Also in this letter:

■ Healthy-snack brands on growth path

■ Cactus Venture logs final close of first fund

■ Cognizant, Freshworks Q4 numbers

CDSL reviews Paytm Money’s KYC process

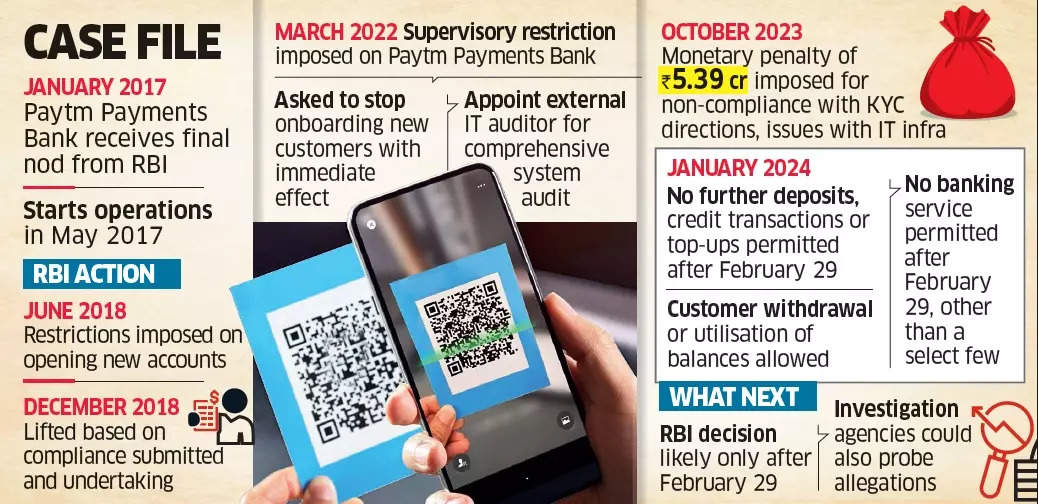

At a time when One 97 Communications, which owns Paytm, is finding means to ensure business continuity at its associate firm Paytm Payments Bank, its subsidiary Paytm Money is facing an inquiry from Central Depository Services (CDSL).

Driving the news: People in the know told ET that CDSL is conducting an audit on Paytm Money trying to ascertain whether its Know Your Customer (KYC) systems have been working properly. This comes at a time when Paytm Payments Bank is under regulatory scrutiny for lapses in following KYC formalities prescribed by the banking regulator.

Company’s response: Responding to ET’s queries, Paytm said it is part of a routine procedure and does not warrant unnecessary attention. “Under Sebi regulations, CDSL performs multiple audits and reviews routinely, which is a normal process. We have maintained the highest compliance standards to Sebi regulations and guidelines and will continue to do so.”

Understanding the process: CDSL is a depository that holds securities owned by Indian investors in dematerialised format. CDSL also runs CDSL Ventures which manages the centralised KYC for market participants. Industry insiders told ET that KYC norms are more stringently implemented by market regulator Sebi and regular third-party audits are done on the same.

Also read | Banks await RBI nod on KYC challenges at Paytm before moving business

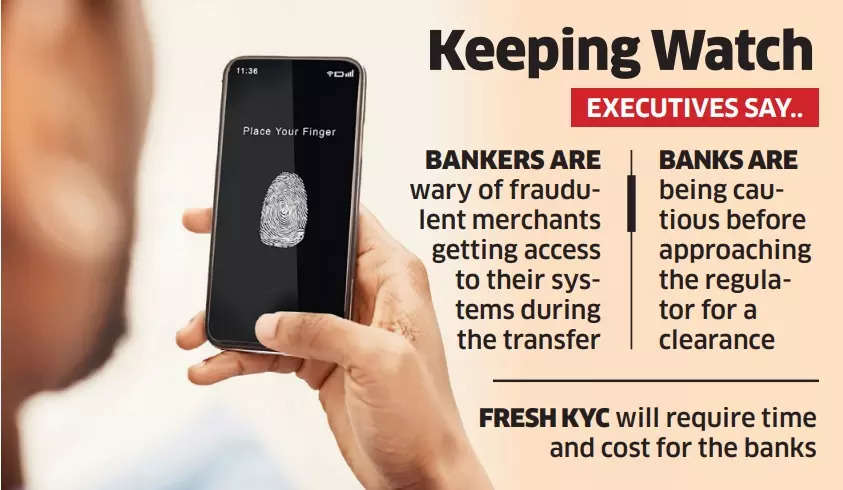

Banks may want fresh KYC of merchants: While multiple banks have eyes on the payments business from Paytm Payments Bank, they are wary of the source of funds in its nodal accounts and may insist on undertaking a fresh KYC of the merchant base, two bankers told ET.

“There is a big business opportunity, but there is also the risk factor associated with it, so we will tread carefully, and a fresh KYC of the merchants we onboard will help us identify them better,” said a senior executive at a bank eyeing the Paytm business.

Others said that while fresh KYC is a standard procedure in a situation where the payments bank has to transfer everything by February 29, additional formalities could end up taking more time.

Quick catch-up: Paytm founder and CEO Vijay Shekhar Sharma held meetings with finance minister Nirmala Sitharaman and central bank officials this week. This helped the stock rebound nearly 10% on Wednesday after three days of non-stop selling.

While emphasising consumer protection, financial services secretary Vivek Joshi said an RBI clarification on the Paytm case is likely soon due to the company’s large user base.

In other news: The RBI granted multiple startups the regulatory nod to operate as payment aggregators. Juspay and Decentro received their final licence on February 6, while software-as-a-service (SaaS) startup Zoho got the approval on February 2.

Read our detailed coverage on the Paytm crisis:

Microsoft to train two million people in India with AI skills: CEO Satya Nadella

Microsoft CEO Satya Nadella announced a plan to upskill 2 million people in India with AI expertise by 2025. With this initiative, the tech giant aims to fuel job creation within the AI domain.

Driving the news: Out of the country’s estimated $5-trillion GDP by 2025, around $500 billion will be driven by AI, Nadella said.

He cited the work done by Karya, an AI startup that enlists and pays over 30,000 rural Indians to create quality datasets through speech, text, images, and videos for training large language models in 12 Indian languages. The GenAI chatbot, Jugalbandhi, created for government assistance also found mention in his address.

Verbatim: “We are devoted to equip 2 million-plus people in India with AI skills, that is, really taking the workforce and making sure that they have the right skills, in order to be able to be a part of this domain. But it’s not just the skills, it’s even the jobs that they create,” he said.

AI regulation: Nadella added that India and the US need to cooperate on framing regulations on AI, stressing that the new-age technology can “equally distribute” growth. A “consensus” on AI is essential at multilateral levels as well, he said.

Consumer awareness, social media put healthy-snack brands on growth path

.jpg)

The healthy-snack industry is booming, fueled by a growing number of health-conscious consumers and the influence of social media. However, these businesses face a big challenge: how to expand beyond niche markets while remaining profitable.

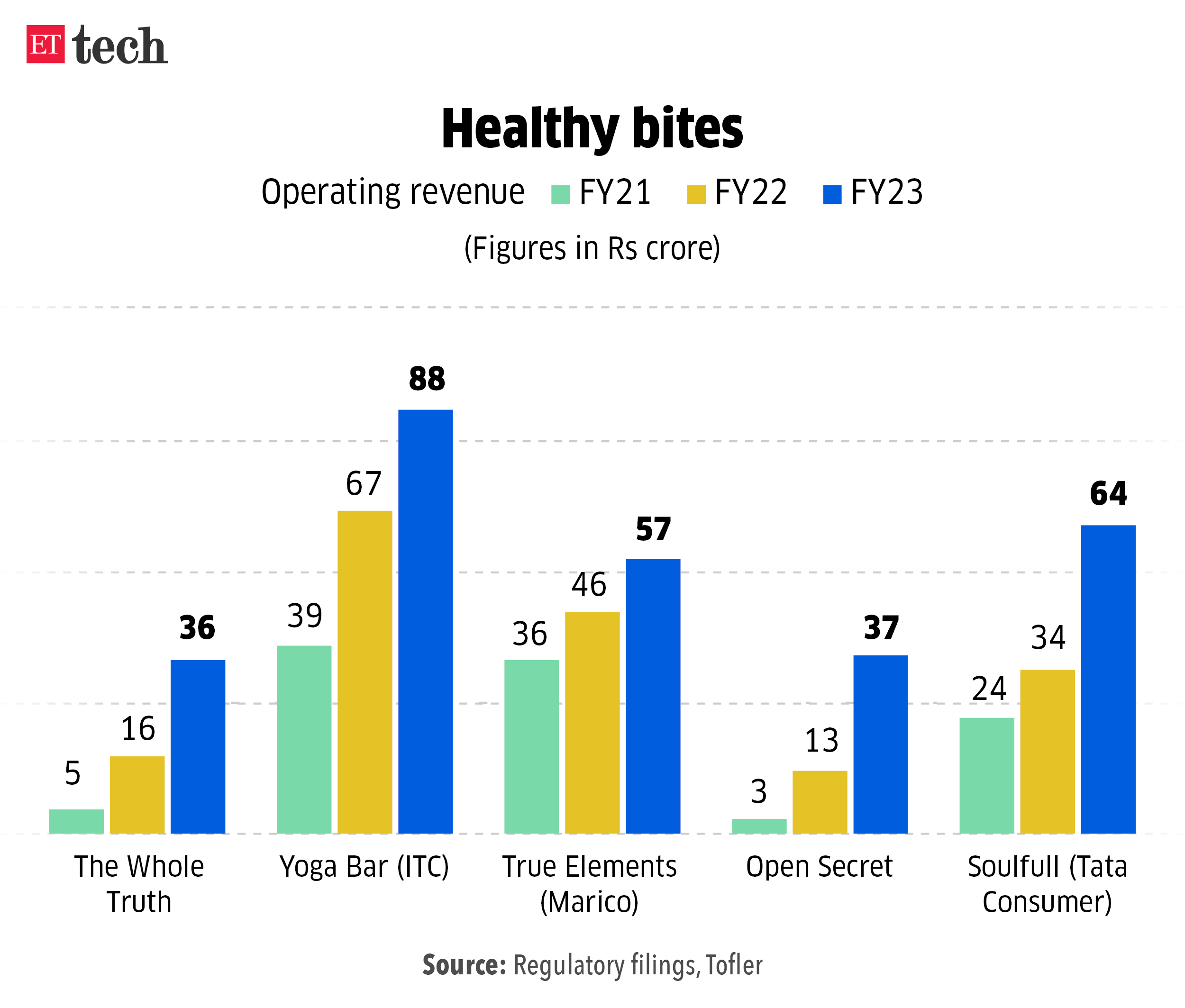

Tracking the numbers: Major players in the space saw a huge revenue bump in FY23.

- The Whole Truth clocked 125% growth in operating revenue to Rs 36 crore

- Matrix Partners India-backed Open Secret nearly tripled its revenue to Rs 37 crore

- ITC-backed Yoga Bar clocked 31% revenue growth to Rs 88 crore

- Tata Consumer Soulfull’s revenue grew 88% to Rs 64 crore

However, these brands, which sell products such as chocolate and protein bars, millets and dry fruits-based snacks, granola bars, oats, and breakfast cereal, also widened their losses during the year.

Next steps: Even as investments into creating awareness by brands are likely to continue, companies are exploring various ways to scale their businesses.

Suhasini Sampath, cofounder of Yoga Bar, said she expects the next phase of growth to come from offline channels. However, The Whole Truth, a comparatively younger brand that expects to double revenue growth in FY24, will continue to focus on the top layer of the market.

Also read | Price rise, funding slump may dampen cloud kitchen growth

Other Top Stories By Our Reporters

Cactus Venture Partners founding partners (L-R) Anurag Goel, Amit Sharma and Rajeev Kalambi

Cactus Venture Partners logs final close of maiden fund: Early growth-stage venture firm Cactus Venture Partners, which backs startups in climate tech, enterprise software, and health tech, announced the final close of its first fund at Rs 630 crore, or about $75.9 million.

Metafin secures $5 million: Clean tech-focused NBFC Metafin has raised $5 million in an equity funding round led by Prime Venture Partners and Varanium Capital.

Cognizant Q4 results: revenue dips 1.7%, profit rises to $558 million: US-based Cognizant Technology Solutions posted a 7% increase in net profit year-on-year (YoY) for the fourth quarter ending December at $558 million. This was backed by healthy deal wins, acquisitions, and steady margins during the period.

Freshworks Q4 results: revenue up 20% to $160 million, loss narrows: Nasdaq-listed software provider Freshworks reported total revenue of $160 million for the fourth quarter ending December 31, 2023, up 20% from a year earlier.

Ather CFO Deepak Jain steps down, Sohil Parekh named successor: The change was announced by chief executive Tarun Mehta in an internal communication to employees. Jain worked at Ather for over four years, after a stint at background-checking software firm First Advantage.

Global Picks We Are Reading

■ Where can people turn for help with ‘digital addiction’? (BBC)

■ YouTube says a Vision Pro app is ‘on the roadmap’ (The Verge)

■ AI in politics is so much bigger than deepfakes (The Atlantic)