Also in this letter:

■ Byju’s vs BCCI in NCLAT

■ China’s bet on GenAI models

■ Swiggy tweaks service fee policy

Programming note: ETtech Morning Dispatch & Top 5 will be off on Friday. Stay tuned to ETtech.com for all the news and updates.

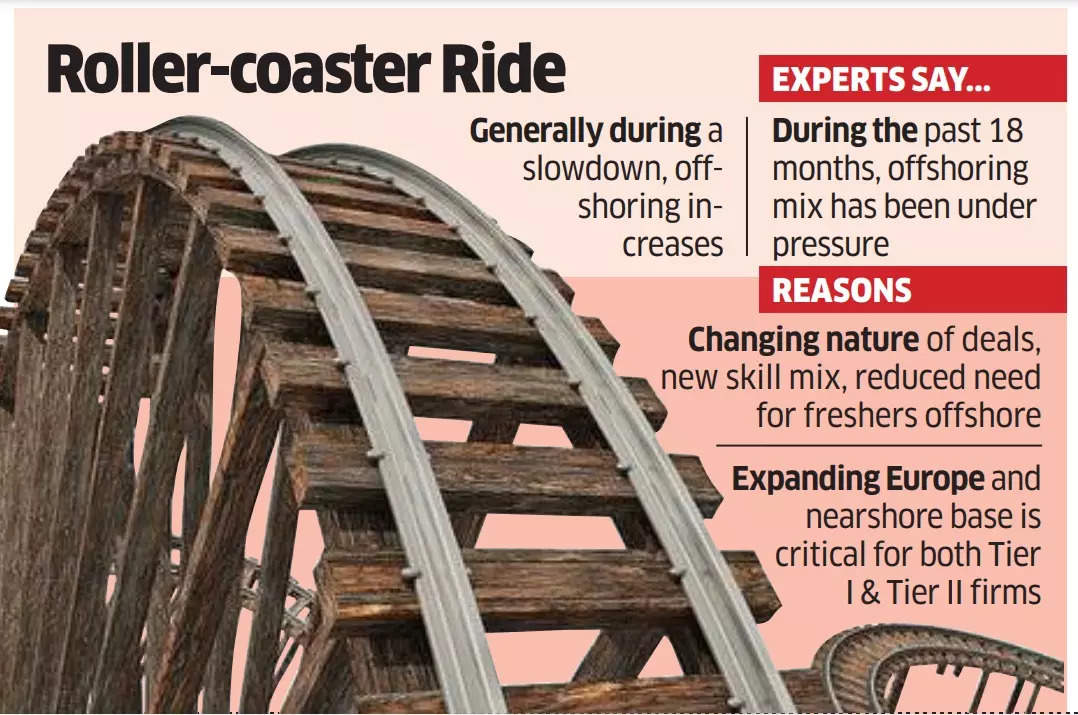

IT’s slump-driven offshoring deals in reverse gear

Large offshoring, which took off in the last two years, on the back of numerous cost optimisation deals has either halted or started reversing, as per experts.

Driving the shift: “The reversal in trend is largely due to the significant move over the last year from onshore to offshore. It is now balancing out with a modest swing the other way. There is a limit to how far the offshore lever can be pulled before clients ask for more onshore,” said Peter Bendor-Samuel, chief executive at Everest Group, a consulting and research firm.

Wipro, LTIMindtree, Coforge, Mphasis, and Happiest Minds have seen their offshore contribution (efforts or revenue) decrease in the first quarter of fiscal 25.

Also Read: Digital transformation deals back in play for IT industry with a cost twist

Jargon buster: Offshoring is the practice of relocating work to another country to cut costs and increase efficiency and had seen an increase in the last five to six quarters.

Expert take: Generally, during a slowdown, offshoring increases, said Gaurav Vasu, founder, UnearthInsight, a tech market intelligence firm.

Vasu added, “However, during the last 18 months, the offshoring mix has been under pressure due to the changing nature of deals, the new skill mix, and the reduced need for freshers offshore. We saw 0.5-1.5% growth in nearshore/onsite headcount, led largely by M&A, digital transformation, or BoT/BOOT deals for the likes of HCLTech, TCS, etc.”

Also Read: Source of IT’s pain decoded: why clients are pulling back outsourced work in-house

Ola Electric Q1 net loss widens to Rs 347 crore on year

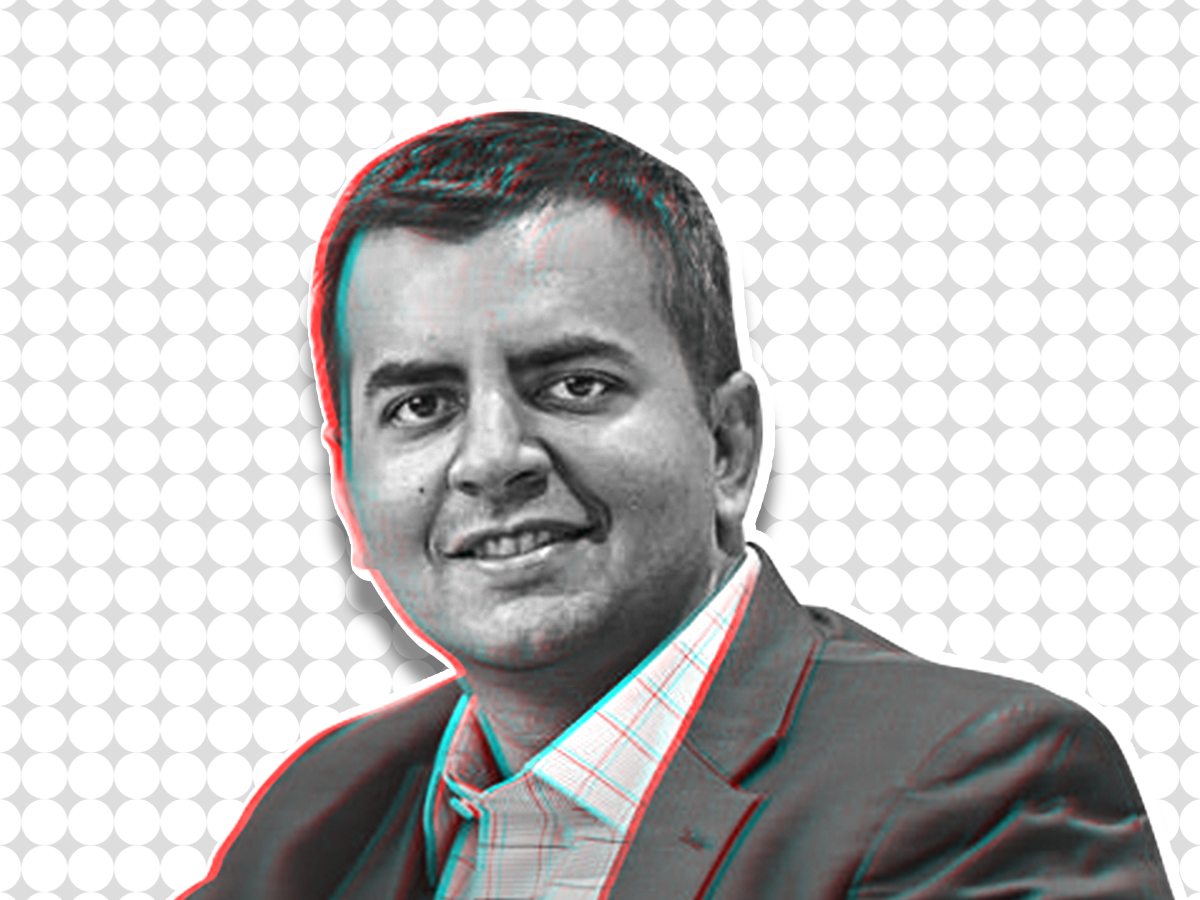

Bhavish Aggarwal, founder, Ola Electic

Electric scooter maker Ola Electric on Wednesday reported a 32% jump in revenue for the first quarter of fiscal year 2025 to Rs 1,644 crore.

Key numbers:

- Net loss widened to Rs 347 crore for the quarter ended June 30, from Rs 267 crore a year ago

- Total expenses grew to Rs 1,849 crore, compared to Rs 1,461 crore in the same period a year ago

- Automotive division saw total income jump 34% to Rs 1,722 crore

- Battery division reported an income of Rs 5 crore for the quarter, with a loss after tax of Rs 37 crore

New announcements: The firm said it delivered over 1.2 lakh scooters during the quarter, adding that it will launch a line of electric motorcycles on August 15. It said that it has also started the production of its own battery cells and expects to use its cells in its vehicles by the first quarter of FY26.

Also Read: Lowered IPO price to rope in a wider set of investors: Ola Electric CEO Bhavish Aggarwal

Nazara net profit up 13% to Rs 24 crore in Q1: Media and gaming firm Nazara Technologies reported a 13% increase in net profit to Rs 23.6 crore for the first quarter of fiscal year 2025, even as its quarterly revenue dipped slightly. The firm’s operating revenue fell 1.7% to Rs 250 crore on a year-on-year (YoY) basis for the quarter ended June 30, 2024.

Oyo posted Rs 229 crore net profit in FY24: Ritesh Agarwal: Hospitality startup Oyo posted a net profit of Rs 229 crore for FY24, founder and chief executive Ritesh Agarwal said. In a post on X, Agarwal said the audited results have been published after adoption by the company board, but financial statements for FY24 were not available with the Registrar of Companies (RoC) by Thursday noon.

Also Read: Aris Infra files draft IPO papers, plans to raise Rs 600 crore

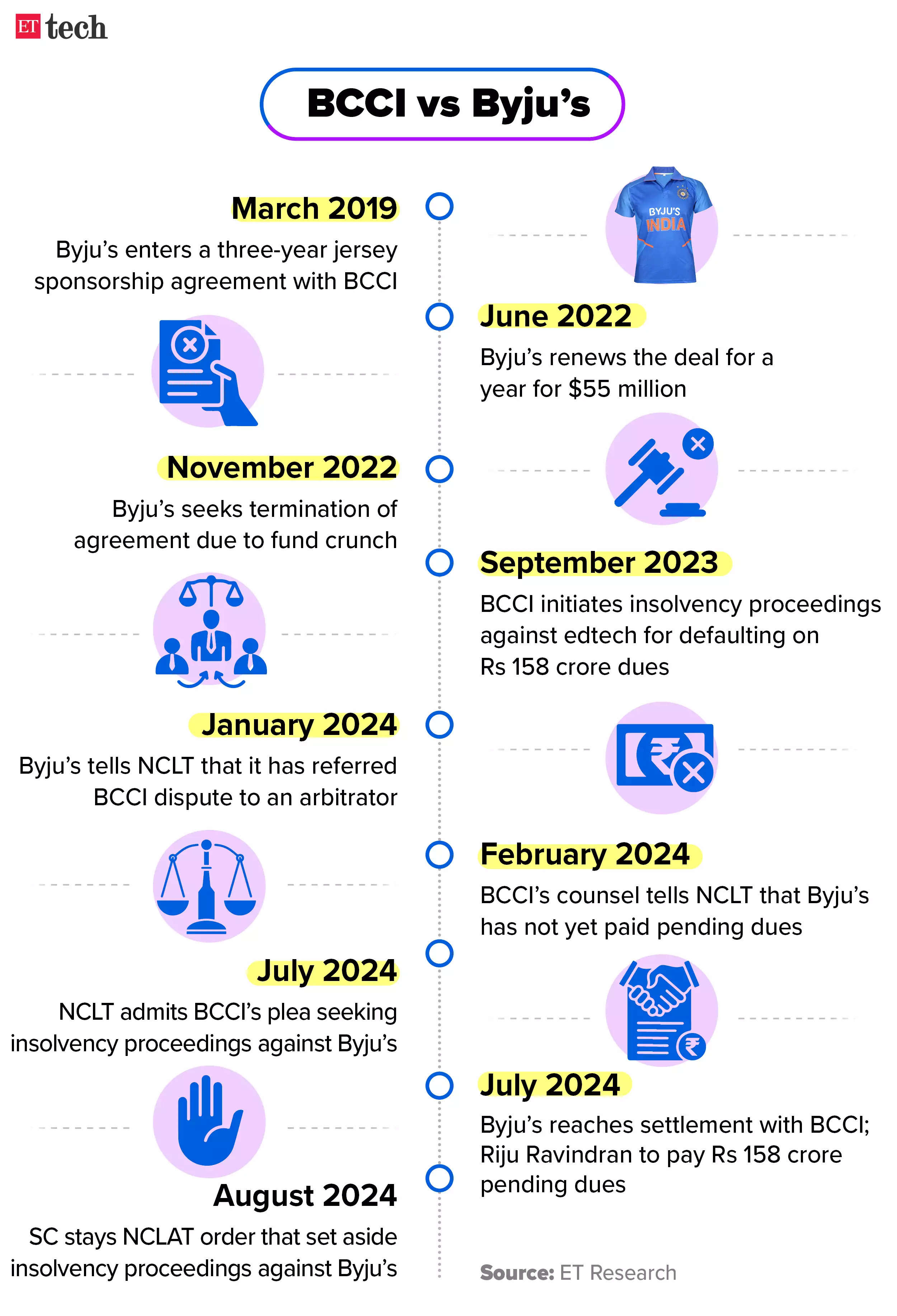

Byju’s vs BCCI: SC stays NCLAT order that set aside insolvency case against edtech

The Supreme Court on Wednesday stayed the National Company Law Appellate Tribunal’s (NCLAT) order approving the settlement between edtech firm Byju’s and the Board of Control for Cricket in India (BCCI) over unpaid dues of Rs 158 crore.

The tribunal had earlier quashed the bankruptcy proceedings initiated by the BCCI against Byju’s after a settlement between the two parties.

Fine print: Solicitor General Tushar Mehta, appearing for the BCCI, opposed the appeal against the NCLAT order. He said the earlier settlement with Byju’s will not stand in light of the stay. The Supreme Court bench, led by CJI DY Chandrachud, asked the cricket administrator to keep the settlement amount in a separate account until August 23 – the next date of hearing.

Appeal in top court: The NCLAT order was appealed by Glas Trust, the trustee for lenders to which Byju’s owes $1.2 billion. Glas Trust had alleged that the money being paid to the cricketing authority by Riju Ravindran, brother of the company’s founder, Byju Raveendran, was tainted.

Counsel for Ravindran had said he would be using personal funds to make the payment.

Background: The BCCI had moved NCLT under the Insolvency and Bankruptcy Code (IBC) over a default of Rs 158 crore by Byju’s parent, Think & Learn.

The company had signed a jersey sponsorship agreement with BCCI in March 2019 for three years, which was extended by a year. The company made the payments until September 2022, and the dispute is over the non-payment during the period October 2022 to March 2023.

Other Top Stories By Our Reporters

Explained: China’s bet with Jimeng and other GenAI models: TikTok parent ByteDance last week launched a new text-to-video generative AI app called Jimeng AI, said to be a rival to OpenAI’s Sora, which is yet to be made publicly available. We take a close look at Jimeng and other Chinese GenAI models and their place in the global AI race.

Swiggy tweaks service fee policy; non-metro restaurants to pay more in commision: IPO-bound food delivery firm Swiggy has started charging its service fee on the gross order value, which includes GST and packaging charges too, from restaurants outside metro cities as well. This will effectively increase the commission its restaurant partners in such markets pay.

Ecom Express secures board nod for Rs 2,600 crore IPO: Ecom Express board has approved the plan for a Rs 2,600 crore IPO. According to the company’s internal documents accessed from the RoC, Ecom Express is considering a fresh issue of up to Rs 1,284.5 crore and an offer-for-sale (OFS) component of up to Rs 1,315.5 crore.

Flexiloans to raise $35 million in fresh equity: Flexiloans, a digital lending platform for small businesses, is in talks with a bunch of large global and domestic investors to raise around Rs 300 crore ($35 million) in a fresh equity round, two people in the know said.

Global Picks We Are Reading

■ Amazon, Meta, and Big Tech’s bid to rewrite the rules on net zero (FT)

■ The Tech Job Paying Six Figures, No College Degree Required (WSJ)

■ The ACLU Fights for Your Constitutional Right to Make Deepfakes (Wired)