On the BSE, the sensex opened about 300 points up, but selling pressure pulled it down soon enough – by about 450 points – from its previous close.It then rallied to close at 73,664 points, up 677 points or 0.9%. On the NSE, Nifty showed a similar pattern and closed 203 points up at 22,404.

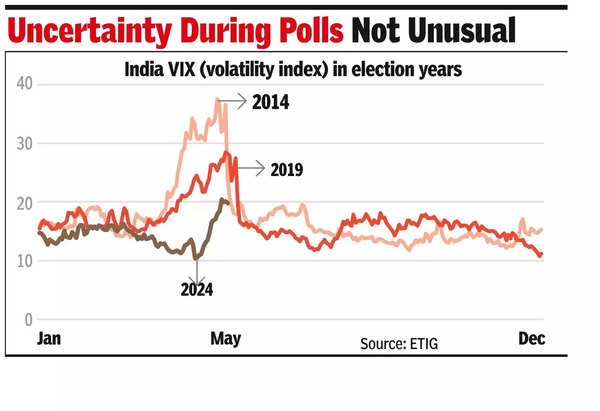

As a result of the huge gyrations in the market, India VIX – the measure of volatility in the market – hit a fresh high at 21.1 during Thursday’s session. In less than a month since the Lok Sabha elections started on April 19, the index, also called the fear gauge, has more than doubled, exchange data showed.

According to Prashanth Tapse, senior VP (research), Mehta Equities, it was another volatile trading session where strong buying during the closing hour saw key indices notch up significant gains. “At a time when FIIs have been ploughing out funds from domestic equities, news of new stocks being added to the MSCI index, which is expected to bring in fresh FPI flows, has brought some cheer to the markets.”

On Thursday, domestic institutional investors were net buyers at Rs 2,128 crore while foreign portfolio investors were net sellers at Rs 776 crore.

So far in May, FPIs have been net sellers at over Rs 27,500 crore (translating to more than $3 billion) in Indian stocks alone, data from CDSL showed. In contrast, DIIs were net buyers at over Rs 32,400 crore, BSE data showed.

At the session’s close, 25 of 30 sensex constituents closed higher while the rest closed in the red. In the broader market, there were 2,040 advances to 1,798 declines, data on BSE showed.

Looking ahead, Nifty has technically entered a rising phase. According to Rupak De, senior technical analyst at LKP Securities, the index has moved back up into the rising channel after a few days of failed attempts. “Over the next few days, the bulls might have the upper hand in the market as the index moved above the critical moving average after several days. On the higher side, the Nifty might move towards 22,600 in the short term.”