According to the information provided by the RBI in its FAQ section on SGBs, the Reserve Bank of India (RBI) allows early redemption of SGBs, but there are clear rules to adhere to.Usually, the redemption window opens yearly, starting from the fifth year of the SGB series. Despite the bond’s eight-year term, early cash-out is permitted after the fifth year, aligned with coupon payment dates.

What is the deadline for submitting SGBs for premature redemption to the RBI?

There’s a set yearly deadline for SGB investors to request premature redemption after five years of investment. If an investor misses this deadline, they won’t be able to redeem the SGB in that year and will have to wait for the next opportunity when the premature redemption window reopens for that specific SGB.

As per an FAQ provided by the RBI on SGBs, investors can initiate premature redemption by reaching out to the respective bank, SHCIL office, post office, or agent at least thirty days before the coupon payment date.

ALSO READ | Sovereign Gold Bonds Series IV 2023-24 tranche: This SGB issue is the highest priced till date!

Mukesh Chand, Senior Counsel at Economic Laws practice told ET that investors must act within a specific timeframe to request premature redemption. They need to notify the relevant Receiving Office, bank, SHCIL, or post office before the 29th day of the Coupon Date.

Chand illustrates the timeframe for premature redemption of SGB with an example. Suppose an investor has purchased SGB 2018-19 Series V Tranche issued on January 22, 2019, with an interest payment date of January 22, 2024. In this case, the period for submitting the request for premature redemption of the SGB would be from December 22, 2023, to January 12, 2024.

Another example can be SGB Series VI, issued on February 12, 2019, with an interest payment due on February 12, 2024. To request premature redemption for this series, investors need to submit their requests between January 12, 2024, and February 2, 2024. Chand emphasises the importance of adhering to the dates notified by the RBI for SGB investors.

Rajiv Sharma, Partner at Singhania & Co, agrees with Chand’s perspective and further explains that SGB investors will have access to a premature redemption window beginning from the fifth year of the bond, typically coinciding with the interest payment date.

Sharma further said, “The premature redemption window opens thirty days before the interest payment date and closes one day before the respective interest payment date. Investors wanting to exercise the option of premature redemption must keep this in mind, as the request for premature redemption will have to be raised within this timeframe only, post which the investor will have to wait for the next premature redemption window.”

It’s important to note that interest on SGBs is paid twice a year, and the premature redemption window is available twice annually for each specific SGB.

ALSO READ | New Sovereign Gold Bond Series-IV 2023-24 is now open for subscription; check out five ways to invest

Why is there a 10-day gap in the SGB premature redemption timeline?

There is a 10-day interval between the final day for premature redemption and the interest payment date. For instance, if the interest payment date for SGB 2018-19 Series V was January 22, 2024, the premature redemption window would be open from December 22, 2023, to January 12, 2024. This 10-day gap spans from January 22, 2024 (the interest payment date) to the last day to submit the SGB for premature redemption, which is January 12, 2024.

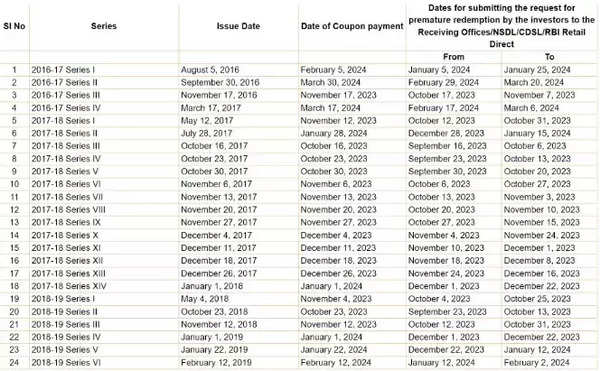

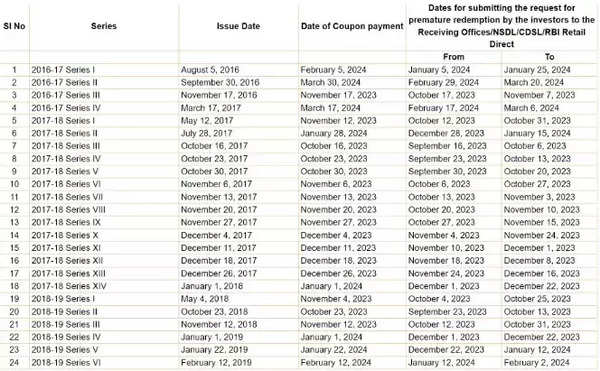

Below is a table presenting the interest (coupon) payment dates of the bonds along with the last date to offer the respective SGB for premature redemption:

Source: RBI Press Release

Chand further explains that as per RBI’s operational guidelines to banks, the request for premature redemption of SGB must be submitted to the Receiving Office or Depository at least 10 days before the next interest payment date. This requirement accounts for the 10-day gap before the coupon date. If the SGB is held in a Demat account, the request should be routed through the Depository Participant.

He clarifies that the 10-day gap between the interest payment of an SGB and the last date for premature redemption serves as a buffer period. This time allows for any additional requirements from the SGB investor to be addressed.

Chand further elaborates that the time gap is essential to allow the Receiving Office, Depository Participant, or Depository to request any additional documents, KYC proof, or declarations from the SGB investor if necessary.

He added, “Every SGB redemption request is required to be scrutinised in order to verify the correctness of the particulars and before submission to RBI through the E-Kuber Portal at least four days before the due date of interest payment for the respective SGB.”