According to an ET report, financial experts recommend that investors should allocate at least 10% of their portfolio to gold. They suggest that the current dip in gold prices offers a favorable opportunity for those who have not yet invested in gold to consider adding it to their portfolio.

The recent reduction in customs duty on gold has led to a 6% drop in domestic gold prices, bringing the cost down to Rs 69,100 per 10 grams.

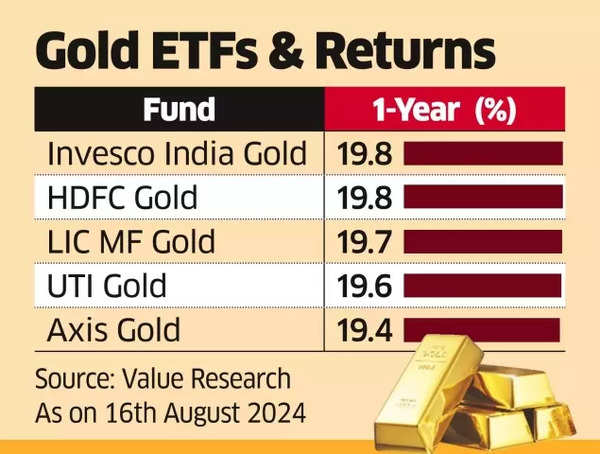

Gold ETFs & Returns

In addition to the price drop, the recent budget announcement has also made gold more tax-efficient in the long run. The long-term tax incidence on gold has been changed from the investor’s tax slab to a flat 12.5% after a holding period of two years.

Chirag Mehta, chief investment officer at Quantum Mutual Fund, was quoted as saying, “This is a significant advantage from a tax perspective and should stand at an advantage for investors in addition to other benefits that Gold ETFs provide.”

Previously, wealth managers preferred sovereign gold bonds due to the additional 2.5% annual interest paid by the government, the absence of an expense ratio, and tax-free capital gains upon maturity.

Also Read | These mutual funds have returned 100% more than Nifty! Where should investors put their SIP money?

However, with the last primary issue of sovereign gold bonds in March 2024 and no announcement of fresh issues this year, coupled with the existing series trading at a 10-12% premium in secondary markets, investors looking to add gold to their portfolios may be better off buying gold ETFs or gold mutual funds, according to Nikhil Gupta, founder of Sage Capital.

Gold is considered a valuable asset in a portfolio due to its ability to diversify and act as a hedge against inflation. Analysts recommend holding 5-10% of one’s portfolio in gold.

Tapan Patel, fund manager at Tata Asset Management, believes that market uncertainty surrounding the US elections and the Federal Reserve’s policy stance may drive inflows into gold funds, especially in a rate cut scenario. Additionally, strong economic stimulus from China may boost investment demand for gold.