Also in this letter:

■ Scaler fires 150 employees

■ Paytm shares recover losses

■ Number of unicorns in India declines

Cultfit elevates Naresh Krishnaswamy as CEO, Mukesh Bansal takes on executive chairman role

(L-R) Cultfit CEO Naresh Krishnaswamy and chairman Mukesh Bansal

Zomato and Tata Digital-backed fitness startup Cultfit has formally elevated Naresh Krishnaswamy as the chief executive with cofounder and former CEO Mukesh Bansal moving to the chairman position.

Driving the news: Krishnaswamy, who was previously the head of fitness services at Cultfit, has been running all key operations since cofounder and former chief executive Mukesh Bansal moved to Tata Digital as its president, people in the know said.

A company spokesperson confirmed the development.

Internally, Krishnaswamy was made the CEO in October but it was not formally announced. He was previously the chief revenue officer at Flipkart-owned online fashion retailer Myntra, which was also cofounded by Bansal.

What’s next for Bansal? After a short stint at Tata Digital, Bansal is finalising his new venture in the fashion space with Zomato cofounder Mohit Gupta. The venture has been in talks with several investors to raise new capital.

Recent job cuts: In January, Cultfit laid off between 100-120 employees as part of a cost-cutting exercise. It is looking to go public over the next two years and is aiming to turn profitable.

The company last raised Rs 84.5 crore (around $10.2 million) in a round led by existing backer Valecha Investments, which contributed over Rs 36 crore.

In FY23, Cultfit’s operating revenue more than tripled to Rs 694 crore, while its loss for the year narrowed to Rs 551 crore from Rs 688 crore the year before.

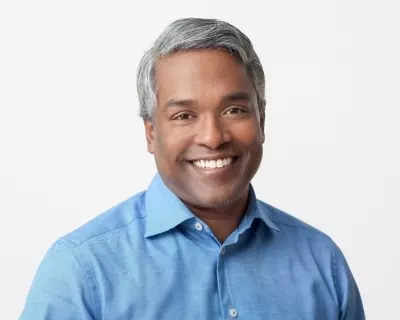

Google unveils Arm-based chip to take on rivals

Google Cloud CEO Thomas Kurian

Google unveiled its latest weapon in the ongoing chip war to counter rivals such as Microsoft and Amazon. At its annual Google Cloud Next 2024 event in Las Vegas, the company announced the Axion Processor — its first custom Arm-based chip or central processing unit (CPU) designed for data centres.

Driving the news: The new silicon chip processor will become available for customers later in 2024. It is already powering YouTube ads, the Google Earth Engine and other Google services.

“Our first custom Arm-based CPU designed for the data centre delivers up to 50% better performance and up to 60% better energy efficiency than comparable current-generation x86-based (processor) instances,” said Google Cloud CEO Thomas Kurian.

Rivals in the game: Among global rivals, Amazon Web Services (AWS) revealed its Graviton Arm-based chip and Inferentia AI processor in 2018. It announced Trainium for training models in 2020. Chinese competitor Alibaba launched arm processors in 2021 and Microsoft launched one in November 2023.

Other key launches:

- The monetisation of Google Workspace productivity suites offering competitive rates of $10 per user per month with add-on packages

- AI large language model (LLM) Gemini 1.5 Pro

- Gemini Code Assist for developers

- Expanded cybersecurity capabilities with Gemini in Threat Intelligence

- New enhancements for Gemini in Google Workspace

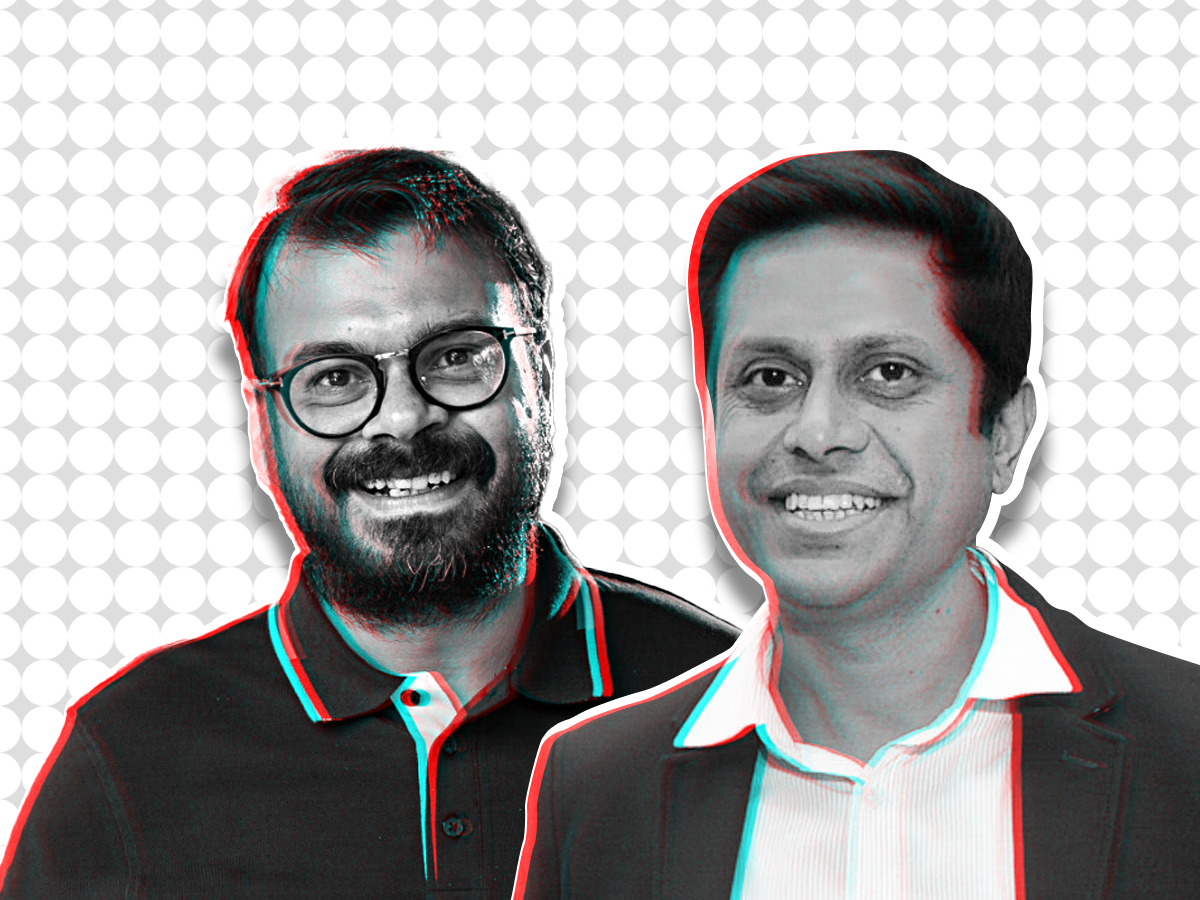

Edtech startup Scaler lays off 150 staffers

Abhimanyu Saxena, cofounder, Scaler Academy

Edtech startup Scaler has sacked 150 staffers across its marketing and sales functions in a bid to cut costs.

Reduction in size: Scaler, which helps college students and tech professionals upgrade skills, has laid off about 17% of its 900 full-time employees, one of the sources told us. The edtech firm employs about 1,400 staff including part-time workers, contractual employees and interns.

Scaler has attributed the job cuts to its need for long-term growth and sustainability.

Companyspeak: “We have designed a new way of working to be able to achieve sustainable growth while delivering the best learning experience and outcomes for our learners – something that we’ve always been committed to,” cofounder Abhimanyu Saxena told us.

Go deeper: Total expenses at Scaler shot up by 2.7 times to Rs 654.6 crore, significantly driven by employee expenses of Rs 322 crore in the financial year ended March 2023. However, Scaler also reported a 4.8 times increase in yearly operational revenue to Rs 316.7 crore during the period, in which it raised no external capital. Its losses nearly doubled to Rs 330 crore.

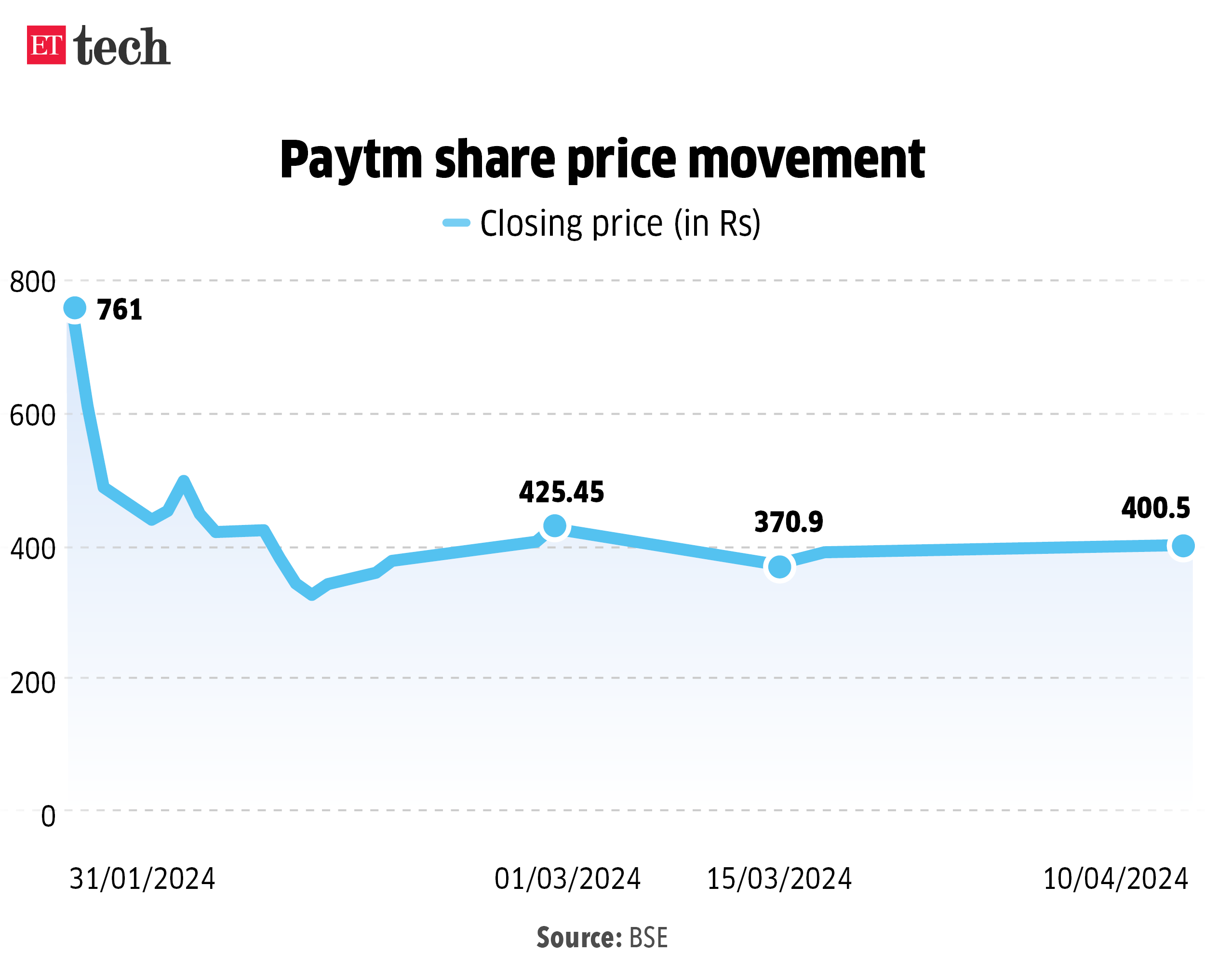

Paytm shares recover losses, PB Fintech hits 52-week high

Vijay Shekhar Sharma, founder, One 97 Communications

Stocks of two new-age companies — Paytm and PB Fintech — saw significant movement on the bourses on Wednesday. While shares of Paytm tanked before recovering, Policybazaar parent PB Fintech rallied to hit a 52-week high.

Paytm tumbles: Shares of Paytm fell 4% to Rs 388 in intraday trade on the BSE a day after Surinder Chawla, managing director and CEO of Paytm Payments Bank Limited (PPBL), tendered his resignation. The stock, however, recovered its losses to close at Rs 400.

Driving the news: Chawla’s resignation could be a possible cause. He resigned citing personal reasons and to pursue “better career prospects.” While PPBL has lost its top executive, Paytm has lost further market share on Unified Payments Interface (UPI), the most popular payment mechanism in the country.

PB Fintech rallies: Shares of PB Fintech jumped over 7% on Wednesday to hit a fresh 52-week high at Rs 1,400 on the BSE after the company announced a partnership with ICICI Lombard to provide insurance solutions to 1 crore customers. The shares closed at Rs 1,333, up 2.20%.

Subsidiary unit: The rise in PB Fintech’s share price also comes after the company incorporated a subsidiary unit by the name of PB Pay Private Limited.

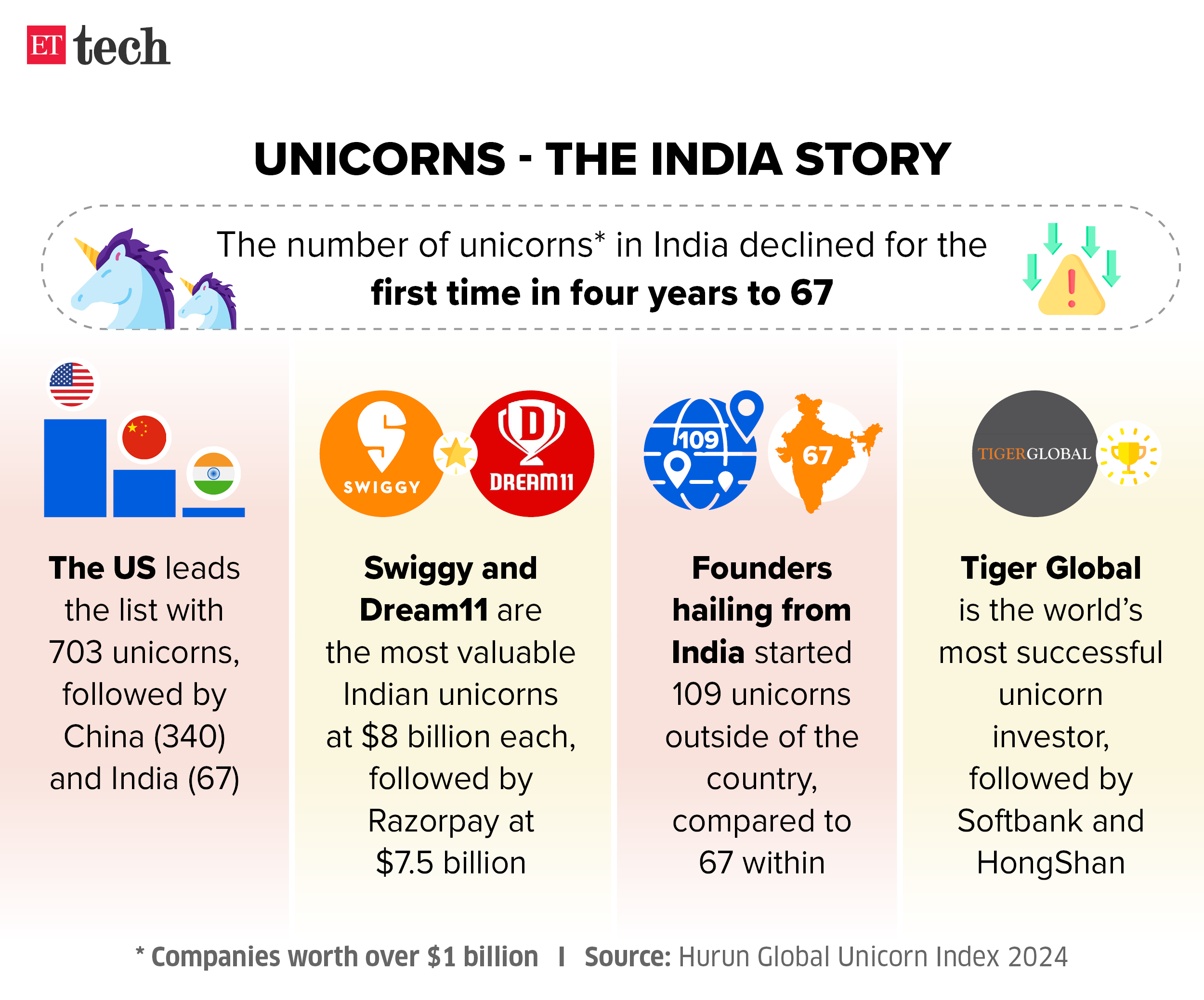

Infographic Insight: Number of unicorns in India declines for first time in four years

The total number of unicorns – companies worth over $1 billion – in the country has declined for the first time in four years to 67, according to the Hurun Global Unicorn Index 2024. India, however, retained the tag of being the third biggest hub for unicorns across the world.

On investments in startups, the report said the year 2024 has seen a slowdown in new unicorn investments, especially compared with the heyday of 2021 as investor exits prove harder to come by.

Today’s ETtech Top 5 newsletter was curated by Megha Mishra in Mumbai and Gaurab Dasgupta in New Delhi.