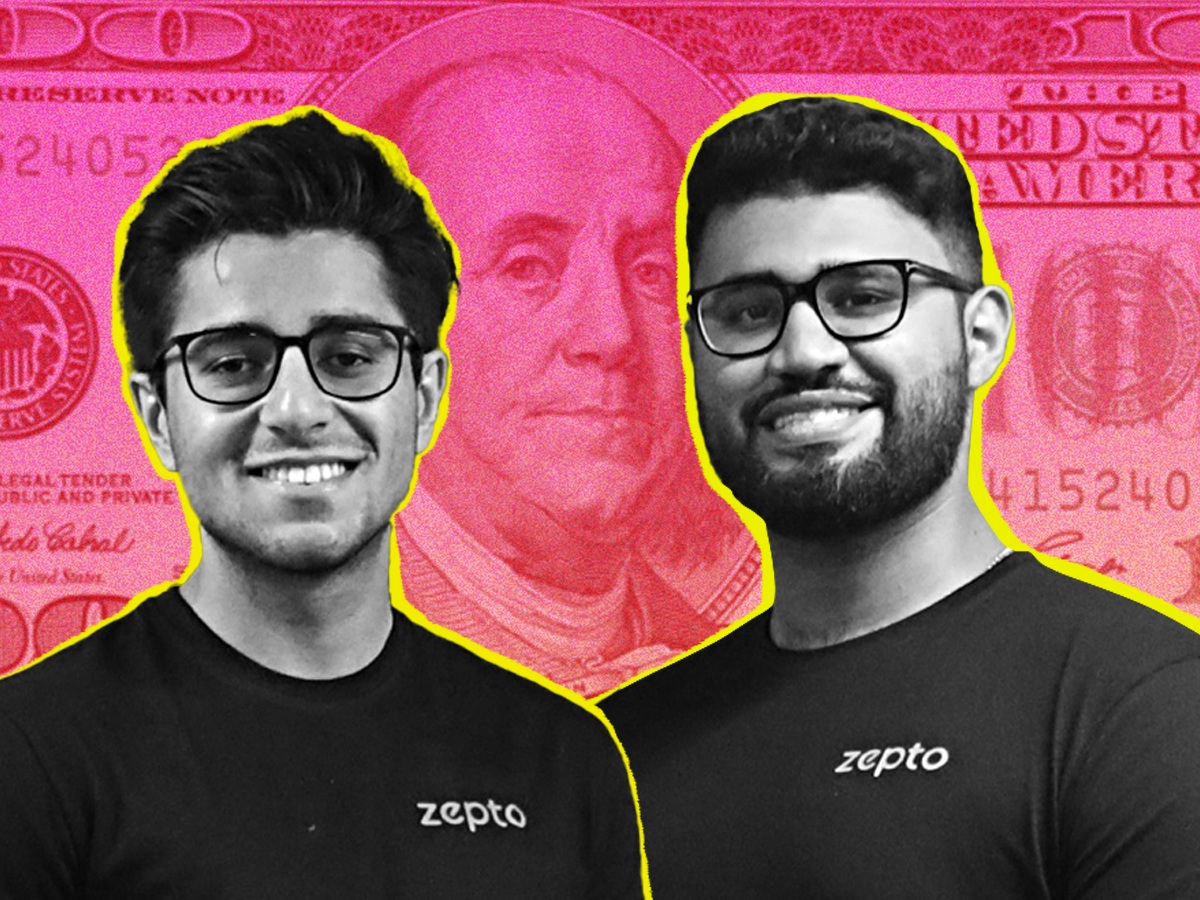

Also, in 2021, Mumbai-based Zepto raised $60 million in its Series A round, announcing its arrival on the 10-minute delivery battlefield.

On Friday, Nexus Venture Partners-backed Zepto announced raising a massive $665 million – leaving no doubts that the quick commerce market is about to heat up.

Zepto’s fundraise has a backdrop of Swiggy’s upcoming $1.25 billion initial public offering (IPO) – $450 million of which will be fresh capital.

Zomato, too, sitting on $1.5 billion in cash, sees its quick commerce business becoming bigger than its mainstay food delivery vertical soon.

Players in the segment, meanwhile, did not stop at delivering groceries in 10 minutes. They have added products ranging from beauty products and apparel to consumer electronics and jewellery.

At ETtech, we have brought you all the developments in quick commerce through our detailed coverage of the space.

Stay tuned to know how the latest capital infusion into Zepto impacts the workings of this fledgling sector.

Scoop street

Paytm CEO Vijay Shekhar Sharma and Zomato CEO Deepinder Goyal

Zomato in talks to acquire Paytm’s movies, ticketing business: Food delivery company Zomato is in advanced negotiations to acquire Paytm’s movie ticketing and events division as the Deepinder Goyal-led firm looks to double down on its ‘going-out’ businesses. The deal may value Paytm’s vertical at Rs 1,600-1,750 crore, sources said.

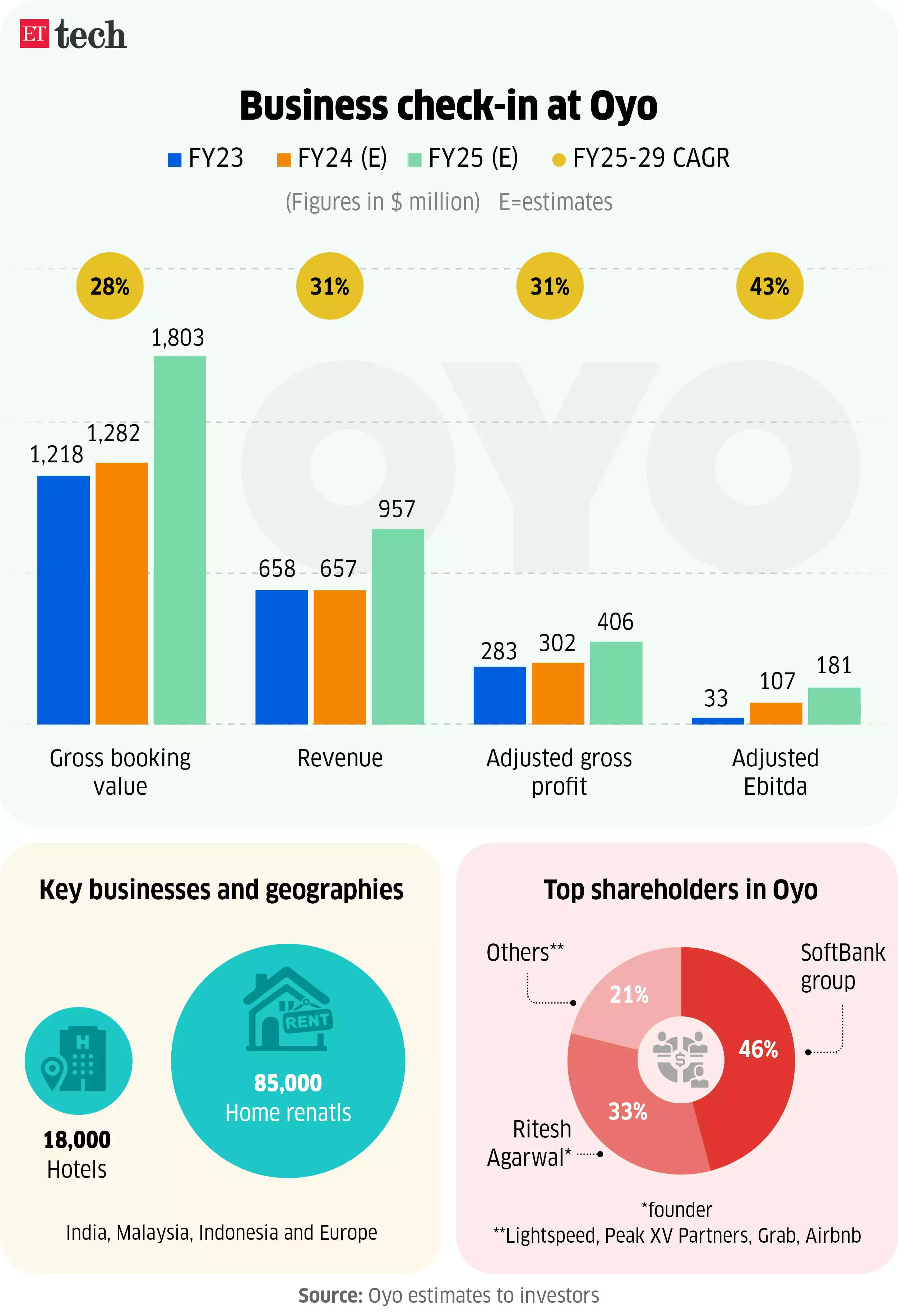

Oyo eyes Rs 1,000 crore fundraise from Indian family offices: Hospitality startup Oyo is at an advanced stage of talks to raise around Rs 1,000 crore ($120 million), primarily from the family offices of top Indian corporate executives and stock market experts, said people aware of the move.

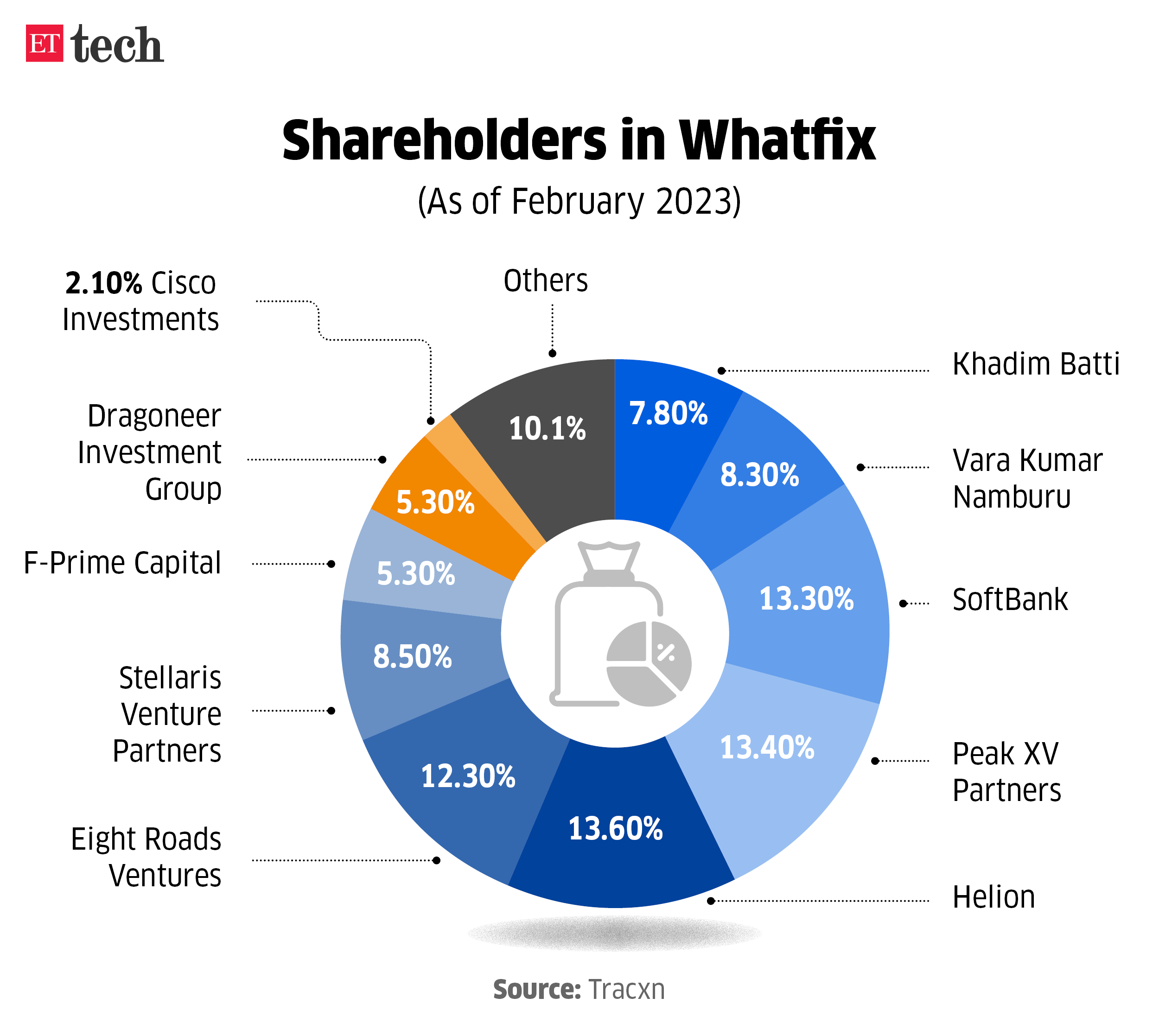

Warburg Pincus may lead $150-million funding round in Whatfix | Private equity firm Warburg Pincus is set to lead a $100-150 million (about Rs 833 crore to Rs 1,250 crore) funding round in SoftBank-backed software-as-a-service (SaaS) firm Whatfix, said people with knowledge of the matter.

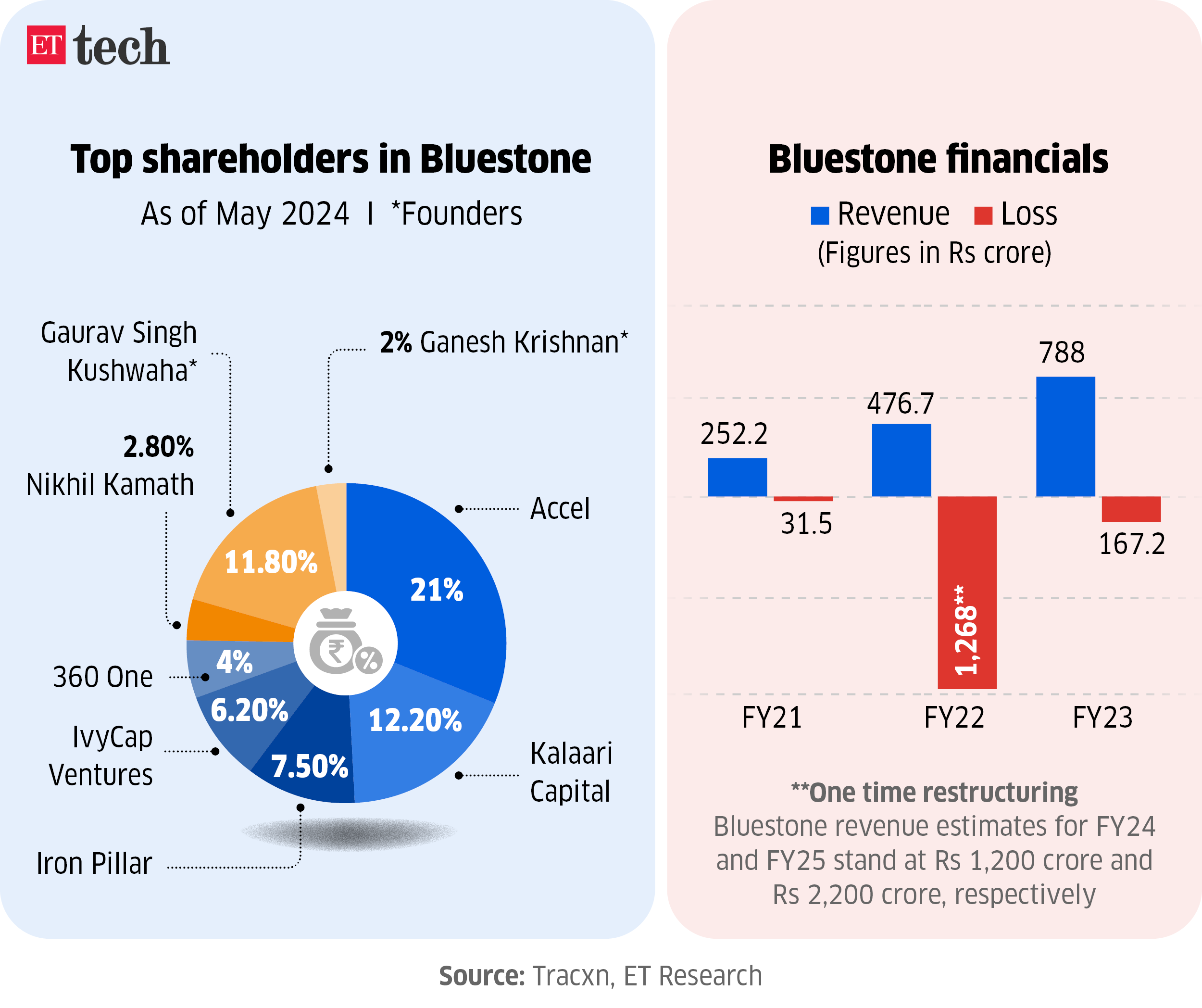

Peak XV Partners, Steadview, Think Investments line up to fund Bluestone | Jewellery retailer Bluestone is negotiating an investment of about Rs 830 crore ($100 million) from Peak XV Partners, Steadview Capital and Think Investments, people aware of the matter said.

This pre-IPO (initial public offering) round will be a mix of share sale by early backers and fresh capital infusion that is expected to value the omnichannel retailer at around Rs 7,500 crore ($900 million) pre-money, they added.

Top Stories This Week

(L-R) Venture Highway’s Neeraj Arora and Priya Mohan; General Catalyst’s Hemant Taneja

General Catalyst acquires Venture Highway; will deploy up to $1 billion in India | Silicon Valley-based venture capital firm General Catalyst, which has backed global tech giants such as Airbnb, Snap, Canva and Stripe, said it will acquire India-focused early-stage investor Venture Highway as it looks to broaden its presence here.

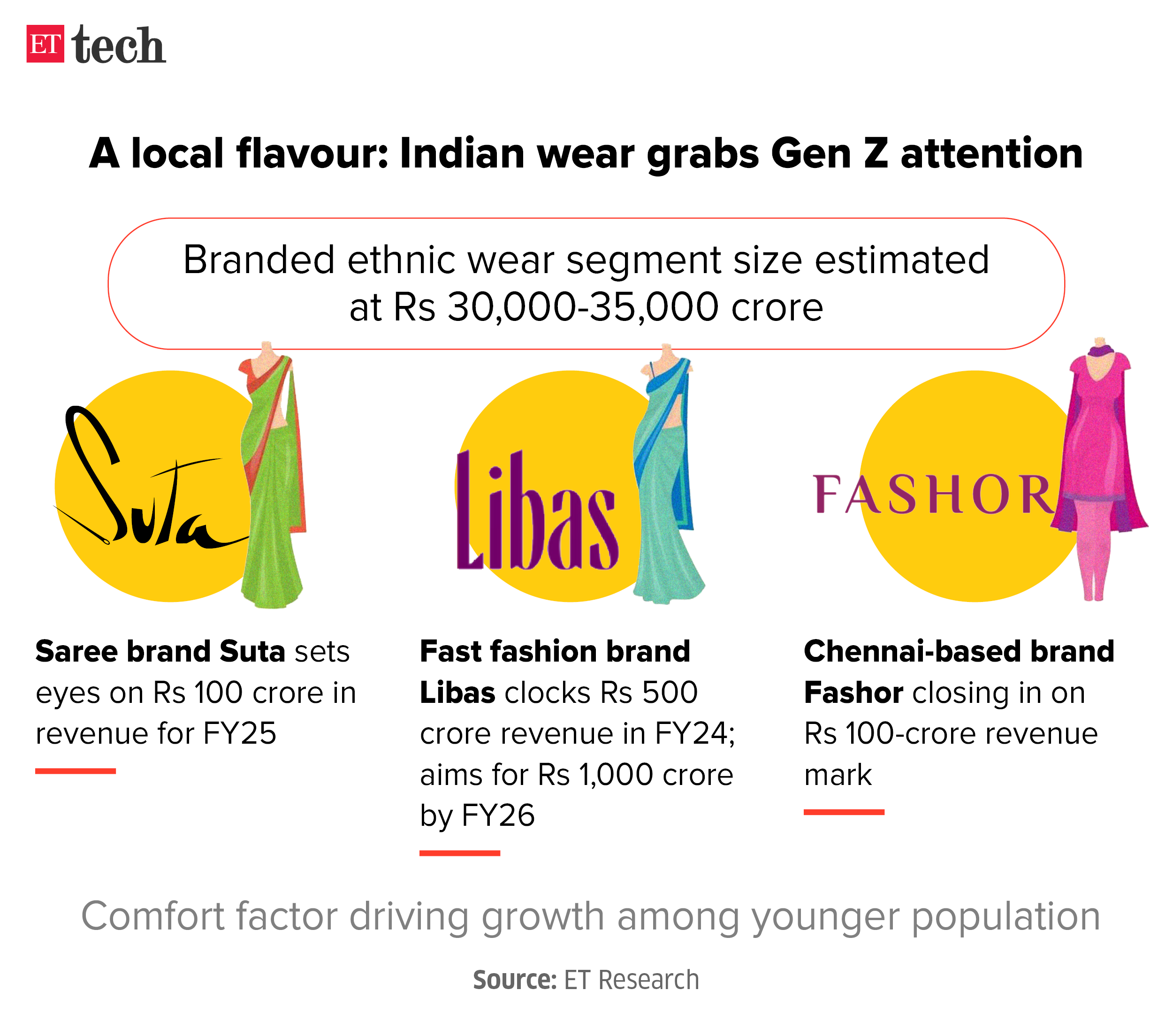

As Gen Z shoppers take fancy to Indian wear, venture investors look to stitch deals | New-age ethnic garments brands are venture investors’ latest pick — spurred by an uptick in business as Gen Z employees develop a penchant for formal ethnic wear, be it sarees or kurtas. In May, Libas raised Rs 150 crore ($18 million) from ICICI Venture, while Bengaluru-based Koskii secured Rs 61 crore ($7 million) from Baring Private Equity last year.

ETtech Q&A | We pivoted multiple times, have been close to bankruptcy: Ixigo founders | In an interaction with ET, company cofounders Aloke Bajpai and Rajnish Kumar spoke about the timing of the Rs 740 crore IPO and whether the offer size could have been bigger given the investor response. Read edited excerpts here.

Ola Electric secures Sebi approval for Rs 5,500 crore IPO | Ola Electric has received market regulator Securities and Exchange Board of India’s (Sebi) nod to get listed on the country’s public bourses. India’s largest electric two-wheeler maker had filed its draft red herring prospectus (DRHP) with Sebi on December 22, proposing to raise up to Rs 5,500 crore through a fresh issue, apart from an offer-for-sale (OFS) component of 95.2 million shares.

Fintech Corner

Fintech startups may take a hit as most banks stay away from BBPS: Fintech startups Cred, PhonePe, BillDesk and Infibeam Avenues are among those bracing for significant disruption as a regulation requiring credit card bill payments to be routed through a centralised billing network comes into force from July 1.

ONDC is bulking up financial services play with consumer-facing apps | Tata Group Super app Tata Neu and credit marketplace Paisabazaar are conducting early pilot studies for credit disbursals through the ONDC (Open Network for Digital Commerce) network. To provide loans, lenders like DMI Finance and Aditya Birla Finance have already integrated with the ONDC network.

IT & Tech Updates

Winning design: Nokia mulls shifting big chunk of global design capacity to India | Nokia, maker of tech and telecom enterprise equipment, is considering a reorganisation proposal that could involve shifting a majority of its global design capacity to India, sources aware of the development told ET.

The fuel secretly powering India’s economy — GCCs | The explosive growth of global capability centres (GCCs) providing technical, operational, research and innovation services to some of the world’s largest corporations is emerging as a “force multiplier” for the Indian economy, industry experts and analysts said. Currently, over 1,600 GCCs — employing an estimated 1.5 million people across India’s major cities — are generating cumulative revenue of about $46 billion.

Indian IT professionals are batting for cricket in the US: Indian IT professionals are becoming the ambassadors of cricket in the United States with a significant proportion of the diaspora working for the IT industry whose largest market is the US. An array of companies including Cognizant, ServiceNow and Cigniti, are playing hosts to clients and partners during the T20 World Cup matches.