Also in this letter:

■ SoftBank may double down on Icertis

■ Ad-film makers await launch of OpenAI’s Sora

■ PB Fintech reports Rs 60 crore profit in Q4

NBFCs pull the plug on Paytm’s lending biz, invoke loan guarantees

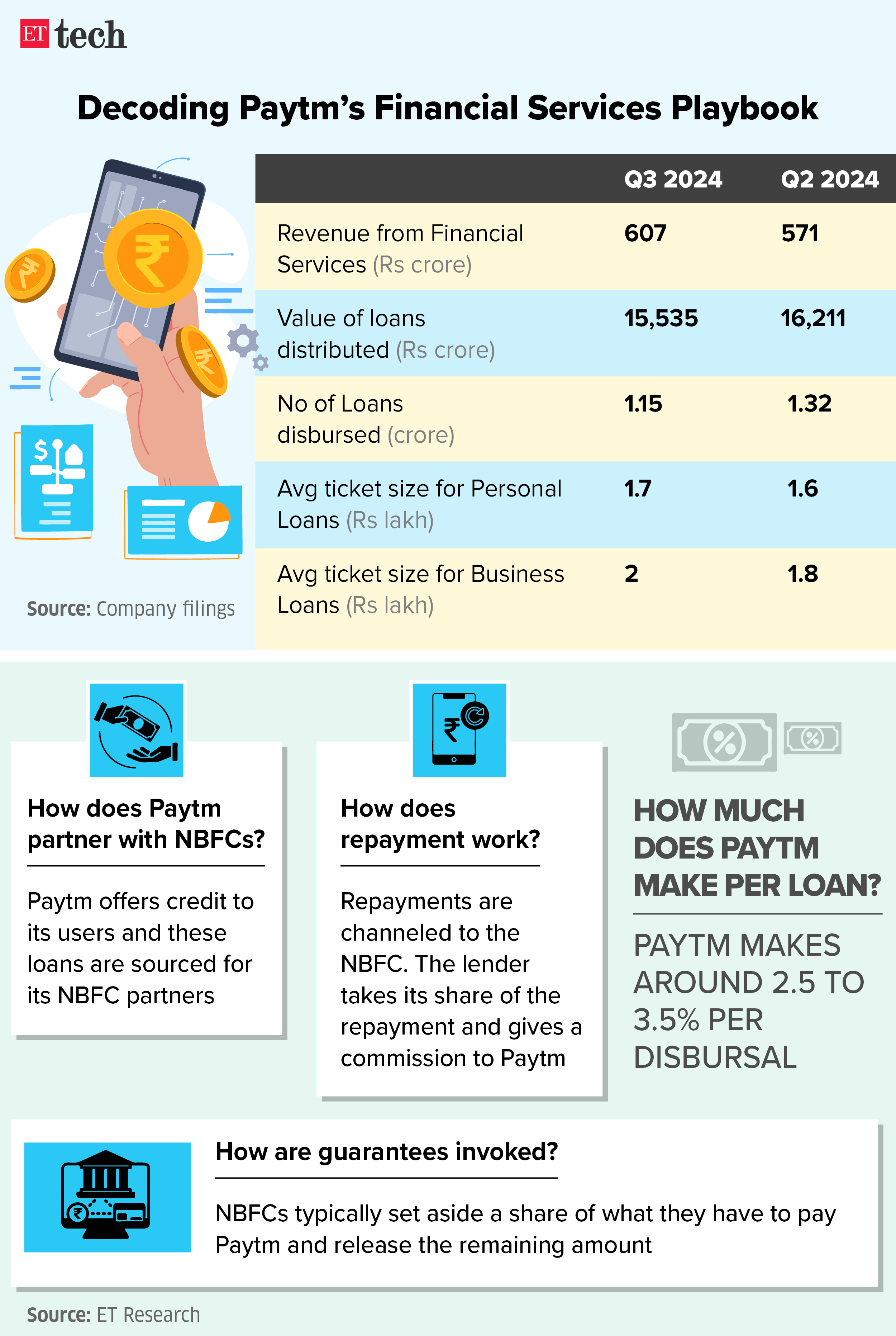

The challenges faced by Paytm Payments Bank, an associate entity of One 97 Communications, are impacting the fintech major’s lending business.

Driving the news: A bunch of non-banking finance companies (NBFCs) that worked with Paytm for consumer loans have now pulled the plug, sources told us.

The likes of Aditya Birla Finance (ABFL), Piramal Finance, Clix Capital, among others are leant to have paused disbursement of fresh loans sourced through Paytm, people in the know said. Also, ABFL is learnt to have invoked some of the guarantees which Paytm had offered the NBFC against unsecured loans facilitated through the fintech platform.

The big picture: For Paytm, which made nearly 21% of its overall quarterly revenue from financial services, a hit on its lending business could be damaging. ABFL invoking the guarantees would also have a direct impact on its top line.

New partnerships: While a bunch of older partnerships have slowed down for Paytm, the company is looking to stitch some new alliances, sources said. Muthoot Fincorp is set to strike a deal with Paytm, people in the know said.

Also read | Paytm COO & president Bhavesh Gupta resigns; to take on advisory role

Tata Digital sees big reorganisation post new CEO’s arrival

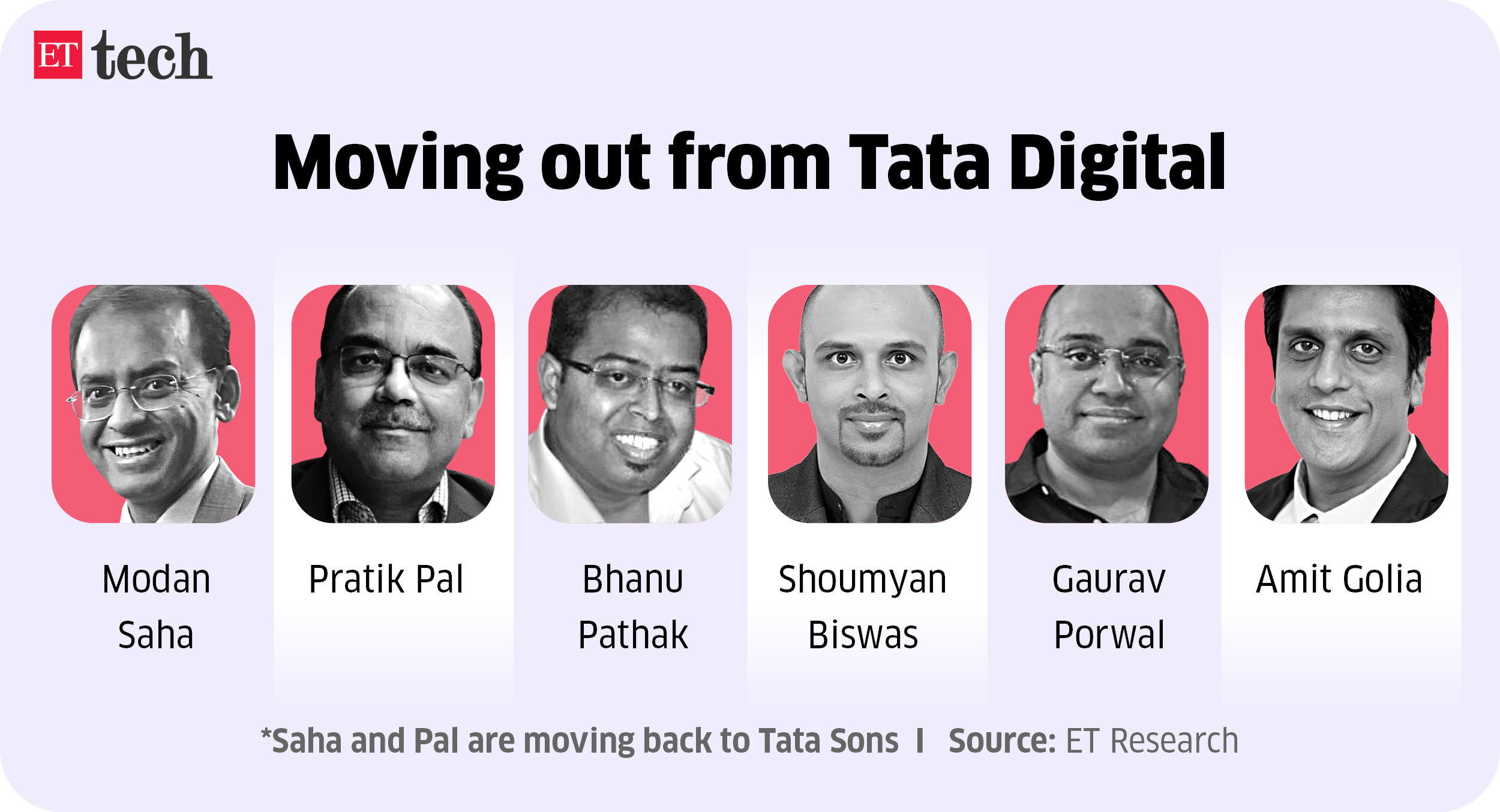

In February, Tata Digital, which runs superapp Neu, appointed Naveen Tahilyani as the new CEO, replacing Pratik Pal. Cut to May, and the old guard at the group’s ecommerce unit is out. Here are the details:

Exit list: Modan Saha, chief executive of the fintech business, is moving back to parent Tata Sons, after steering the vertical for two-and-a-half years. Bhanu Pathak, Shoumyan Biswas and Gaurav Porwal — all senior executives hired by former president and Myntra founder Mukesh Bansal — have resigned and will leave after serving their notice period, which coincides with the end of the Indian Premier League cricket tournament. The Tata group is the title sponsor for IPL. Amit Golia is another executive quitting Neu.

Pal has also moved back to Tata Sons, sources said.

Tell me more: Even as most members from the original team of Tata Neu are out, the company has shelved plans to onboard non-Tata brands on the superapp, sources said. The new CEO’s focus is on utilising the existing Tata brands on Neu and elevating the consumer experience.

Also read | Tata Neu won’t just offer in-house brands

Zoom in: Tata Neu remains a channel for big digital assets like BigBasket and 1mg, a source said. “The focus is that they (Tatas) should first get the customer experience improved with group brands and then think of external brands. Within the group, integration has not been easy.”

Tata Digital didn’t have an ideal start with Neu, launched on April 7, 2022. There has been a consistent churn in its senior ranks, including Bansal’s exit within a year of coming in as president in June 2021. Neu’s contribution, meanwhile, remains less than 10% of the gross sales of egrocer BigBasket and epharmacy 1mg.

Also read | Tata Digital CEO steps up focus on lowering costs

SoftBank back at deal counter with Icertis deal talks

We have one more scoop on another SaaS deal with a SoftBank link.

Deal details: SoftBank, one of the world’s largest technology investors, is in early talks to double down on Icertis through a secondary share sale, sources told us. The round could be around $150 million in size, but the valuation, as yet undecided, will hold the key to the deal closing.

Yes, but: Icertis was last valued at $5 billion. The ‘price discovery’ for the new investment – where others may be involved along with SoftBank – is still underway.

“The talks are in early stages and the key to the deal would be in the valuation and the price discovery is yet to be finalised,” one of the sources told us.

Also read | Kaiser may steer $250 million funding in SaaS firm Innovaccer at flat valuation

SoftBank back? The Japanese investor, which has largely stayed away from new investments and took exits from several of its listed bets in India, holds around 3% in Icertis and wants to double down. Simultaneously, it is investing in Meesho in a new funding round.

While these are existing portfolio firms, SoftBank’s plan to step up its investment in Icertis is quite significant.

Number game: Icertis, which provides contract management services to enterprise clients, in February said it had hit annual recurring revenue of $250 million. The company said at the time that 30% of its clients were Fortune 100 companies and 70% of its customers had more than $1 billion in revenue.

Also read | SoftBank took home $1.8-1.9 billion from four listed portfolio companies

Other Top Stories By Our Reporters

Ad-film makers await launch of text-to-video AI models | Marketing agencies and ad-film makers are eagerly awaiting the release of text-to-video models such as OpenAI’s Sora and China’s Vidu AI, which could bring down the cost of shooting celebrity ad-films from Rs 1 crore to perhaps just a few lakhs.

Policybazaar parent reports PAT of Rs 60 crore vs loss of Rs 9.34 crore YoY | Online insurance aggregator PB Fintech, which operates Policybazaar, on Tuesday reported a net profit of Rs 60.19 crore for the quarter ended March 31, 2024, as against a loss of Rs 9.34 crore in the year-ago period.

Shiprocket eyes more revenue streams | Ecommerce logistics startup Shiprocket, which hit $3 billion in gross merchandise value in 2023-24, is targeting revenue from additional services for online sellers such as marketing, sourcing, payments and lending, said its chief product officer Praful Poddar.

One month of Wipro’s Srinivas Pallia as CEO | Srinivas Pallia, who completed one month as CEO of fourth largest software services firm Wipro, has been globe-trotting to meet employees and stakeholders. Last week, he did a town hall in London, where he has been focussed till recently as CEO of Americas 1.

LTIMindtree aspires to grow revenue to $10 billion: CEO Debashis Chatterjee | LTIMindtree, India’s sixth largest IT services firm, aspires to more than double its revenue from $4.3 billion in 2023-24 through organic growth as well as acquisitions over the next six years, chief executive Debashis Chatterjee said.

Global Picks We Are Reading

■ How Google lost ground in the AI race (FT)

■ Apple is developing AI chips for data centers, seeking edge in arms race (WSJ)

■ Amazon’s delivery drones won’t fly in Arizona’s summer heat (Wired)