Are your bank deposits insured if your bank fails? The recent news around IndusInd Bank has raised concerns about the safety of deposits. The Reserve Bank of India (RBI) has been quick to reassure bank customers that their deposits are safe.

Small depositors have protection through the DICGC’s (Deposit Insurance and Credit Guarantee Corporation) deposit insurance programme. Here’s a detailed analysis of how this protection system functions.

What is the deposit insurance scheme?

According to an ET report, the deposit insurance programme provides coverage of up to Rs 5 lakh per individual bank account. The DICGC becomes active in three specific situations: during bank liquidation, where it pays the insured sum to the court-appointed liquidator within two months of receiving claims; during bank reconstruction or merger, where it covers the gap between the full deposit amount (capped at Rs 5 lakh) and the amount received under new arrangements; and when the RBI implements all-inclusive directions that limit withdrawals.

Also Read | Unified Pension Scheme: Central government employees take note – UPS rules notified; check eligibility, contribution

The insurance coverage extends to various deposit types, including savings accounts, fixed deposits, current accounts, recurring deposits, FCNR, NRO accounts, and NRE accounts. However, certain deposits are not eligible for this protection, such as those belonging to foreign governments, central/state governments, inter-bank deposits, overseas deposits, and specific funds exempted by the RBI.

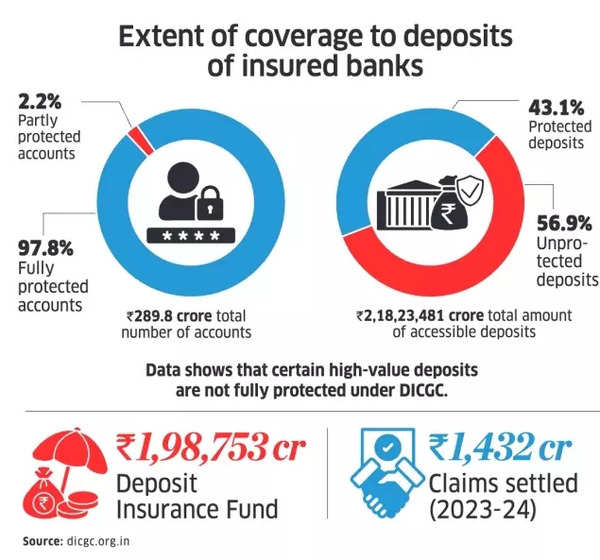

Extent of coverage to deposits of insured banks

Is the Rs 5 lakh deposit insurance cover enough?

The Rs 5 lakh deposit insurance limit often proves insufficient for individuals maintaining substantial savings for long-term commitments such as retirement planning, educational expenses, or contingency funds, says the ET report.

Although IndusInd Bank customers currently face no risk, as confirmed by the RBI, previous incidents involving cooperative banks have resulted in RBI-imposed withdrawal restrictions. Hence, distributing deposits across multiple banks is a prudent financial strategy.

The current banking regulations provide insurance protection of Rs 5 lakh per depositor for each bank. Additional protection can be secured by distributing funds across different banks.

Also Read | Tax planning before March 31 deadline? Tax saving fixed deposits with high interest rates – check list

Within a single bank, varying deposit ownership structures can enhance coverage. Whilst personal accounts across branches share a single limit, distinct ownership categories—business accounts, trustee accounts, or guardian accounts—each receive separate Rs 5 lakh coverage.

Different joint account arrangements offer additional protection. For instance, married couples can establish two joint accounts with alternating primary holders to secure separate coverage for each account. Further coverage can be achieved by creating joint accounts with children or parents.

DICGC maintains the right to reject or postpone claim settlements under specific conditions. Delays may occur when banks fail to submit comprehensive deposit records within the 45-day period after being placed under AID.

The organisation will not process claims for deposits outside DICGC Act coverage, such as inter-bank and government deposits. Furthermore, processing delays can occur until corrections are made for claims containing incorrect or insufficient information.

Also Read | Gold prices at record high! Have yellow metal prices peaked? Check these 5 charts before putting more money in gold

Joydeep Sen, Independent Financial Adviser and author, notes that India’s banking sector has witnessed numerous institutions facing financial difficulties in recent years, necessitating consolidations, rescue packages, or temporary restrictions.

In 2020, YES Bank faced an acute liquidity shortage attributed to substantial non-performing assets, requiring intervention from a State Bank of India-led banking consortium.

Punjab & Maharashtra Cooperative Bank’s collapse, triggered by dishonest lending activities, left depositors in distress. The PMC bank crisis prompted RBI to increase deposit insurance from Rs 1 lakh to Rs 5 lakh in 2020.