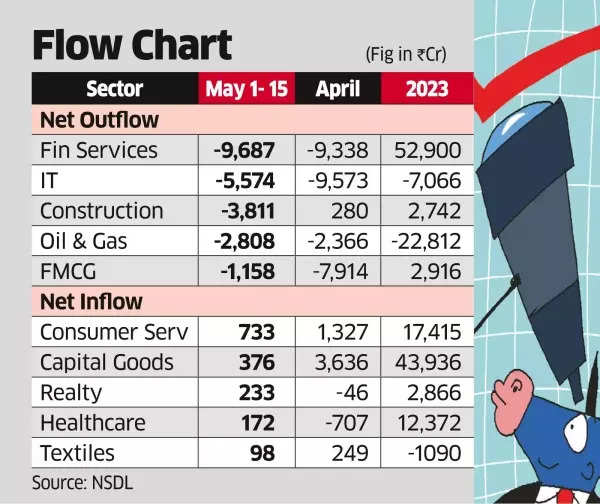

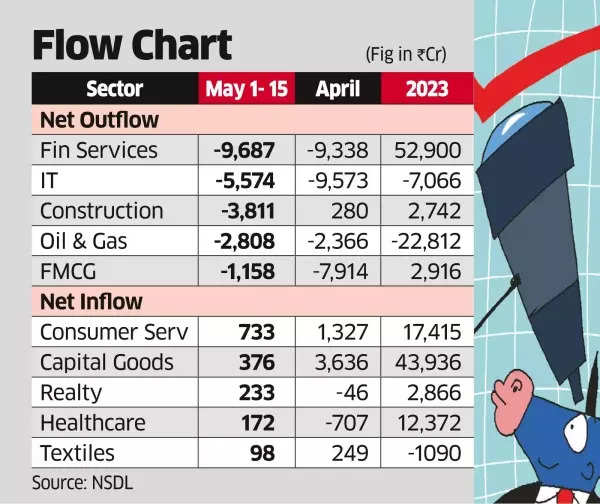

FPI selloff in Indian stock markets: According to NSDL data, foreign investors sold Indian equities amounting to Rs 27,258 crore across 14 sectors from May 1 to 15. The financial services and information technology sectors experienced the highest selling pressure during this period, with foreign investors offloading shares worth Rs 9,687 crore and Rs 5,574 crore, respectively, according to an ET report.

In April, each of these sectors saw selling of over Rs 9,000 crore.Since the beginning of 2023, the financial services sector had attracted foreign inflows of Rs 52,900 crore, while the IT sector witnessed outflows of Rs 7,066 crore.

The construction sector also faced significant foreign selling, amounting to Rs 3,811 crore in the first half of May, following a buying trend of Rs 280 crore in April. Other sectors, such as oil & gas and FMCG, experienced foreign selling of Rs 2,808 crore and Rs 1,158 crore, respectively.

In April, each of these sectors saw selling of over Rs 9,000 crore.Since the beginning of 2023, the financial services sector had attracted foreign inflows of Rs 52,900 crore, while the IT sector witnessed outflows of Rs 7,066 crore.

The construction sector also faced significant foreign selling, amounting to Rs 3,811 crore in the first half of May, following a buying trend of Rs 280 crore in April. Other sectors, such as oil & gas and FMCG, experienced foreign selling of Rs 2,808 crore and Rs 1,158 crore, respectively.

FPI Net Outflow

Additionally, the power, automobile, and telecommunication sectors saw a reversal in sentiment, with foreign investors selling shares worth Rs 792 crore, Rs 706 crore, and Rs 272 crore, respectively, in the first half of May.

This contrasts with the buying trend observed in April, where these sectors attracted foreign investments of over Rs 4,000 crore, Rs 1,000 crore, and Rs 8,000 crore, respectively.

Indian stock market benchmark indices, BSE Sensex and Nifty50, have been witnessing volatile trading sessions for some weeks now. Market experts are of the view that the volatility is driven by multiple factors such as uncertainty over Lok Sabha poll results on June 4 and the unpredictability of a US Federal Reserve rate cut.