Reliance Industries Limited, Viacom 18 and the Walt Disney Company on Wednesday announced the signing of binding definitive agreements to form a joint venture that will combine the businesses of Viacom18 and Star India. This joint venture will become one of the leading TV and digital streaming platforms for entertainment and sports content in India, bringing together iconic media assets across both sectors.

The media undertaking of Viacom18 will be merged into Star India Private Limited through a court-approved scheme of arrangement as part of the transaction, according to an official release. Reliance has agreed to invest Rs 11,500 crore for the joint venture, currently valued at Rs 70,352 crore on a post-money basis.

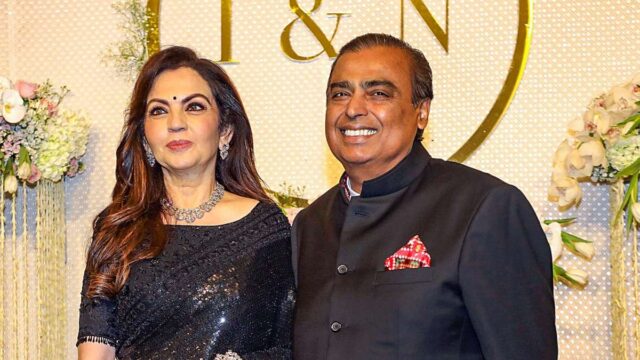

The joint venture will be controlled by RIL and owned 16.34 per cent by Reliance, 46.82 per cent by Viacom 18 and 36.84 per cent by Disney. Nita Ambani will be the chairperson and Uday Shankar will be the vice-chairperson of the venture, providing strategic guidance. Disney may also contribute certain additional media assets to the joint venture.

What the joint venture will entail?

The merger will bring iconic assets like Colors, StarPlus and StarGold in entertainment and Star Sports and Sports18 in the realm of sports through television and digital platforms through JioCinema and Hotstar. The JV will have over 750 million viewers across India and will also cater to the Indian diaspora across the world.

According to the release, the merger seeks to lead the digital transformation of the media and entertainment industry in India and offer consumers high-quality and comprehensive content offerings anytime and anywhere. This combination of media expertise, cutting-edge technology and diverse content libraries of Viacom18 and Star India will allow the JV to offer more appealing domestic and global entertainment content and sports live-streaming services.

With the addition of Disney’s acclaimed films and shows to Viacom18’s productions and sports offerings, the joint venture will offer a compelling, accessible and novel digital-focused entertainment experience to people in India and the Indian diaspora globally.

The new venture will also be granted exclusive rights to distribute Disney films and productions in India, with a license to more than 30,000 Disney content assets. The transaction is subject to regulatory, shareholder and other customary approvals and is expected to be completed in the last quarter of 2024 or the first quarter of 2025.

What did business leaders say about the venture?

Speaking on the venture, Mukesh Ambani, Chairman and Managing Director of Reliance Industries, said, “This is a landmark agreement that heralds a new era in the Indian entertainment industry. We have always respected Disney as the best media group globally and are very excited at forming this strategic joint venture that will help us pool our extensive resources, creative prowess, and market insights to deliver unparalleled content at affordable prices to audiences across the nation. We welcome Disney as a key partner of Reliance group.”

“India is the world’s most populous market, and we are excited for the opportunities that this joint venture will provide to create long-term value for the company. Reliance has a deep understanding of the Indian market and consumer, and together we will create one of the country’s leading media companies, allowing us to better serve consumers with a broad portfolio of digital services and entertainment and sports content,” said Bob Iger, CEO of the Walt Disney Company.

“We are privileged to be enhancing our relationship with Reliance to now also include Disney, a global leader in media and entertainment. All of us are committed to delivering exceptional value to our audiences, advertisers, and partners. This joint venture is poised to shape the future of entertainment in India and accelerate the Hon’ble Prime Minister’s vision of making Digital India a global exemplar,” Uday Shankar, co-founder of Bodhi Tree Systems, said.

Additionally, Goldman Sachs is acting as financial and valuation advisor and Skadden, Arps, Slate, Meagher & Flom LLP, Khaitan & Co and Shardul Amarchand Mangaldas & Co are acting as legal counsels to RIL and Viacom18 on the transaction. Ernst & Young has provided an independent valuation to RIL and Viacom18, while HSBC India acting as financial advisor has provided a Fairness Opinion to Viacom18.

ALSO READ | Reliance Foundation announces ‘Vantara’ focused on rescue, care of threatened animals in India, abroad