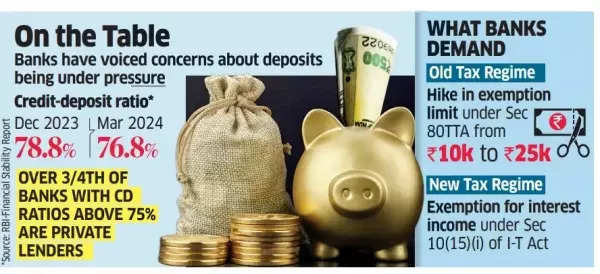

This suggestion was put forward by banks during a recent meeting with key officials from the finance ministry.Banks have been advocating for deposit incentives due to increasing concerns about the widening credit-deposit ratio.

“It (the suggestion) is under review, and there could be some relief for banks, which have demanded incentives to shore up deposits,” a government official was quoted as saying in an ET report by Dheeraj Tiwari. The final decision on the proposal will be made closer to the budget announcement.

Budget 2024 expectations

Under the old tax regime, interest income up to Rs 10,000 per year from savings accounts is tax-exempt under Section 80TTA of the Income Tax Act. For senior citizens aged 60 and above, this limit is set at Rs 50,000 and includes interest income from fixed deposits under Section 80 TTB. However, these benefits were removed under the new tax regime, when it was introduced in the 2020 budget.

“Both issues, including enhancement of the old limit and allowing interest income earned from savings accounts in scheduled commercial banks (SCBs) under existing regulations in the new regime, are being deliberated,” said the person cited above, noting that banks had previously made a presentation on this matter.

Also Read | Budget 2024 income tax expectations: Top 10 things FM Sitharaman should do for salaried taxpayers

The Reserve Bank of India (RBI) observed in its latest Financial Stability Report that households are diversifying their financial savings, allocating more to non-banks and the capital market.

The report highlighted that the growing gap is reflected in the rising credit-deposit (C-D) ratio, which peaked at 78.8% in December 2023 before moderating to 76.8% at the end of March.

Recently, HDFC Bank, the country’s largest private sector lender, reported a 5% sequential decline in its current account-savings account (CASA) deposits to Rs 8.63 lakh crore during the first quarter of the current financial year.