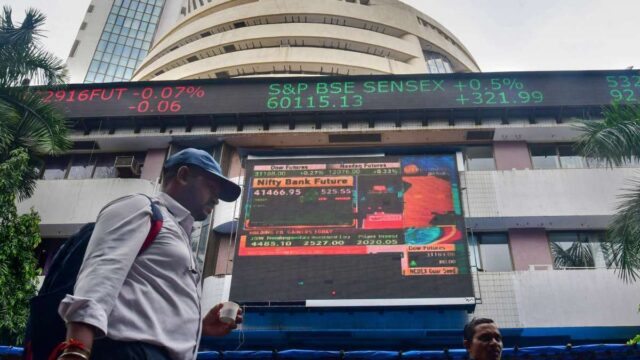

The Indian stock market witnessed another day of gains as the Sensex and the Nifty 50 closed higher for the fourth consecutive session, reaching new closing highs on Monday. Experts suggest that the market is currently operating within a range due to the absence of new triggers. Taher Badshah, Chief Investment Officer at Invesco Mutual Fund, highlights the dearth of actionable events, except for global policy rates, monsoon developments, and domestic election results. With robust economic growth and political stability already factored in, the market awaits key events to drive future movements.

Sensex hits all-time high

The 30-share BSE Sensex extended its rally for the fourth consecutive session, gaining 66.14 points or 0.09 per cent to settle at an all-time high of 73,872.29. Throughout the day, it surged 183.98 points or 0.24 per cent to touch 73,990.13.

Nifty reaches lifetime high

Similarly, the Nifty rose by 27.20 points or 0.12 per cent, closing at a lifetime high of 22,405.60 points, with an intraday peak of 22,440.90.

Market movers and shakers

Key gainers among the Sensex constituents included NTPC, Power Grid, Reliance Industries, Bajaj Finserv, Axis Bank, Tech Mahindra, ICICI Bank, Bharti Airtel, and IndusInd Bank. However, JSW Steel, Mahindra & Mahindra, Tata Steel, UltraTech Cement, Infosys, and Titan were among the laggards.

Global market trends

In Asian markets, Seoul, Tokyo, Shanghai, and Hong Kong closed in the green, while European markets traded with mixed sentiments. The US markets ended with gains on Friday, further boosting investor confidence.

Moody’s raises India’s growth forecast

Global rating agency Moody’s revised India’s growth forecast for 2024 to 6.8 per cent, citing stronger-than-expected economic data from 2023 and diminishing global economic headwinds.

Special trading session and oil prices

Over the weekend, the BSE and NSE conducted a special trading session to test their readiness for handling major disruptions. Meanwhile, global oil benchmark Brent crude edged up to USD 83.80 a barrel.

FIIs offload equities

Foreign institutional investors (FIIs) divested equities worth Rs 81.87 crore on Saturday, as per exchange data, adding a layer of caution amidst the market’s bullish run.

Also read | How can senior citizens lodge complaints regarding pension-related issues? All you need to know