Also in the letter:

■ Explained: The boardroom battle at Byju’s

■ Accenture’s revenue bet on GenAI

■ India’s first text-to-image generator

Exclusive | While Ola taps new roads, our focus still ride-hailing: Uber CEO Dara Khosrowshahi

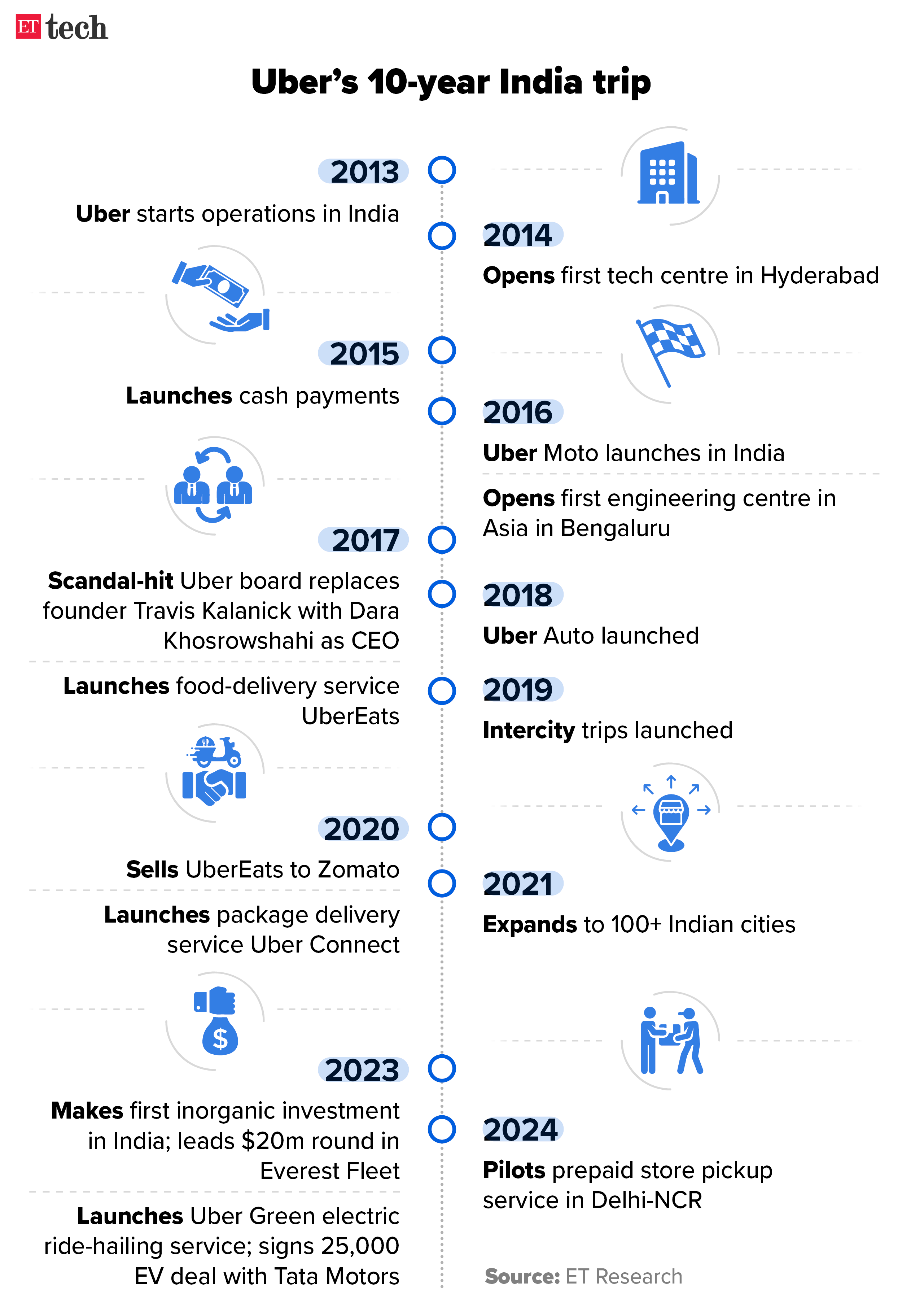

In an exclusive interview with ET, during a four-day trip to India, Dara Khosrowshahi, who took over as the chief executive of Uber Technologies in 2017 when the San Francisco-based mobility company was traversing its most controversial period, is now being hailed as tech’s newest turnaround chief.

The Iran-born executive, who replaced Uber’s go-for-broke founder Travis Kalanick, has steered the company to profitability in a business which most experts thought would never make money. In a wide-ranging interview, Khosrowshahi, spoke about the company’s focus on mobility, profitability, electric vehicle push, investment strategy in India and how his management style is different from that of Kalanick.

Also read | Uber pushes intercity, reserve rides, leans on longer trips

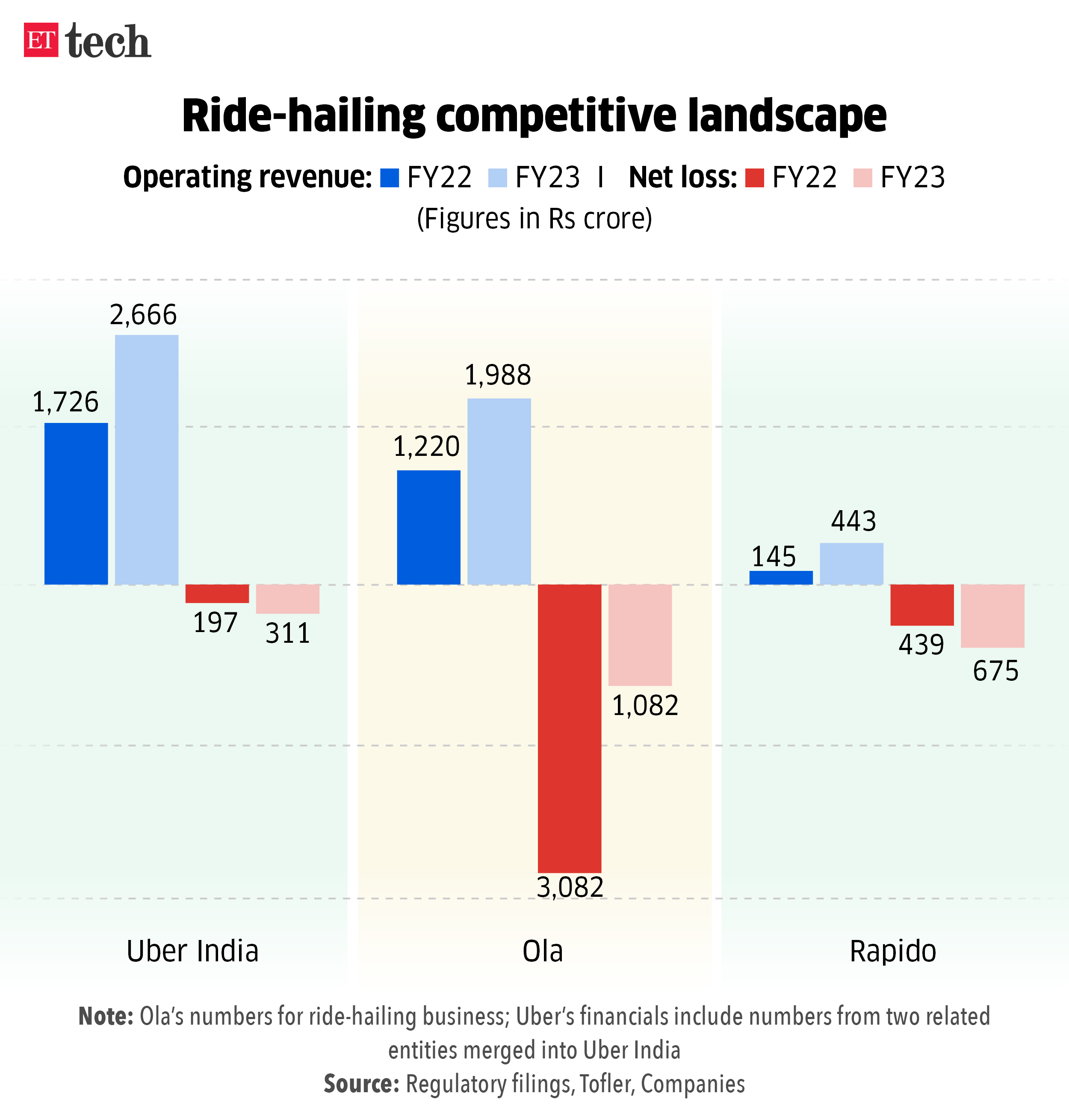

The Indian market: “The Indian market is getting more competitive. It was a two-player market previously, now there are three-four players, there are many young upstarts. We have to make sure we’re on our toes and we compete effectively against them,” Khosrowshahi said.

Uber’s mobility focus in India, he said, “As a company, we want to focus on markets where we have a right to win. I’m not in this to be in second place, I’m in this to win. Saying ‘no’ to certain areas actually strengthens your core.”

Also read | New ride-hailing apps racing Uber, Ola for mobility business

No distractions: “While (rival) Ola focuses on other areas…we love the ride-sharing business…Some of our competitors are distracted by shiny, new efforts and IPOs, that’s great. I’m undistracted and completely focused on the mobility business here as there’s an enormous amount of upside for us and our positioning has never been better.”

Road to profitability: “When we were just making some headway, Covid hit…Not only was the company losing money, but the most profitable part of our business, mobility, lost 85% of its volume,” Khosrowshahi said. “Coming out of Covid, we were a leaner, more focused company. We focused on profitable growth earlier than other technology companies.”

Also read | Uber India posts 54% increase in FY23 revenue

On profitability in India, he said, “We can be profitable in India tomorrow if that was the direction I gave to the teams, but based on what I see in terms of the potential, it would be a wrong move… Short-term profits aren’t the answer.”

Former Uber CEO Travis Kalanick

On Travis Kalanick: “Travis was the right person for Uber in its founding. I could have never accomplished what he accomplished and have a high degree of respect for what he did, but I also understand what he did wrong. I think he understands what he did wrong. He’s still passionate about the company even though he doesn’t own a share … He is very happy about what’s happened with Uber and to me that’s a sign of a good person.”

Read the full interview here.

No question of Fema breach, Paytm Payments Bank tells ED

Embattled Paytm Payments Bank has told the Directorate of Enforcement (ED) that it does not possess the licence required for outward foreign remittances, and hence, the question of it violating forex laws does not arise, sources told ET.

The federal agency last week reached out to the Reserve Bank of India (RBI) to verify this claim.

Driving the news: The ED is probing alleged violations of the Foreign Exchange Management Act (Fema) by entities using Paytm Payments Bank.

The ED recently received the additional data it requested from the central bank regarding entities suspected of violating Fema regulations through Paytm Payments Bank. However, the ED has not found any initial evidence suggesting that the bank was involved in any violations after perusal of this fresh data, according to sources.

Paytm bank’s stance: Companies need the ‘AD-II’ licence issued by the RBI to make foreign remittances. The company has said that the said licence was never issued to it by the central bank and, hence, the question of Fema violations does not arise.

Also read | RBI allows Paytm’s UPI payment business to be migrated to four to five other banks

In other news: In a related development, the agency has reached out to the RBI, seeking details of entities, both companies and individuals, who may have violated Fema norms on other mobile payment platforms besides Paytm Payment Bank.

Recap: ET was the first to report on February 15 that the ED has quizzed Paytm Payments Bank officials earlier this month in connection with its probe into alleged Fema violations. ET had reported that the ED, after quizzing Paytm officials and gathering its own evidence, found certain “procedural deficiencies”, which can only be dealt with by the regulator.

Also read | ED tapped RBI for more info on FX violations by Paytm Bank users

I continue to remain CEO: Byju Raveendran to staff

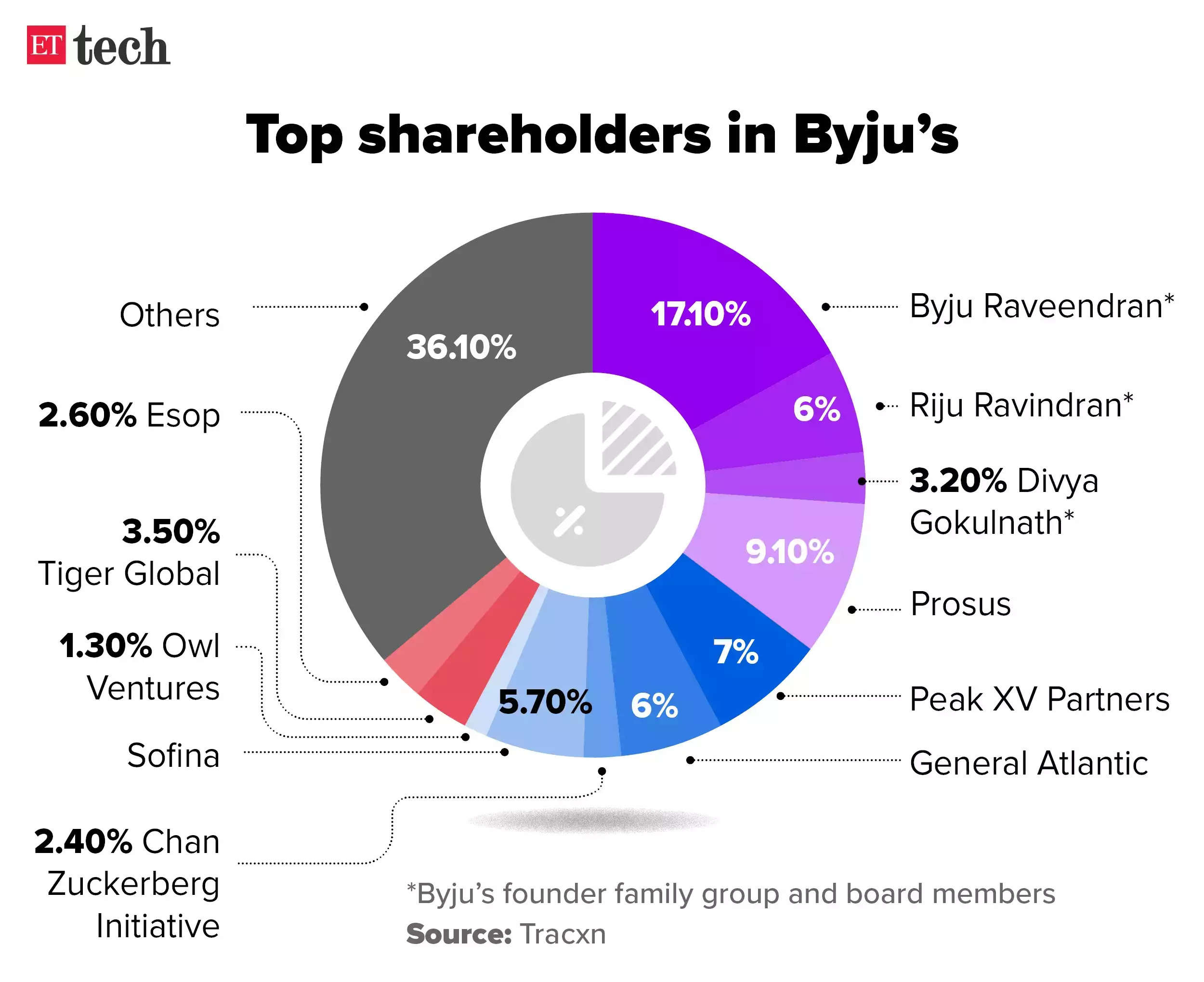

In the extraordinary general meeting (EGM) of Byju’s parent company Think & Learn, key investors voted to remove founder Byju Raveendran as the chief executive and also to restructure the board, which includes his wife and cofounder Divya Gokulnath, and brother Riju Ravindran. The founder, however, said he would not go quietly.

Terming the EGM a ‘farce’, Raveendran told employees in a note that he continues to hold the top post at the edtech firm, and the board remains unchanged.

Tell me more: He asserted that the claims made by a small group of select minority shareholders who unanimously passed the resolution in the EGM are ‘completely wrong’.

Raveendran also said the shareholder agreement grants the authority to modify the board’s composition, the management team, and the CEO’s role “exclusively to the board, not to a group of shareholders.”

Flouting rules: The founder said a lot of “essential rules were violated” at Friday’s EGM. “Rest assured that I am not taking any of these allegations lying down and will challenge these illegal and prejudicial actions,” he said.

Read the full letter here.

Explained: Shareholder resolutions and the boardroom battle at Byju’s

EGM vs AGM: An AGM is a required annual meeting of shareholders that a company, regardless of size or type, must hold within six months of the ending of the financial year. On the other hand, an EGM is held when a matter needs an immediate decision and cannot wait until the next AGM.

Resolutions passed at Byju’s EGM: The resolutions included addressing governance, financial mismanagement, and compliance issues at Byju’s. They also called for a reconstitution of the board of directors to remove control by Think & Learn founders and to change the company’s leadership. The group wants a new board with nine members–one founder, two executives from group companies, three shareholders, and three independent directors.

What next? While the investors have said that the EGM was valid and was conducted in accordance with the rules, no decisions can be implemented at least until March 13, when the Karnataka High Court will hear the edtech startup’s petition against the investor group.

Read full explainer here.

Other Top Stories By Our Reporters

Accenture spots about 10% revenue upswing via GenAI: Accenture has started to see a potential revenue upswing of about 10% with the use of generative artificial intelligence (GenAI) in some important business units, Senthil Ramani, global lead – data and AI at Accenture, told ET in an exclusive interview.

Kalaido.ai paints a pretty picture from local language text prompts: Homegrown AI unicorn Fractal has developed India’s first text-to-image diffusion model Kalaido.ai, capable of generating high-quality images from text prompts in English and 17 Indian languages including Hindi, Kannada, Tamil, Telugu and Sanskrit.

The great AI debate: Open-source vs proprietary models in global showdown | The development and regulation of AI technologies, such as chatbots, GPTs, and search engines, are causing concern and debate. Geopolitical tensions arise as open-source AI models from China compete with proprietary models from the US and EU. Data privacy laws, consumer data protection, and standardized definitions and regulations for AI are seen as essential.

Also read | Need more women in AI for inclusive development of the technology

Whatever is not written in regulation, means a ‘No’: NPCI chief | National Payments Corporation of India (NPCI) head Dilip Asbe emphasised that fintech founders cannot build a long-term business in the space without compliance. Asbe said there are no grey areas in Indian fintech.

Global Picks We Are Reading

■ Nvidia hardware is eating the world (Wired)

■ Piers Morgan and Oprah Winfrey ‘deepfaked’ for US influencer’s ads (BBC)

■ How a shifting AI chip market will shape Nvidia’s future (WSJ)