Also in the letter:

■ Fintechs eye overseas markets

■ IT firms slash travel costs

■ Coforge pays big bucks to CEO

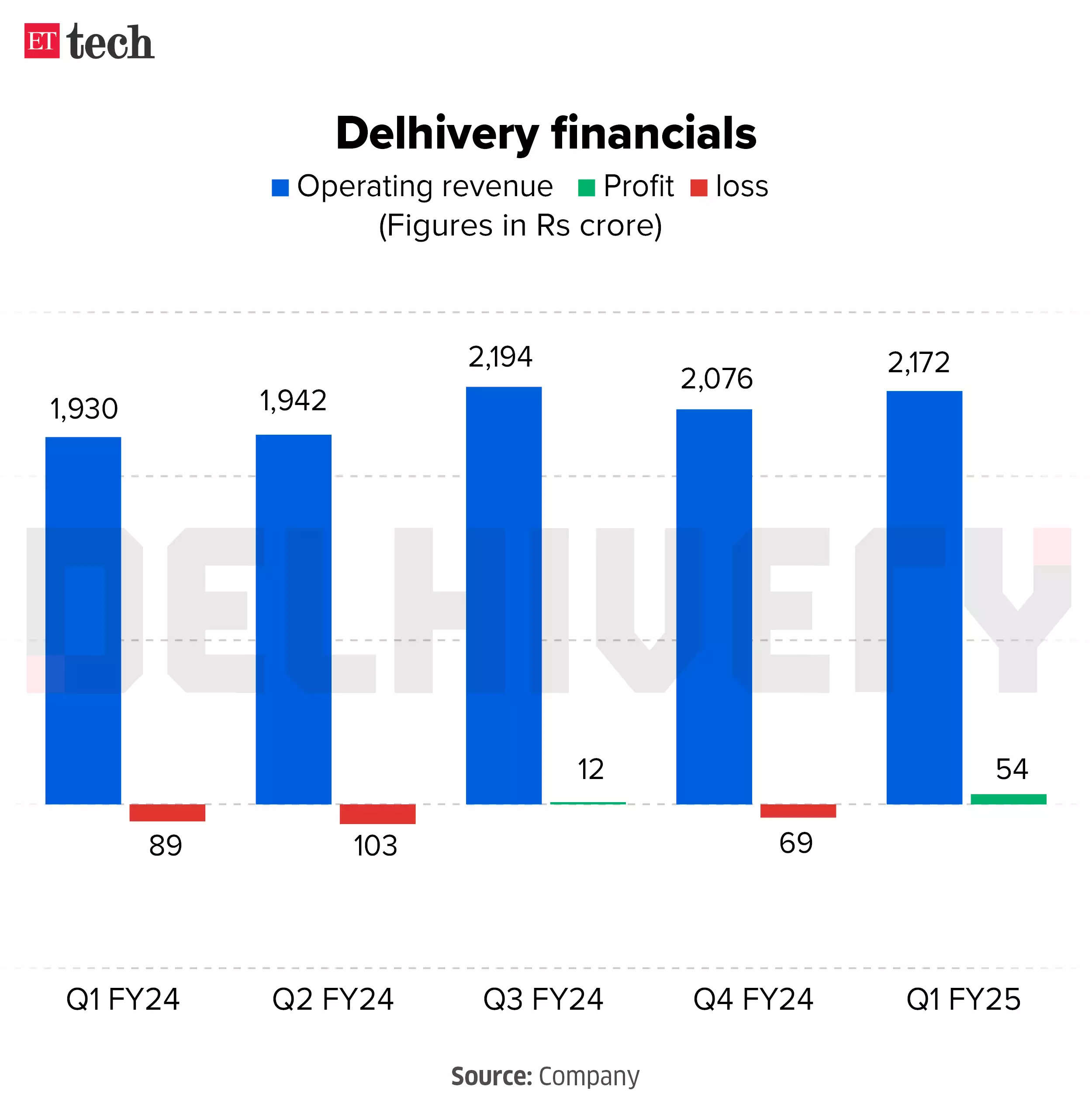

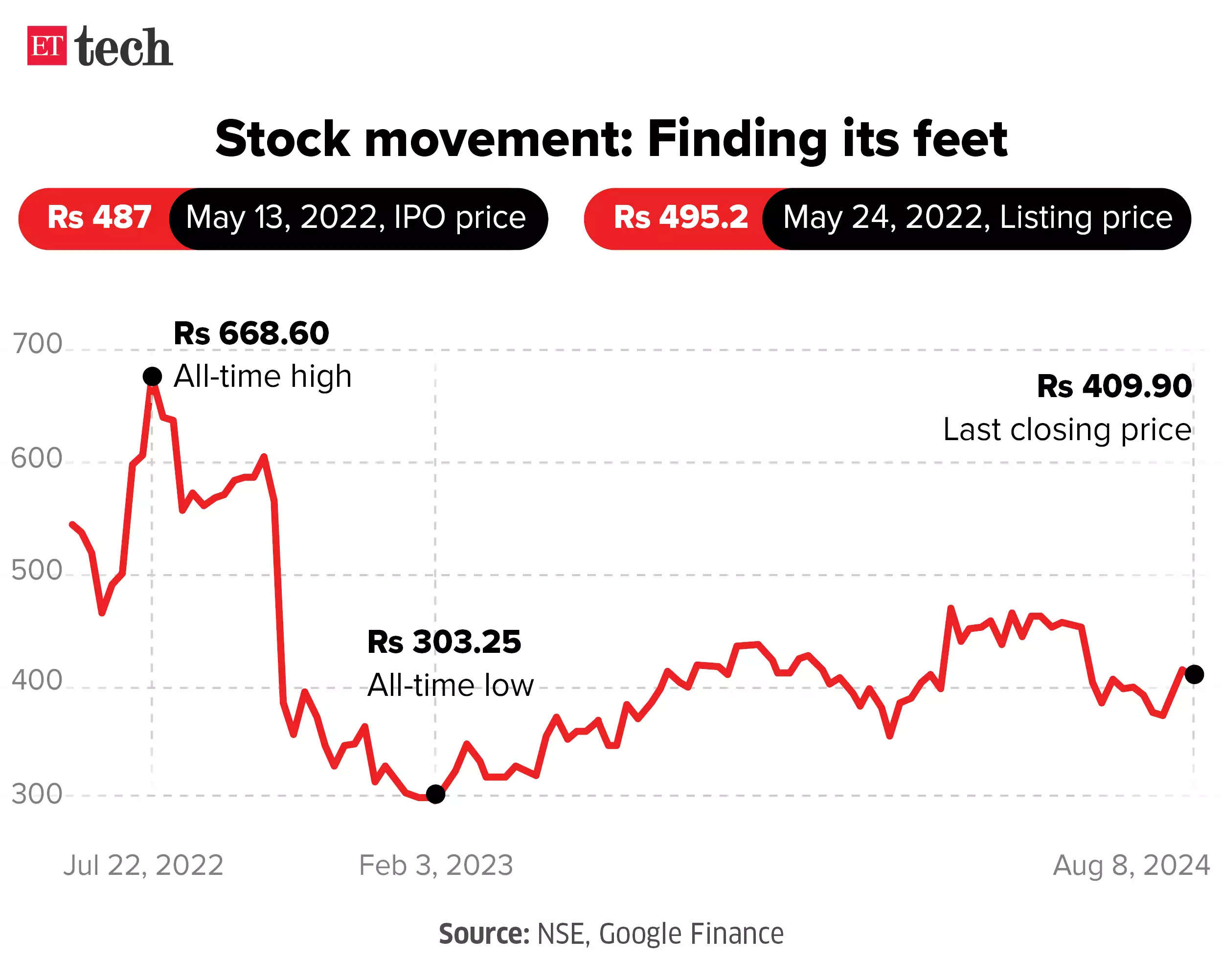

Exclusive | Quick commerce eating into market share of kiranas, not ecommerce: Delhivery CEO Sahil Barua

In an exclusive interview with ET, new-age logistics company Delhivery’s cofounder and CEO Sahil Barua, said that the economics of 10-15 minute deliveries may not be sustainable beyond groceries and fast-moving consumer goods (FMCG).

Barua, who sits on the board of public markets-bound food and grocery delivery firm Swiggy, also spoke about the outlook on India’s ecommerce market and how quick commerce’s impact on horizontal marketplaces was not as much as being projected.

Delhivery’s report card: “Our express parcel business, which is the ecommerce-linked segment…is reflective of market conditions. Our volume growth could have been slightly higher, but, last year, Meesho launched Valmo (its logistics vertical) and overall volumes for third-party players have been constrained a little bit,” Barua said, adding that Delhivery was relatively less affected given limited dependence on Meesho.

On quick commerce economics: “When you look at the quick commerce economy, it is being financed by $40-50 million of burn every month, maybe more,” he said. Barua also pointed out that the 10-15 minute delivery timelines could increase going ahead when “the real cost of the service becomes apparent to everyone”.

The company is launching a shared network of dark stores for direct-to-consumer (D2C) brands, allowing them to deliver within two to four hours. Barua said the company will target the top eight cities for this new service to begin with, having 35-40 dark stores in each city.

Also read: Delhivery back in red for Q4; CEO Sahil Barua flags softness in online consumption

Ecommerce share: Barua said that the growth in quick commerce was coming at the expense of India’s kirana stores and not horizontal marketplaces such as Amazon and Flipkart. “Over 95% of the market is not amenable to quick commerce…The reality is quick commerce is eating into the share of kirana stores,” he said.

Earlier this month, Blinkit CEO Albinder Dhindsa had said that the quick commerce platform’s growth was mainly on account of incremental growth in consumption as well as a shift in share from next-day ecommerce and mid-premium range modern retail in large cities.

Read the full interview here.

Rapido goes past $1 billion GMV mark

Rapido, which launched as a bike-taxi platform, has crossed $1 billion in gross merchandise value (GMV) on the back of aggressive expansion into newer segments across geographies, according to people aware of the matter.

Riding high: The mobility firm, which has ventured into autorickshaws and cabs since it launched, has clocked an over threefold growth since FY23, when it was at a GMV of around $300 million. It currently facilitates over two million rides daily, most of which is being on two-wheelers.

Zoom in: Rapido joined the unicorn club recently after raising $120 ( around Rs 1,000 crore) million from its existing backer WestBridge Capital. The Swiggy-backed company will use these funds to further fuel expansion. Today, while the bike-taxi segment continues to be the biggest driver of Rapido’s GMV, cabs and auto-rickshaws are the fastest-growing categories.

Also read: Rapido liable to pay GST for cab services: Karnataka AAR

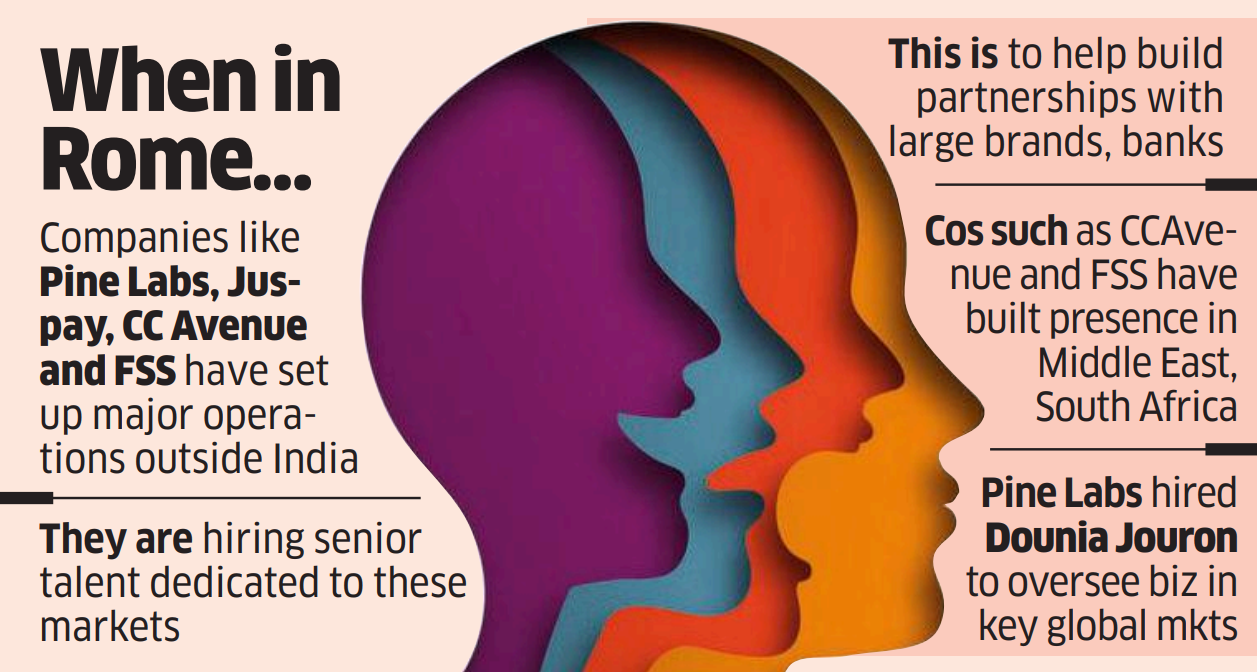

Indian payment companies shore up talent in foreign shores to boost revenues

Indian payment firms are strengthening their presence in countries across the world. From the Middle East to the United Kingdom, Africa, and the United States, players like Juspay, Pine Labs, CCAvenue, and FSS are building domestic merchant payment systems there.

Driving the news:

- Pine Labs has hired a senior executive from rival payment firm Adyen to lead its operations in the Middle East, Europe, and also look at Africa. Last year, it had hired a senior executive from American payment firm Netspend to drive its US business.

- CCAvenue has tripled its team to 30 executives from last year to manage audit, sales, and services based in the Middle East.

- Juspay has hired an ex-Citibanker, James Lloyd, to drive its international business.

Also read: Payment firms in a fix as UPI, RuPay incentives dry up

Big picture: Setting up global businesses requires strong partnerships and an understanding of local rules. Indian founders might find it difficult to run these operations from here. Hence, most of them invest in hiring key talent in those geographies.

Also read: PhonePe eyes South East Asia, Middle East for its global foray

Other Top Stories By Our Reporters

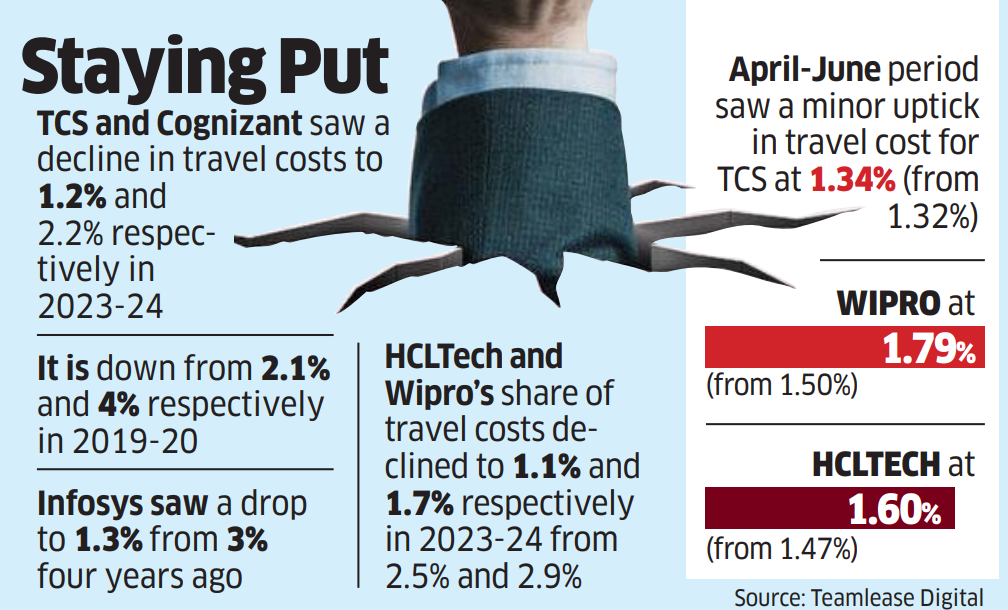

Grounded by weak biz, IT companies cut travel bills by half: India’s large IT service providers have slashed their travel costs by almost half since 2020 as a result of weak demand, cost optimisation, and increasingly stringent US visa policies over the past few years.

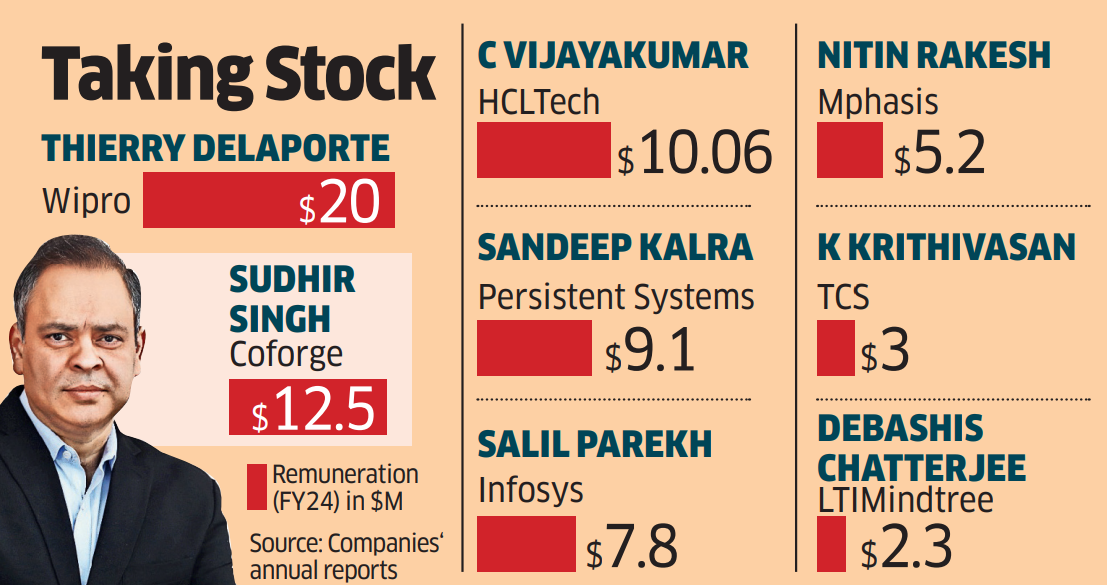

Some IT midcap CEOs earn more than counterparts at larger companies: Chief executives of Coforge and Persistent Systems earned more than their counterparts in TCS and Infosys in the last financial year, as some Indian midcap IT firms are paying top dollar to their CEOs who are growing their businesses despite headwinds from multiple directions.

Nazara buys UK’s Fusebox Games in all-cash deal: Listed media and gaming firm Nazara Technologies has acquired UK-based gaming studio Fusebox Games for Rs 228 crore ($27.2 million) in an all-cash transaction. Separately, it has received a letter of intent (LOI) for the acquisition of Sachin Tendulkar-backed sports entertainment firm Smaaash Entertainment, which is undergoing an insolvency process.

Byju’s says US bankruptcy court dismissed lenders’ plea against its settlement with BCCI: The Delaware Bankruptcy Court has dismissed a plea by Glas Trust Company, which represents US lenders, to block the settlement deal of Byju’s Rs 158-crore overdue payment to the Board of Control for Cricket in India (BCCI) over a sponsorship deal, the edtech firm said.

Global Picks We Are Reading

■ Inside the dark world of doxing for profit (Wired)

■ Google and Meta struck secret ads deal to target teenagers (FT)

■ How Spotify started — and killed — Latin America’s podcast boom (Rest of World)