Indian stock markets have reversed the 2025 losses in the last six trading sessions. While BSE Sensex is marginally down from its December-end closing, Nifty50 has turned positive for the calendar year 2025. Stock market investors’ wealth has risen by Rs 27.10 lakh crore in the last six trading sessions to Rs 4,18,29,351.91 crore ($4.87 trillion).

Since March 17, BSE Sensex has risen over 5.6% or 4,302.47 points, while the broader 50-share index Nifty50 has also rallied over 5.6% or 1,261.15 points. To put things in perspective, BSE Sensex plunged 5.55% in February and 0.81% in January this year. In March this year, Sensex has risen 6.53% so far.

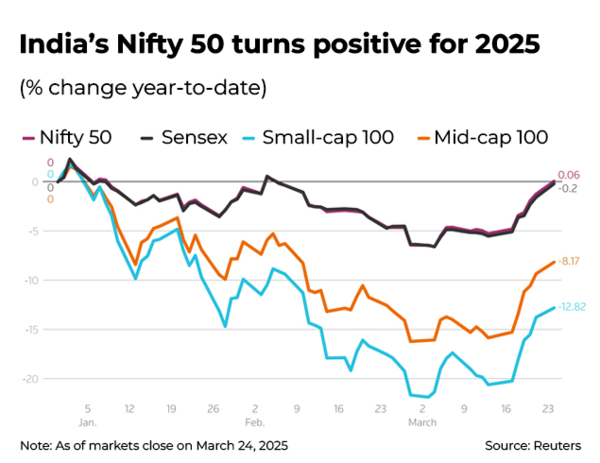

Nifty50 Turns Positive For 2025

Amidst global turmoil and India’s GDP growth slowdown and tight liquidity conditions, Indian stock markets had been bleeding. Foreign investors had been selling stocks relentlessly, and for now that trend seems to have reversed. But is the current stock market rally sustainable? Are foreign investors conclusively back on D-Street? Here’s why market experts are cautious:

Stock market rise in numbers:

- BSE Sensex and Nifty50 have rallied strongly in the last six trading sessions, but are still down around 10% from the record high they touched in late September 2024.

- Stock markets have seen a robust recovery in March 2025, with Nifty50 and BSE Sensex gaining nearly 7% in the month so far.

- Importantly,

Foreign Portfolio Investors (FPIs), which had been persistently selling Indian equities for over 5 months now, have turned net buyers in the three out of the last four trading sessions. - According to a Reuters report, heavyweight financials, which FPIs have the highest exposure to, have been leading the stock market rally. The index rose 2% on Monday, contributing 58% to the Nifty’s gains, the report said.

Foreign investors back on D-Street – but is the rally sustainable?

Market experts say that the stock market rally is driven by improving economic fundamentals – GDP growth appears to be back on track, earnings are expected to improve, inflation is cooling, and RBI is expected to cut rates further in the April policy review, hence providing a much-needed liquidity boost. Experts also suggest that investors are bargain hunting ahead of the earnings season which will kick off in early April.

Siddhartha Khemka, Head – Research, Wealth Management, Motilal Oswal Financial Services says that the positive momentum is largely attributed to FPIs returning as buyers, coupled with opportunistic bargain hunting.

Also Read | Why Jim Walker, man who foresaw 2008 market crash, wants investors to ‘absolutely double down’ on Indian equities

“Further, positive data on cooling inflation (CPI inflation eased to seven-month low of 3.61% in February, down from 4.31% in January) and improved growth in GDP (6.2% in Q3FY25, up from 5.4% in the previous quarter) have bolstered market sentiment,” Khemka tells TOI.

Khemka cautions that the continuation of this rally will rely on multiple global and domestic factors including clarity on the US reciprocal tariffs slated to be imposed on India from 2nd April, the upcoming corporate earnings and foreign investor flows.

FPIs bought Indian equities in three out of five trading sessions last week (net: + Rs 6,000 crore for the week), however they have sold shares worth over Rs 3 lakh crore since the indices peaked in September. “Therefore, it is too early to comment on the sustainability of FII buying but the same will largely depend on stable economic conditions, healthy earnings growth and improved valuations,” he adds.

Satish Chandra Aluri, Analyst, Lemonn Markets Desk believes that the Indian stock markets have had a ‘remarkable rebound’ in March till now. “Bargain hunting at lower levels and better valuation, return of foreign investors amid softer dollar and lower US yields and domestic macro-outlook getting better, are the reasons that may have factored in the rebound,” Aluri was quoted as saying by PTI.

Also Read | Indian stocks look attractive! Sensex expected to recover lost ground against EM peers in 2025 – top 10 reasons

He is of the view that after selling a record $29 billion in the last 5 months, foreign investors are now showing a renewed interest in Indian equities. “Foreign outflows have been a major factor in recent corrections. Softer US dollar, after the Trump trade war sparked concerns over US growth, also helped as capital moved from the US to Europe and EMs like India etc,” he adds.

According to Mehul Kothari, DVP – Technical Research, Anand Rathi Shares and Stock Broker, the current stock market rally has strong momentum driven by FII inflows, domestic economic improvements, and sector-specific gains.

However, he notes that its sustainability remains uncertain due to global uncertainties and the need for earnings growth to justify valuations.

“FIIs are back on Dalal Street for now, but their return is not yet conclusive, as their behavior could shift with changing global dynamics. Investors should remain cautious, focusing on quality large-cap stocks and monitoring global cues, rather than assuming this rally marks a definitive end to 2025’s volatility,” Kothari tells TOI.