Responding to a parliamentary query, state minister for finance Pankaj Chaudhary said RBI rules allowed banks to fix penal charges for non-maintenance of minimum balance, according to their board-approved policy, while ensuring that penal charges should be a fixed percentage levied on the difference between the actual balance and the minimum balance as agreed.He added that the charges were not applied on basic savings bank deposit accounts (Jan Dhan accounts).

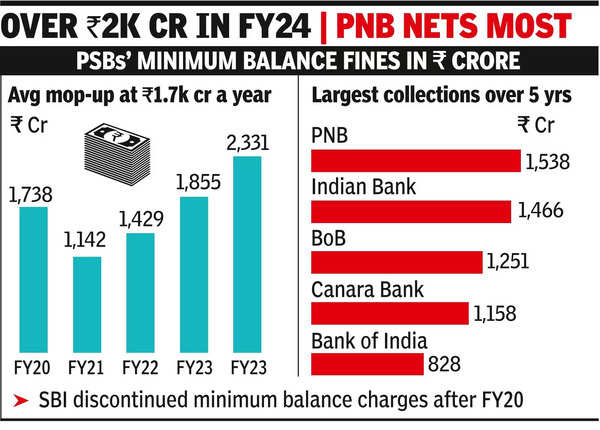

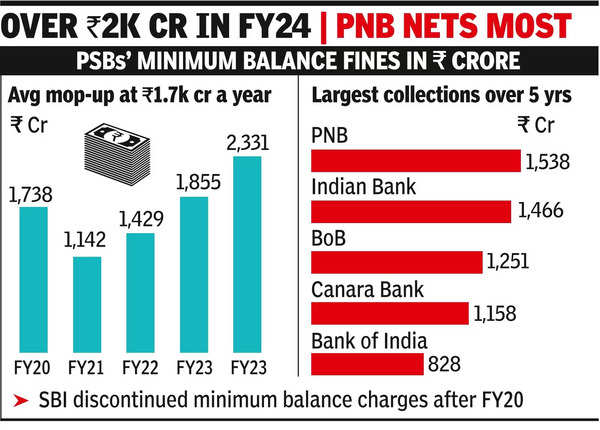

The data shared by the finance ministry shows that the amount collected as penalty for failing to meet minimum balance has progressively risen from Rs 1,738 crore in FY20 to Rs 2,331 crore in FY24 (see graphic). This is despite SBI, the largest bank, discontinuing minimum balance charges after FY20. SBI had stopped charging a penalty for minimum balances after an RTI query showed that a major chunk of the bank’s (at that time depressed) profits came from this penalty.

With SBI dropping out of minimum charges, the highest collection of fines was made by Punjab National Bank, which collected Rs 1,538 crore in the last five years. Indian Bank, Bank of Baroda and Canara Bank collected Rs 1,466 crore, Rs 1,251 crore and Rs 1,158 crore, respectively.

In the Budget, govt has set aside Rs 1,441 crore to incentivise banks to continue providing account-to-account transfers using UPI payments and RuPay debit cards free of charge. In the previous Budget, govt had set aside Rs 2,485 crore as incentive for digital payments.

For banks, the other incentive in providing digital payments is that money remains in the banking system for longer and reduces cash burden. Historically, Indian banks have not charged for providing services. The difference between the interest paid on deposits and loans was used to cover the expenses. However, following liberalisation, private banks imposed fixed charges for not maintaining minimum balance. This practice was adopted by most banks after computerisation.