Markets regulator Sebi reduced the minimum investment amount for privately traded debt securities, slashing it by 90%. On Tuesday, Sebi allowed companies to issue NCDs at a face value of Rs 10,000. The regulator said it will expand the scope of the market and bring in more retail participation. This opened up a fresh opportunity for the likes of Grip Invest and Wint Wealth, who operate under Sebi’s Online Bond Platform Providers’ (OBPP) guidelines.

“Sebi has done an amazing job of making bonds accessible to small investors,” wrote Zerodha chief executive Nithin Kamath on X.

But some market participants raised the question if retail investors will actually understand the risks involved and whether there will be mis-selling in this space.

While wealthtech startups had something to rejoice, gold loan fintechs had a tough week.

We broke the news of the Reserve Bank of India (RBI) cautioning banks about procedural lapses in the gold loan business. The move could impact the business of India’s gold loan startups Rupeek, Indiagold and Oro Money.

Issues in the larger gold loan market and the regulatory action on IIFL Finance’s gold loan business have impacted the growth prospects in this market. And some aggressive investors are looking at bottom-fishing. Manipal group boss Ranjan Pai’s family office and Axis Bank are both looking to buy a stake in Rupeek at a heavily discounted valuation.

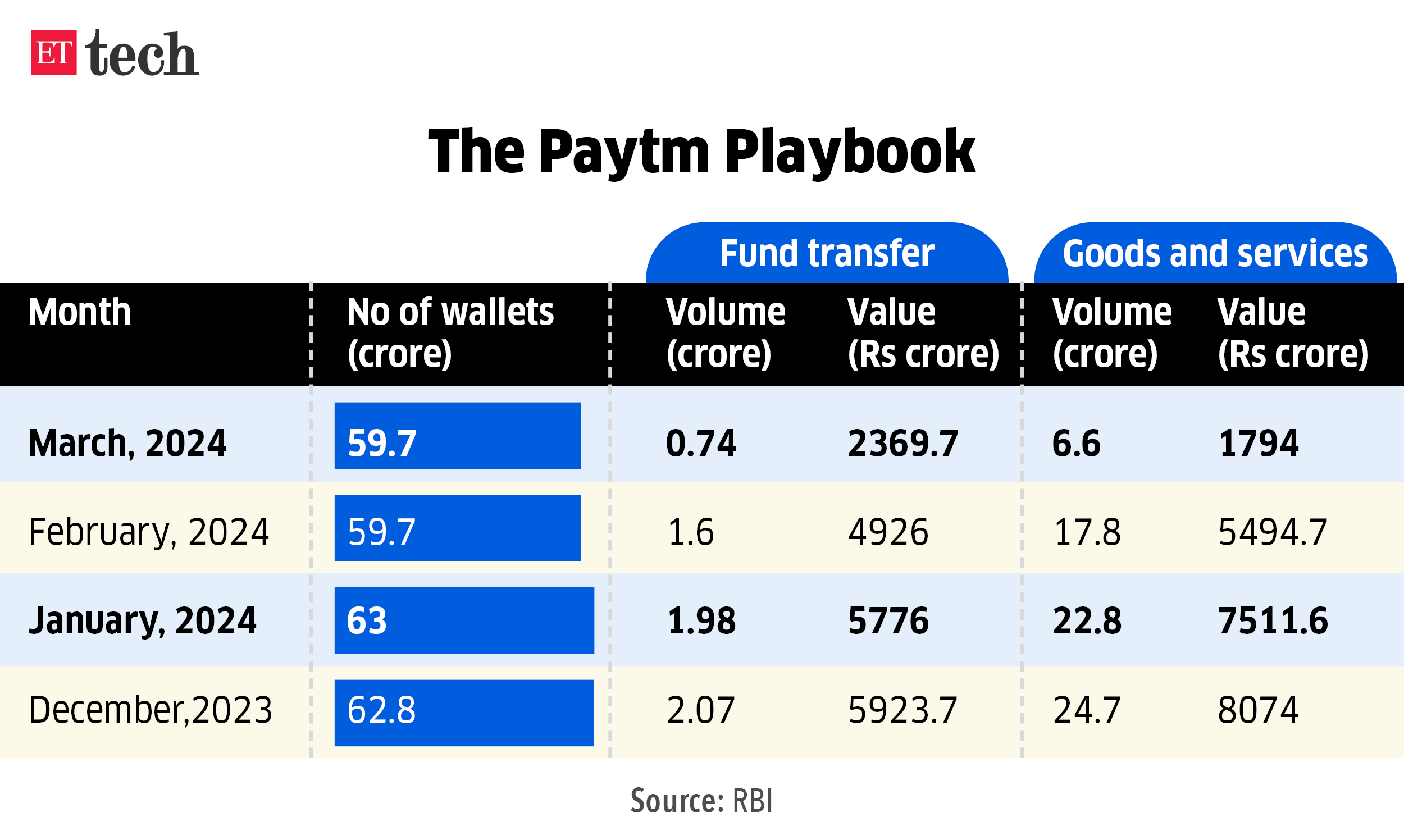

Besides gold loan fintechs, which are facing regulatory heat, Paytm Payments Bank, the associate entity of Paytm seems to be staring at a bleak future. Mobile wallets, the core business of the Noida-headquartered group, are seeing transactions decline by around 70% and more. As Paytm switches focus towards UPI, its original payments game plan seems to be staring at a dead end.

Another section of the fintech space that has been under regulatory scrutiny for a while now is peer-to-peer (P2) lending startups. After losing one of their most popular products — liquid funds — last month, P2P lenders have now been asked by the RBI to give up any form of default loss guarantee. This could impact the partnership and affiliate businesses of the likes of Liquiloans, Faircent, LendenClub and Lendbox.

But it’s not all doom and gloom in the fintech world. Both Peak XV Partners-backed unicorn Groww and France’s Worldline ePayments received a payment aggregator licence. Now they can operate as an online merchant payments business. For Groww, this adds another financial services offering on top of its most profitable stock broking business.

Fintech in Focus

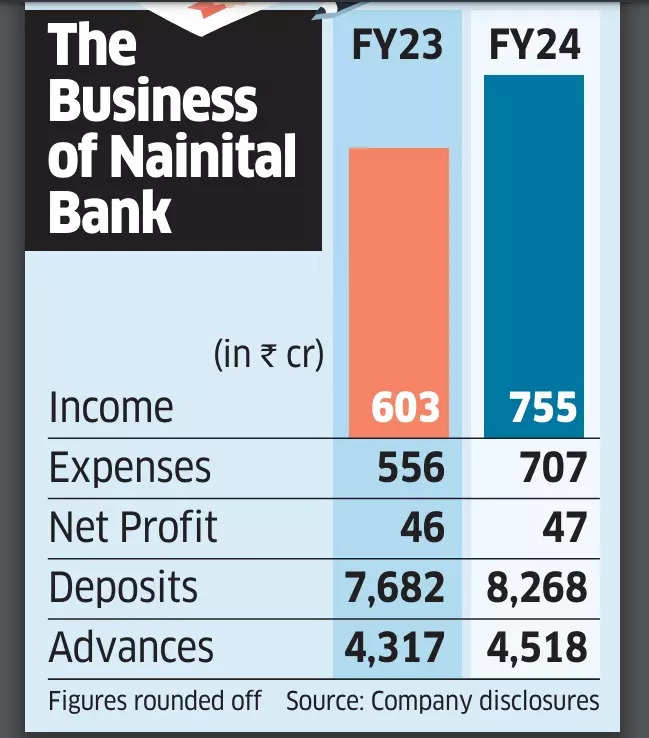

Premji Invest in talks to pick up big stake in Bank of Baroda’s Nainital Bank | Premji Invest, the family office of Wipro founder Azim Premji, is in advanced talks to acquire a majority stake in Nainital Bank, which is a subsidiary of the publicly owned Bank of Baroda. The proposed investment is likely to value the Uttarakhand-based lender at around Rs 800 crore, people aware of the discussions said.

Ranjan Pai, Axis Bank may back gold loan startup Rupeek | Manipal Group chairman Ranjan Pai’s investment office Claypond Capital and private sector lender Axis Bank are in talks to invest in gold loan startup Rupeek, according to sources aware of the matter. The round will likely see the valuation of the Accel- and Peak XV Partners-backed firm being cut, they said.

RBI cautions banks on gold loan disbursals through fintech startups | The RBI has cautioned banks about gold loan disbursals being made through fintech startups, according to people familiar with the matter. The central bank has flagged “concerns with the evaluation process” by these banks and fintechs, especially in cases where the gold is sourced through field agents of companies.

No default loss cover diktat by RBI to hit peer-to-peer lending startups | The central bank has said P2P lending platforms cannot offer any default loss guarantee (DLG) to investors, as it furthers scrutiny on the digital lending sector.

Paytm Payments Bank’s wallet business fading fast as restrictions bite | The regulatory action on Paytm Payments Bank has brought the mobile wallet business of the entity, one of its most popular offerings, to a grinding halt.

Rakesh Singh replaces Varun Sridhar as Paytm Money CEO | Paytm Money, the wealth management platform of One 97 Communications Ltd, has appointed Rakesh Singh as its chief executive, replacing Varun Sridhar. Sridhar, its CEO since 2020, has been moved to a different role within the group. Singh, who was the CEO of broking services at PayU-backed Fisdom, joined Paytm Money last month.

Groww and Worldline ePayments secure online payment aggregator licence from RBI | Wealth management platform Groww and digital payment processing company Worldline ePayments have received the RBI’s licence to operate as online payment aggregators.

ETtech Exclusives

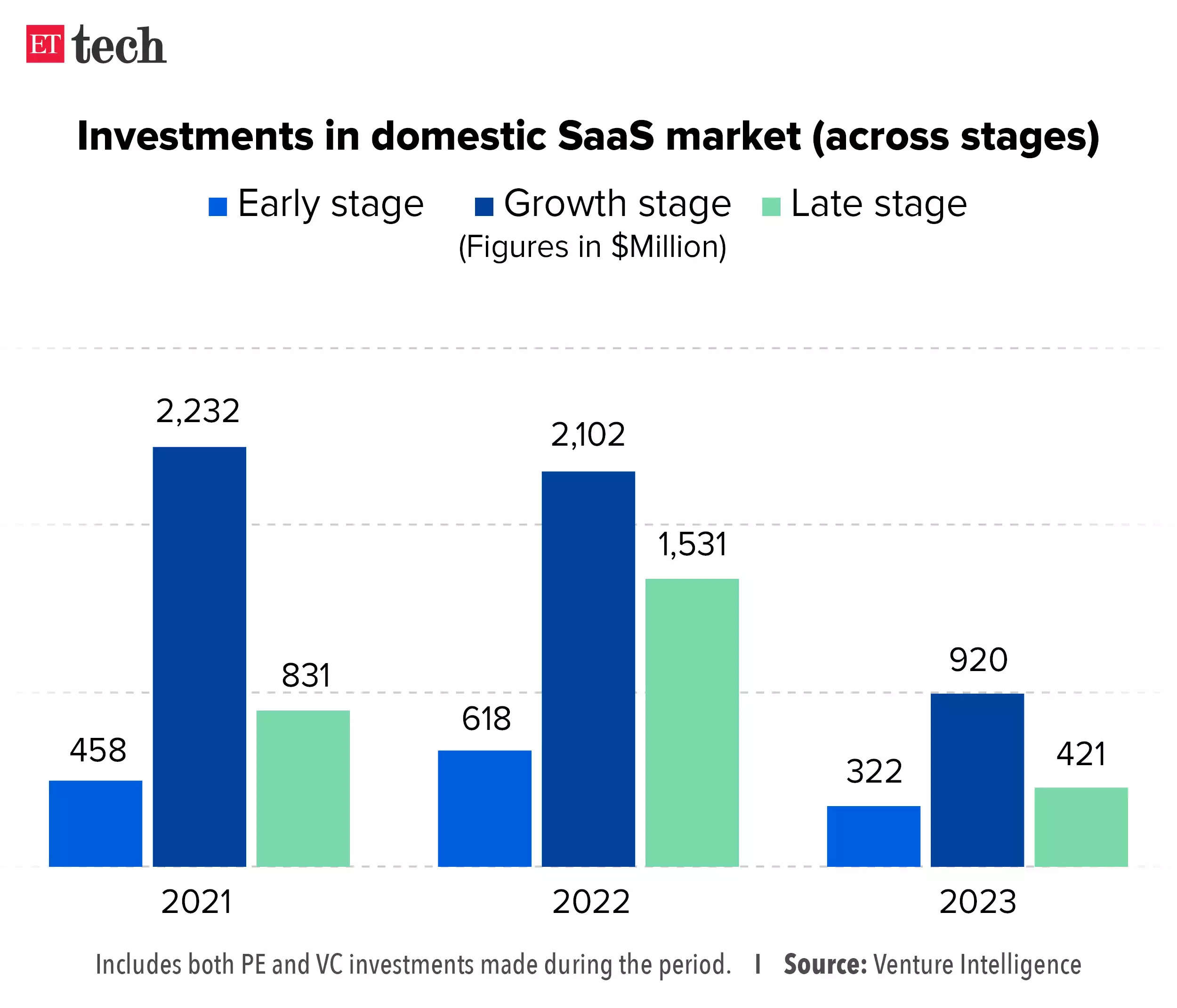

Kaiser may steer $250 million funding in SaaS firm Innovaccer | US health and insurance giant Kaiser Permanente is in advanced talks to lead a $200-250 million investment in healthcare-focused software-as-a-service (SaaS) firm Innovaccer, said people aware of the matter. This will be a mix of primary and secondary funding, they said.

ONDC’s first buyer side logistics app to fix a big gripe | In what could give a boost to Open Network for Digital Commerce (ONDC), the government-backed ecommerce network has approved its first buyer-side app for logistics that will aim to solve one of the biggest sore points of shopping through the network – seamless delivery.

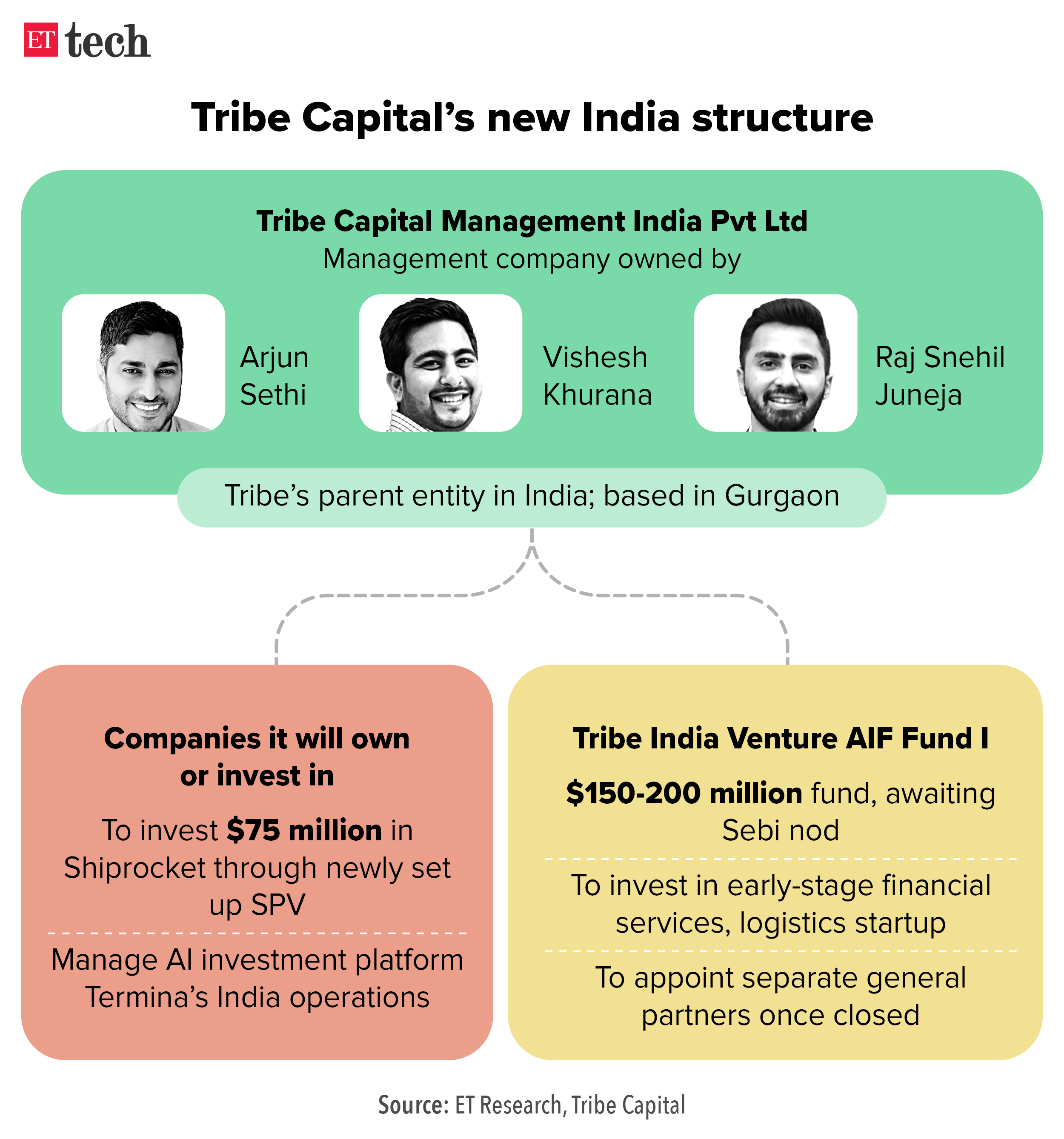

Tribe Capital’s new India investment vehicle to pump another $75 million in Shiprocket | Silicon Valley-headquartered fund Tribe Capital is doubling down on ecommerce logistics startup Shiprocket through its newly set up special purpose vehicle (SPV) in India. Tribe’s cofounder, Arjun Sethi, told ET in an interaction that its India management company will not only make investments but also build and buy out companies here.

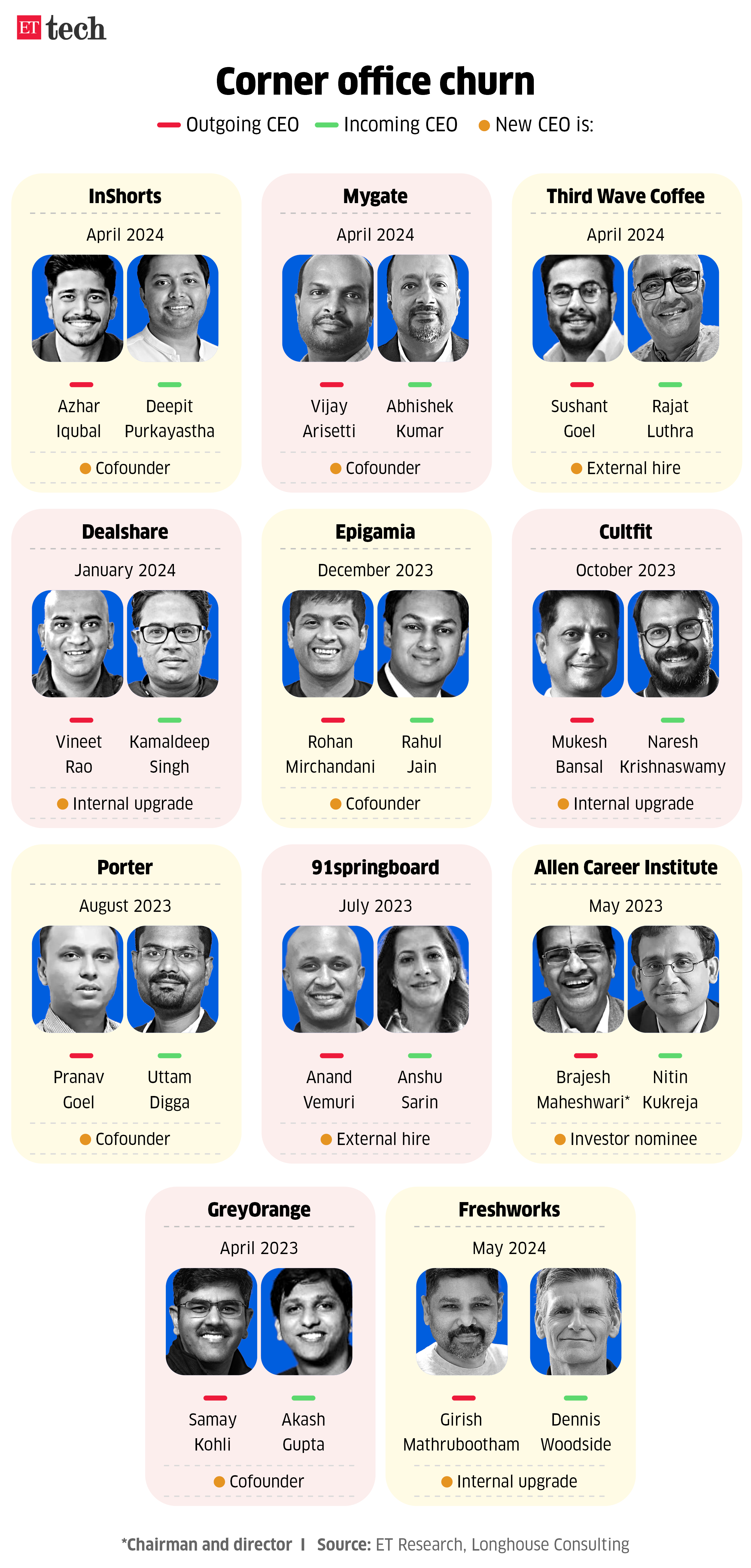

Top Deck Reshuffle

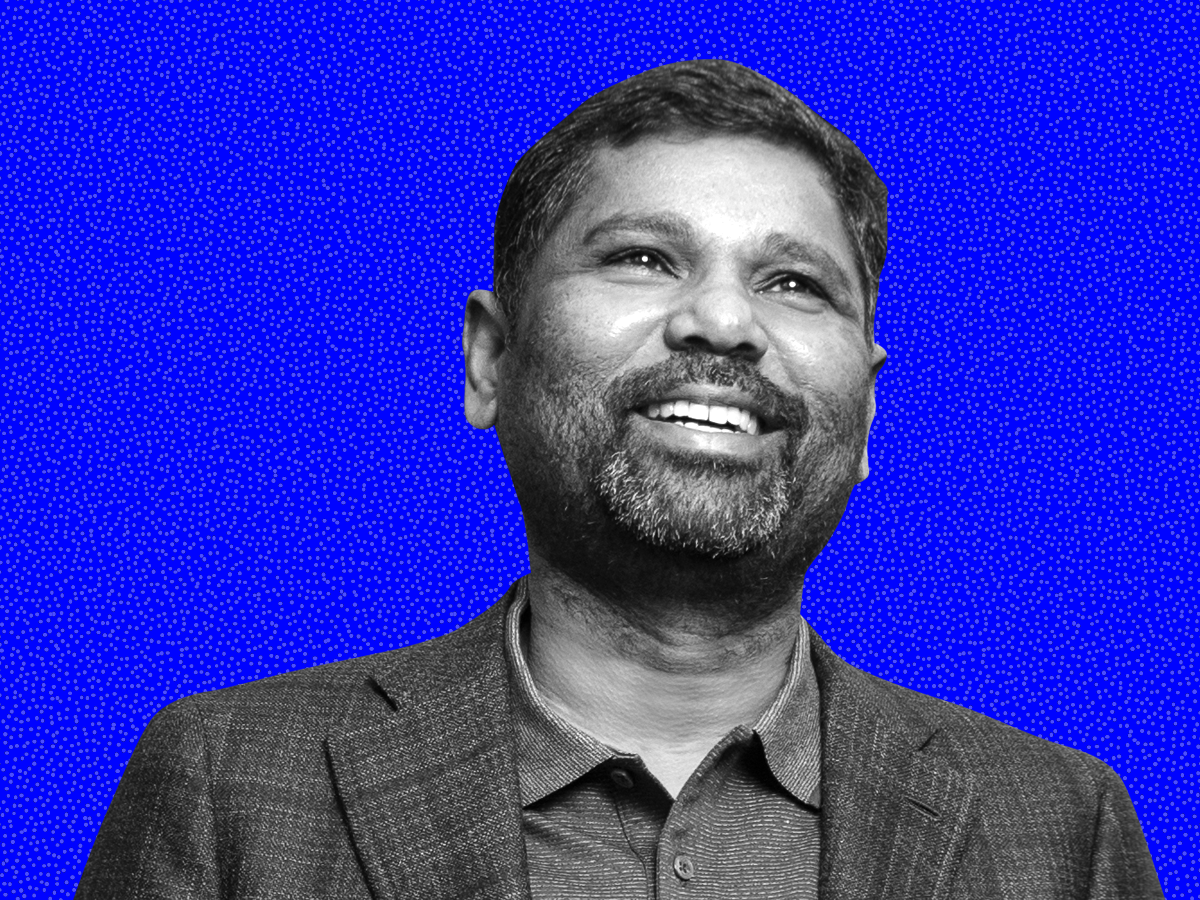

Freshworks founder & CEO Girish Mathrubootham

Girish Mathrubootham steps down as Freshworks CEO; Dennis Woodside takes charge | Nasdaq-listed SaaS major Freshworks said its founder Girish Mathrubootham had stepped down as the company’s chief executive effective immediately. The firm has named its president Dennis Woodside as the new CEO. Mathrubootham will take on the role of executive chairman at Freshworks.

Ola Cabs CEO Hemant Bakshi resigns; company to lay off 200 employees | Ola Cabs chief executive Hemant Bakshi is leaving just three months after the ride-hailing company publicly announced his appointment, with founder Bhavish Aggarwal once again taking over the reins at the firm.

Also read | Who is Freshworks’ new CEO Dennis Woodside?

Other Top Stories This Week

Supam Maheshwari, CEO, FirstCry

FirstCry refiles IPO papers, reports April-December revenue at Rs 4,841 crore | FirstCry, the omnichannel retailer for baby and mother care products, has refiled its draft documents for an initial public offering of shares. The company aims to raise $218 million (about Rs 1,815 crore) by offering fresh shares while existing investors plan to sell 54 million shares held by them.

Drop in renewal deals poses revenue challenge for top IT firms | Despite record deals announced in the final quarter of 2023-24, the deal momentum has slowed down from a year ago as companies are witnessing clients signing more net new and transformational deals rather than renewing old deals.

IT companies log strong revenue growth outside key North America market | India’s top IT services exporters are seeing revenue growth in parts of Europe and regional markets — the Middle East & Africa and India and Asia Pacific — outpacing that in the traditional stronghold of North America, which is experiencing flattening demand.

Midcap IT companies buck the trend to add more employees | A few mid-sized information technology providers registered a net increase in workforce in fiscal 2024 offering a sharp contrast to the steep decline in headcount at India’s top tier IT firms in a year marked by tapering demand for technology services due to macroeconomic and geopolitical uncertainty.