On Monday, the Delhi High Court had upheld the constitutional validity of section 171 of the GST law, but also observed that a “one size fits all” approach was inappropriate as every company and industry has its own dynamics.

While a decision is yet to be taken, the order may be challenged by some of the petitioners, even as the fate of their individual cases lies across several high courts. Companies, industry sources told TOI, are expected to seek a remedy in individual cases in the GST Appellate Tribunal.

“The conclusion of litigation of anti profiteering matters is still some time away as the merit-based hearings will be taken up once the GST Tribunals start functioning and there may be a need to recompute the demands based on the evidence provided by businesses,” said M S Mani, partner at consulting firm Deloitte India. The entire process is expected to be time consuming, with the conclusion of entire process.

The absence of a clear methodology, say, stipulating how much steel or cement is used in constructing a building of a certain size, is adding to complexity and giving companies scope to challenge individual calculations.

“While maintaining validity of anti-profiteering provisions comes as a setback for businesses, upholding factual analysis of each case commercially to identify non-compliance gives a large ray of hope. Each case would now need to be individually evaluated to understand non-compliance or being defendable on the basis various business/commercial considerations,” said Abhishek Jain, who heads the indirect tax practice at KPMG.

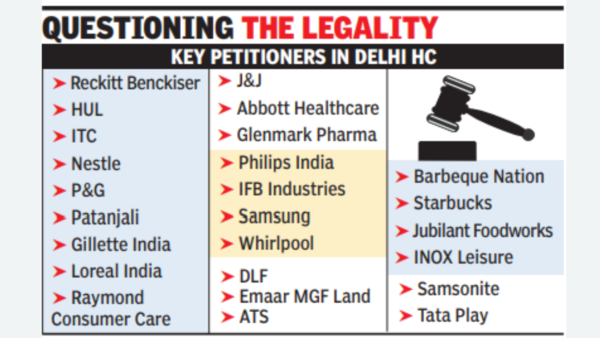

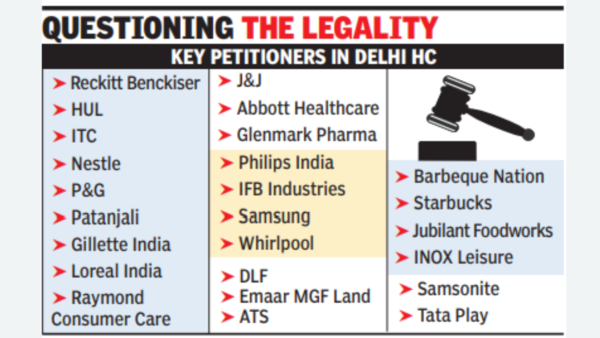

On their part, companies are putting up different arguments. FMCG players (likes of HUL, P&G and Patanjali) are arguing that polyolefin prices had gone up around the time GST was introduced ,resulting in a 20% increase in cost. As a result, they did not reduce prices.

Similarly, furniture companies have contended that they depend largely on imports and cost of goods shipped from overseas was higher, more than offsetting the gains from a reduction in GST on some of the inputs. On their part, auto companies have said that there were few components where GST was lowered from 28% to 18% and cost reduction was miniscule when other input costs rose.

While the court has held that anti-profiteering clause was a consumer welfare measure, the order poses a challenge for the GST Council as and when it decides to rework the slabs, something that it is widely expected to do post-election, said tax experts.

A merger of slabs and reduction in rates will open the doors to similar disputes as some of the companies will cite their cost structure to deny passing on the benefit to consumers.