“Nifty 500 is an all seasons fund as it includes a wide range of companies spanning large-cap, mid-cap and small-cap segments.There is no fund manager risk as it is passively managed and comes at a low cost,” Kunal Valia, founder, StatLane told ET.

He said that the fund could be one of the primary options for any investor, providing a cost-effective avenue for wealth generation.

According to financial planners, the Nifty 500 has outperformed the Nifty 50 over the past three years. The Nifty 500 has delivered returns of 36.98% and 19.12% in the past one and three years, respectively, compared to the Nifty 50’s returns of 25.13% and 16.09%.

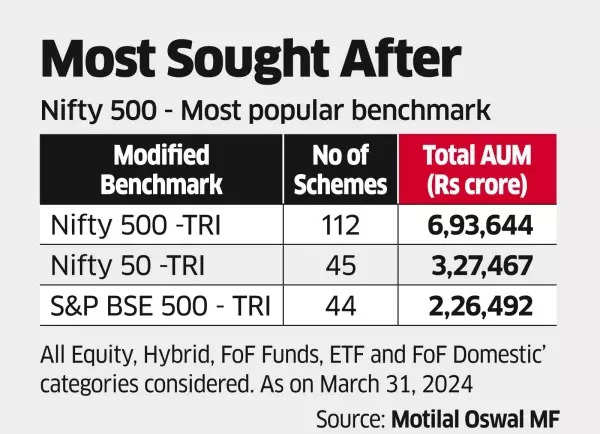

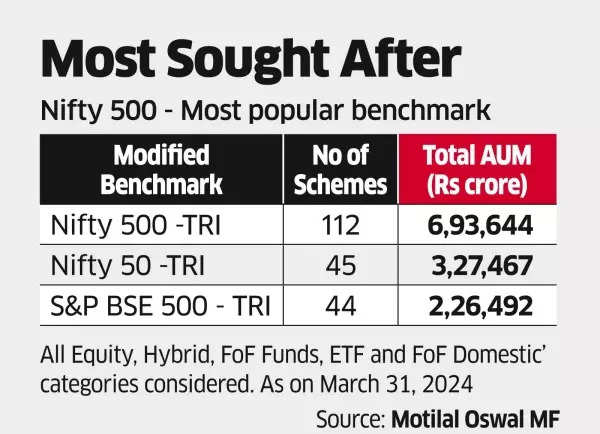

<p>Nifty 500 – Most Popular Benchmark<br><span class=”redactor-invisible-space”></span></p>

A Motilal Oswal report highlighted that the Nifty 50 has a higher sectoral concentration, covering only 10 sectors, while the Nifty 500 covers 21 sectors with a more balanced exposure.

The top 10 stocks in the Nifty 50 account for 56.1% of the portfolio, while in the Nifty 500, they account for 33.9%. The Nifty’s coverage of India’s listed universe has decreased over the past decade, covering 51% of India’s market-cap now, compared to 59.9% in December 2013.

The Nifty 500 has outperformed the Nifty 50 in 14 out of 24 calendar years since 2000. Although the Nifty 500 may experience slightly larger declines during market crashes, it also experiences greater gains during bull markets.

Also Read | Biggest Wealth Creators! Small-cap and mid-cap funds among top performers in last one year; check list here

“Nifty 500 is a passive multi-cap fund, giving exposure to the Indian economy and is a good starting point for first-time investors,” said Nirav Karkera, head of research at Fisdom.

He explained that these types of funds typically exhibit better performance than large-cap stocks throughout the duration of a bull market. Additionally, he noted that they assist in minimizing drawdowns in comparison to strategies that solely focus on mid- and small-cap investments during bear markets.