Also in this letter:

■ HomeLane to acquire DesignCafe

■ Amazon injects Rs 830 crore into India unit

■ Byju’s asset sale in limbo

AI will not only solve challenges for India but also for the world: Satya Nadella

India is poised to gain massively from artificial intelligence (AI), which could solve the country’s unique structural challenges, according to Satya Nadella. The 56-year-old chairman and chief executive officer of Microsoft called AI the new “factor of productivity” and said it will aid India’s goal of becoming a $5-trillion economy.

On AI adoption: Artificial intelligence will help with more productivity in sectors such as energy, retail, and healthcare, he told us, adding that it’s not just about the tech sector’s growth but its ability to impact growth across areas.

The Hyderabad-born technocrat also spoke about his “tremendous optimism” that AI will further accelerate India’s growth as it races towards its goal of becoming a developed nation by 2047.

Also read | Microsoft to train 75,000 women developers in India: Satya Nadella

Some excerpts from the interview:

On AI in IT: The IT sector in India has become early adopters at scale for something like a Copilot because, after all, they’re not only going to be doing work in India, but they’re going to be showing the rest of the world how to use all of these AI technologies.

Also read | Microsoft to train 2 million Indians in AI by 2025: Satya Nadella

On global economic turmoil: The tech sector cannot be immune to what is happening in the rest of the world. I always say Microsoft will do well if the rest of the world is doing well. And so, our job number one is to make sure we are contributing to the rest of the world’s economic growth. And if that happens, we will be fine long term.

Read the full interview here

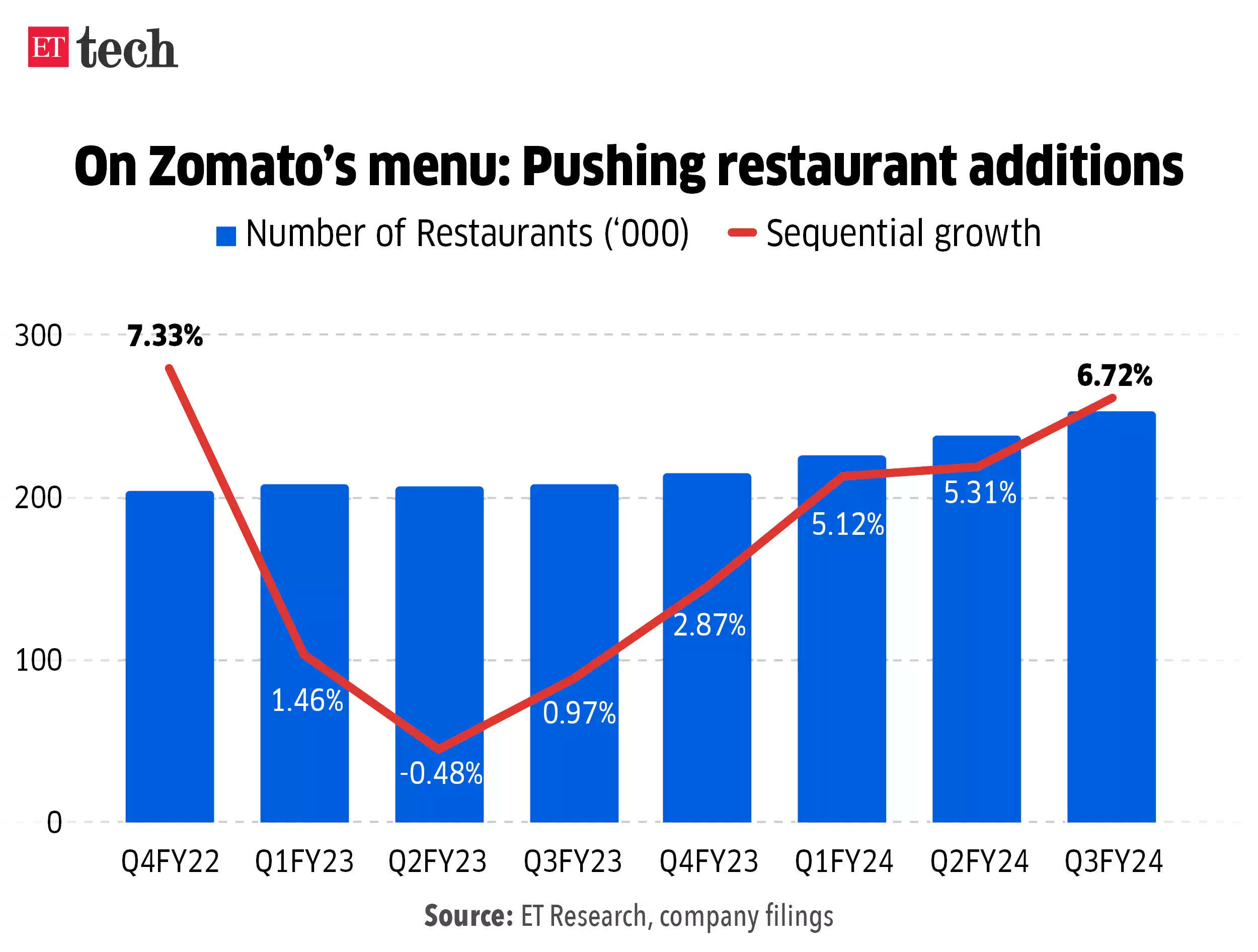

Zomato steps up restaurant onboarding amid macro headwinds

Populating its platform with more restaurants appears to be the key to growth for food-delivery platform Zomato, in a market buffeted by macroeconomic headwinds for consumer demand.

Driving the news: The Gurugram-based listed firm is stepping up onboarding of new restaurants. As of December 31, it had 254,000 restaurant partners on its platform, compared to 238,000 on September 30.

Also read | Subdued consumer spends weigh on food-delivery growth: Zomato

Double clicking: The sequential growth in restaurant addition has improved since falling to a negative 0.5% in October-December 2022, from 7% in the three-month period ended December 2021, to again nearing 7% in the third quarter of FY24.

Tell me more: According to people aware of the developments, the company has increased resources for onboarding restaurants that are not on its platform.

“The company is also spending on hiring account managers, particularly in tier-II and tier-III towns, to keep up with the growth story of food delivery,” one of the people said. “The pace of adding restaurants will continue steadily,” he added.

Also read | Zomato Q3 Results: Profit skyrockets 283% QoQ to Rs 138 crore

Home interior startup HomeLane may acquire DesignCafe

HomeLane cofounders Srikanth Iyer (left) and Tanuj Choudhry

Home interior service startup DesignCafe has signed a term sheet to merge into larger rival HomeLane in a stock swap deal that prices its share at six times that of HomeLane, sources told us.

Driving the news: There have been murmurs of major consolidations in the online interior services startups space since 2022. This could be the first deal in that direction.

The details: The deal provides DesignCafe with a valuation of about $60 million, while HomeLane’s valuation will be pegged at $360 million. The merger aims to generate combined earnings before interest, taxes, depreciation and amortisation (Ebitda) of about Rs 70 crore by the financial year ending March 2025.

While both startups primarily focus on mid- to premium segments, they have also launched brands in the entry-level space. In 2022, DesignCafe launched Qarpentri, while HomeLane unveiled Doowup in 2023.

The backdrop: DesignCafe had been struggling to raise a new round of funding through all of last year. In March 2023, HomeLane undertook a cost-cutting exercise that led to the termination of a significant chunk of its technology and product roles. It was trying to trim fixed costs. In June, it raised about $9 million via convertible notes with no new valuation priced in.

Amazon infuses Rs 830 crore in its India marketplace entity

Amazon Seller Services, the entity that runs the Amazon marketplace in India, said its US parent infused Rs 830 crore into the company.

Transaction details: Amazon Seller Services, the entity that runs the Amazon marketplace in India, allotted 83 crore equity shares to Amazon Corporate Holdings Ltd and Amazon.com Inc Ltd as part of the infusion, the firm said in a regulatory filing.

On January 19, the firm invested Rs 350 crore in the entity that runs its fintech unit Amazon Pay. With this, Amazon’s investment in its Indian entities this year has already crossed Rs 1,000 crore.

FY23 scorecard: Amazon Seller Services saw revenue grow 3.4% to Rs 22,198 crore in the financial year ended March 31, 2023, while its loss widened by 33% to Rs 4,854 crore.

Shifting priorities: The investment into the marketplace comes even as the company has been focusing a lot more on its cloud services arm, Amazon Web Services, as opposed to the core ecommerce business.

In June last year, chief executive Andy Jassy had said the firm would invest a further $15 billion in India, taking their total investments in India to over $26 billion by 2030.

Catch up quick: In December, we reported that Amazon had begun a restructuring of its top management in India. Noor Patel, who headed category management in India, is moving to the US, and his responsibilities will be divided between Nishant Sardana and Ranjan Babu.

Also read | Flipkart in talks to raise $1 billion, Walmart commits $600 million

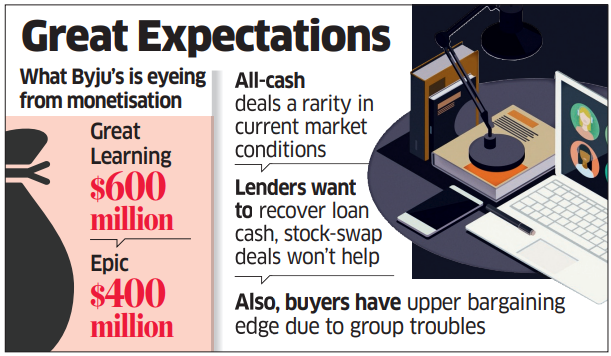

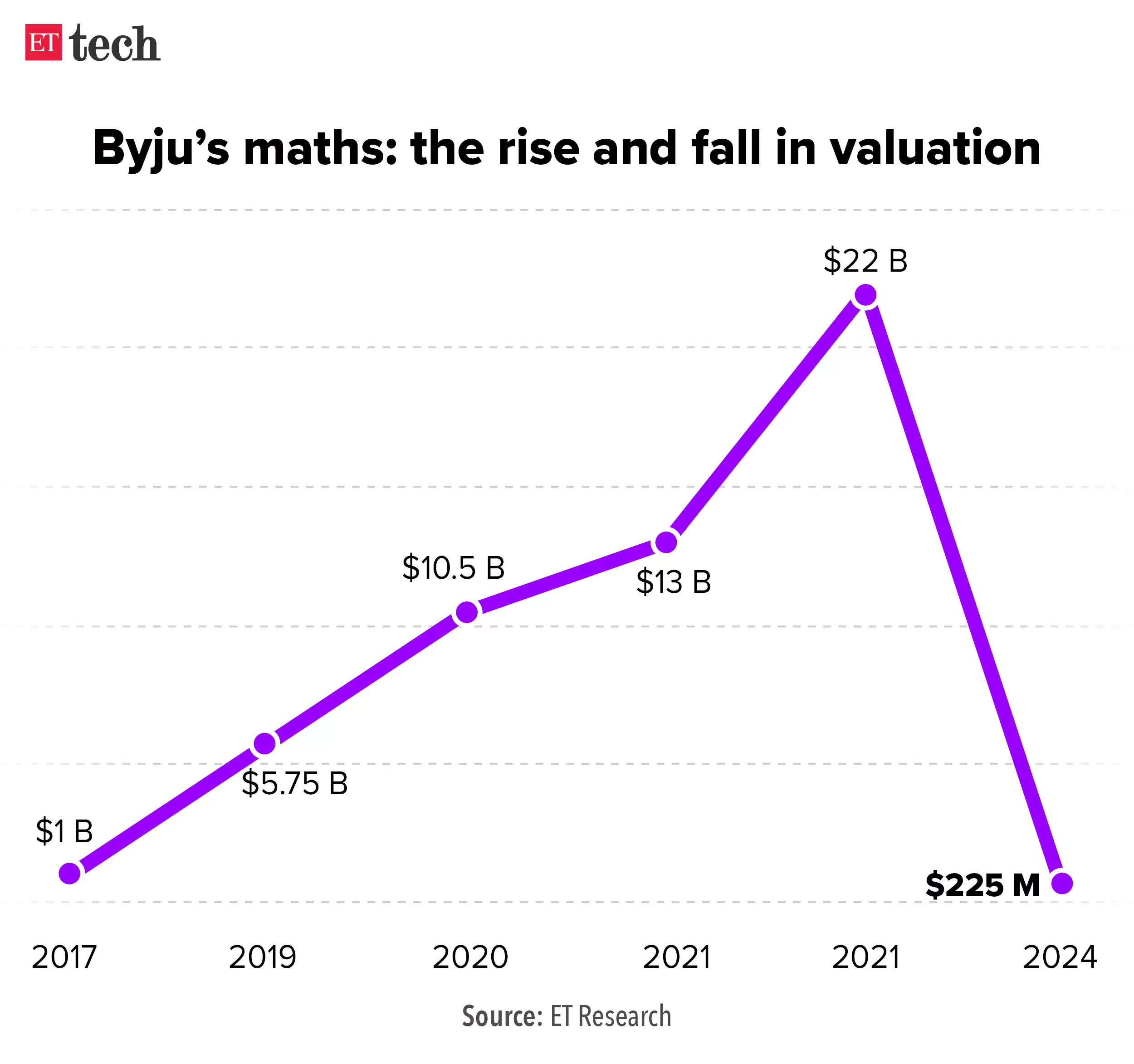

Byju’s asset sale hangs fire amid investor flare-ups

Embattled edtech platform Byju’s plan to sell assets such as Great Learning has stalled amid mounting financial challenges stemming from term loan B (TLB) investor demands and discord with stakeholders.

Buyers playing hardball? Potential buyers, who have been approached, told us that they are waiting in expectation of a lower purchase price. Byju’s is seeking around $600 million from the sale of Great Learning, but is yet to find a buyer with a binding term sheet.

Unlike Epic — which is also on the block — the sale of Great Learning is being overseen directly by its founder Mohan Lakhamraju, along with the TLB investors.

It is also yet to get a binding offer for Epic, underscoring troubles facing the Bengaluru-based startup on all fronts. Byju’s is selling Great Learning to repay a $1.2-billion loan.

‘Tough ask’: A cash-and-stock deal remains a thorny issue for the troubled edtech firm. Lenders don’t favour a mix as they’re trying to fully recover the loan given to Byju’s.

“What will lenders do with stock? They need cash. (But) even for Epic, a better asset, a full-cash deal at $400 million is not an easy task to pull off,” said a person aware of the discussions.

Rift with investors: Last month, Byju’s floated a rights issue at a throwaway pre-money price of $25 million — a 99% discount to Byju’s peak valuation — to raise $200 million. It has made a group of investors — including Prosus and Peak XV Partners — unhappy as their investments will be wiped out completely if they don’t participate.

A group of key shareholders, collectively holding more than 30% stake, even sought to oust Byju’s CEO Raveendran and his family members from the board, but the edtech hit back saying they have “no voting rights to change (its) chief executive.”

Other Top Stories By Our Reporters

Solid business model key to secure funding, panel at Global Business Summit: Unit economics, total addressable market and founder quality are top characteristics that risk capital investors evaluate a startup on, as per a panel discussion at the Global Business Summit. The panel included unicorn founders and Shark Tank India judges, who said positive unit economics matter even for early-stage startups in this phase.

Student accommodation platform Amber raises $21 million: Student accommodation platform Amber has raised $21 million in its first round of institutional funding, led by Mumbai-based private equity firm Gaja Capital. The round comprises $18.5 million in fresh equity and the remaining in venture debt from Lighthouse Canton and Stride Ventures.

No one-size-fits-all approach to deepfakes regulation: industry group to IT MoS | There should be no one-size-fits-all approach to the government’s upcoming regulation on deepfakes, a software industry group which counts enterprise firms like Microsoft as its clients said in its representation to the Ministry of Electronics and Information Technology (MeitY).

Surveillance or security? Social media divided over Digi Yatra facial scanning: Since its rollout, the Digi Yatra application has been downloaded by four million travellers and has been used 10 million times at various airports. However, sceptics believe the implementation model blurs the line between security and commercial exploitation — especially since the airports are managed by private entities.

Global Picks We Are Reading

■ Avatars, robots and AI: Japan turns to innovation to tackle labour crisis (FT)

■ With $3,500 Headsets Out in the Wild, New Social Norms Apply (WSJ)

■ Bluesky CEO Jay Graber Says She Won’t ‘Enshittify the Network With Ads’ (Wired)