MUMBAI: In volatile trades on Monday, the sensex closed a marginal 57-point lower at 79,649 points as investors on Dalal Street mostly discounted US short-seller Hindenburg Research‘s report that alleged conflict of interest on part of Sebi chief Madhabi Puri Buch while investigating alleged wrongdoings by Adani Group.

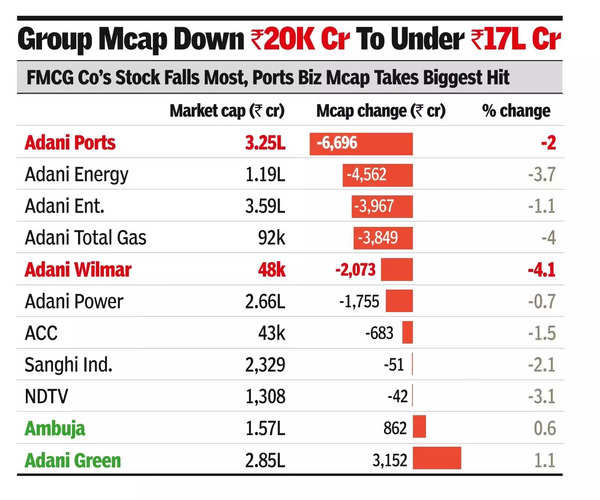

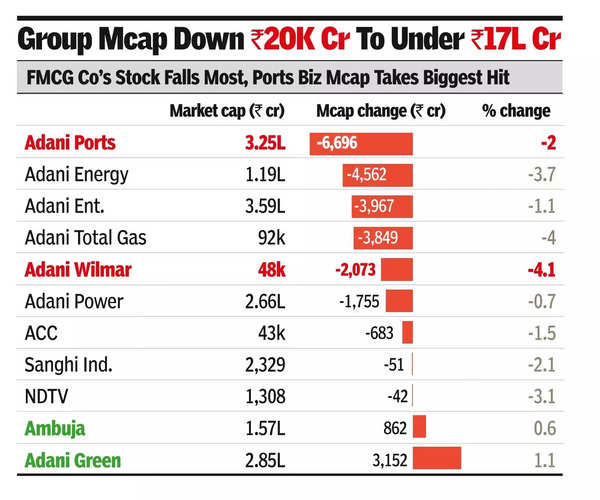

While the latest Hindenburg report didn’t have much impact on the broader market, stock prices of some of Adani Group companies witnessed selling on Monday.However, the selling was not as sharp as during Jan-Feb 2023, after the publication of Hindenburg’s first report that had alleged serious corporate malfeasance against Adani Group, which the it has denied.

After Hindenburg released its report on Saturday, there was apprehension among investors that the market may react negatively to the report, just like it had done when the first report was published in Jan 2023. However, as some market veterans had reasoned that Hindenburg’s second report had no surprise element and hence unlikely to impact investor sentiment, the markets, after a negative start in the new week, recovered quickly.

According to Vinod Nair of Geojit Financial Services, the market’s initial trajectory “was eclipsed” by the controversy generated by Hindenburg’s report on Sebi chairperson. “However, the market tried to ignore these noises, taking positive cues from global markets. Moreover, the domestic market is anticipating ease in CPI inflation (came in at a multi-month low after markets closed), which is going to be further supported by a good monsoon.”

Nair said that there are some upside risks to the market, “given firm oil prices and volatility in food inflation”. Market players don’t see any negative fallout from the Hindenburg report.

While the latest Hindenburg report didn’t have much impact on the broader market, stock prices of some of Adani Group companies witnessed selling on Monday.However, the selling was not as sharp as during Jan-Feb 2023, after the publication of Hindenburg’s first report that had alleged serious corporate malfeasance against Adani Group, which the it has denied.

After Hindenburg released its report on Saturday, there was apprehension among investors that the market may react negatively to the report, just like it had done when the first report was published in Jan 2023. However, as some market veterans had reasoned that Hindenburg’s second report had no surprise element and hence unlikely to impact investor sentiment, the markets, after a negative start in the new week, recovered quickly.

According to Vinod Nair of Geojit Financial Services, the market’s initial trajectory “was eclipsed” by the controversy generated by Hindenburg’s report on Sebi chairperson. “However, the market tried to ignore these noises, taking positive cues from global markets. Moreover, the domestic market is anticipating ease in CPI inflation (came in at a multi-month low after markets closed), which is going to be further supported by a good monsoon.”

Nair said that there are some upside risks to the market, “given firm oil prices and volatility in food inflation”. Market players don’t see any negative fallout from the Hindenburg report.

On Monday, foreign funds were big sellers with a net outflow figure of Rs 4,681 crore, BSE data showed. However, domestic funds were aggressive buyers and recorded a net inflow of Rs 4,478 crore.

On Monday, Adani Wilmar was the worst hit and closed 4.1% down, while flagship Adani Enterprises ended 1.1% lower.