Also in this letter:

■ Indian techies lead cricket culture in US

■ Govt to review IndiaAI Mission progress

■ Simplilearn’s FY25 revenue target

Winning design: As Gen Z shoppers take fancy to Indian wear, venture investors look to stitch deals

Libas founder and CEO Sidhant Keshwani

Ethnic wear brands specialising in Indian wear like sarees and kurtas are gaining popularity among the Gen Z population. This trend has now piqued the interest of venture investors. Let’s dive in:

Driving the news: New-age brands focused on GenZ (born between 1997-2012) include:

- Libas, which raised Rs 150 crore from ICICI Venture last month

- Koskii, which secured Rs 61 crore last year from Baring PE

- Bootstrapped firm Suta, which is aiming to close FY25 with Rs 100 crore in revenue

- Fashor, which is also nearing the Rs 100-crore revenue mark

- Truebrowns, which is owned by ecommerce roll-up company Goat Brand Labs

Growing market: The branded Indian ethnic wear market is estimated to be worth Rs 30,000-35,000 crore in size, growing at 20-25%, as per industry sources. However, with the unorganised market for Indian wear accounting for nearly 80% of the industry, the headroom for growth is massive.

“We never thought that GenZ consumers would be a market. So many GenZs wear sarees now,” said Suta cofounder Sujata Biswas. In the financial year 2024, Suta clocked Rs 75 crore in revenue. The company has 10 stores.

Numbers speak: Founded in 2014, Libas clocked Rs 500 crore in revenue last fiscal, and aims to reach Rs 1,000 crore by the end of FY26. It expects to attain growth primarily from tier-II towns and below.

Currently, it earns 80% of its revenues from online channels–marketplaces and its own website and app–and is increasing its offline presence. The company has opened 14 stores in the last 12-18 months and plans to open another 100 over the next year.

Warburg Pincus may lead $150-million funding round in Whatfix

Khadim Batti, cofounder, Whatfix

Private equity fund Warburg Pincus is likely to lead a new funding round for SaaS firm Whatfix. Here are the details:

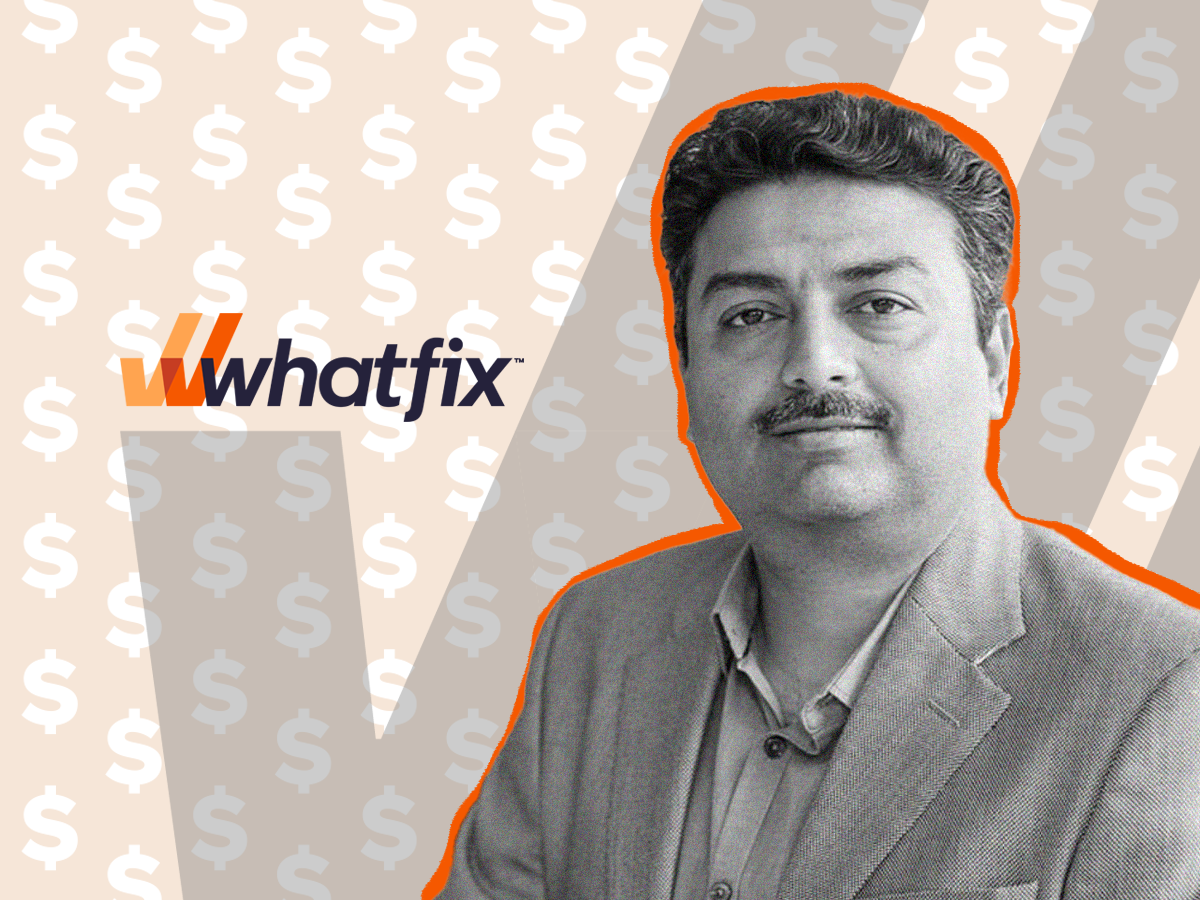

Deal done (nearly): Warburg Pincus–an investor in firms like Ola, Boat, and Ecom Express–is in the final stages of talks to lead a funding round of $100-150 million in Whatfix. Sources told us that SoftBank–with over 13% ownership–may also invest in this round, which is a mix of primary and secondary share sale.

Tell me more: Eight Roads Venture and Helion Venture Partners–early investors in the 2014-founded software firm–are likely to part-sell their holdings in the firm. ET first reported in September last year that Warburg had held early-stage talks with the company.

Jargon buster: In a secondary share sale, existing investors sell their shares to new investors, and money doesn’t go to the company’s coffers.

SaaS deals: After a significant reset in SaaS valuation based on revenue multiples, unicorns like Icertis and Innovaccer are in the middle of closing big-ticket deals. According to Bessemer Venture Partners Nasdaq emerging cloud index, SaaS company valuations are trending at 6.5 times revenue on average.

Indian IT professionals are batting for cricket in the US

Saurabh Netravalkar

Indian IT professionals are becoming the ambassadors of cricket in the US, with a significant proportion of the Indian diaspora working for the IT industry in its largest market, the US.

Emerging trend: A host of companies, including Cognizant, ServiceNow, and Cigniti, are playing hosts to clients and partners during the T20 World Cup matches. From owning cricket franchises to sponsoring leagues and even playing matches, the Indian IT industry is playing a historic role in the rising popularity of the gentleman’s game in North America.

Two months before the T20 World Cup, Cognizant became the first-ever title sponsor of Major League Cricket (MLC), America’s only world-class professional cricket championship. At that time, Cognizant’s chief executive officer Ravi Kumar S said that their extended relationship with MLC would help them create deeper connections with their clients and associates.

On the field:

- Of the eight Indian-origin players in the US squad, two are related to the tech sector.

- Saurabh Netravalkar, an AI engineer working with Oracle, is playing for the US cricket team. Oracle congratulated Netravalkar after the US reached the T20 World Cup’s Super Eight.

- Another US professional cricket player is Nosthush Kenjige, who did his bachelor’s degree in medical engineering at the Dayananda Sagar College of Engineering, Karnataka.

- Shreyas Movva is another Indian-born software engineer who is playing for the Canada cricket team this year.

Other Top Stories By Our Reporters

MeitY to review India AI Mission status this week: The government is likely to review the progress of the Rs 10,372-crore India AI Mission this week to thrash out the various details of the ambitious programme, a senior government official told ET. The meeting will focus on aspects such as the quantum of the viability gap funding necessary to set up enough compute infrastructure in the country, how the AI skill gap can be covered, and the implementation of the India AI Datasets Platform planned to be set up under the scheme, the official said.

Post rejig, Simplilearn eyeing 35-40% FY25 revenue growth: COO | After shuttering some of its unsuccessful programmes and recalibrating focus on three core areas, Blackstone-owned online certification training course provider Simplilearn is aiming for revenue growth of 35-40% in fiscal 2025, cofounder and chief operating officer Kashyap Dalal said.

CCI approves WeWork Inc’s exit from India unit: The Competition Commission of India (CCI) has cleared US-based WeWork Inc’s proposal to sell its entire 27% stake in the local coworking firm unit, the antitrust regulator said in a statement late Tuesday evening.

ETtech Q&A | We pivoted multiple times, have been close to bankruptcy: Ixigo founders | Shares of Le Travenues Technology, which operates the travel platform Ixigo, listed on stock exchanges Tuesday at a premium of 48.5% to its IPO price of Rs 93, and later hit the 20% upper circuit at Rs 161.99 on the BSE. In an interaction with ET, company cofounders Aloke Bajpai and Rajnish Kumar, spoke about the timing of the Rs 740-crore IPO and whether the offer size could have been bigger given the investor response.

Global Picks We Are Reading

■ How AI may become the new offshoring (FT)

■ OpenAI-backed nonprofits have gone back on their transparency pledges (Wired)

■ Social media influencers aren’t getting rich—they’re barely getting by (WSJ)