The move could impact P2P investment opportunities through popular consumer-facing fintechs like Cred and BharatPe. Instant withdrawal schemes of Cred-run Mint and BharatPe’s 12% Club will be affected by the move.

Overall, these products accounted for 25-30% of disbursals in the sector, according to industry estimates. That could get wiped off, insiders added.

The move comes in the backdrop of the RBI Deputy Governor M Rajeshwar Rao calling out certain business practices of this sector on February 9 as defying regulatory guidelines.

Also read | After online payments, digital loans, now P2P lending under RBI lens

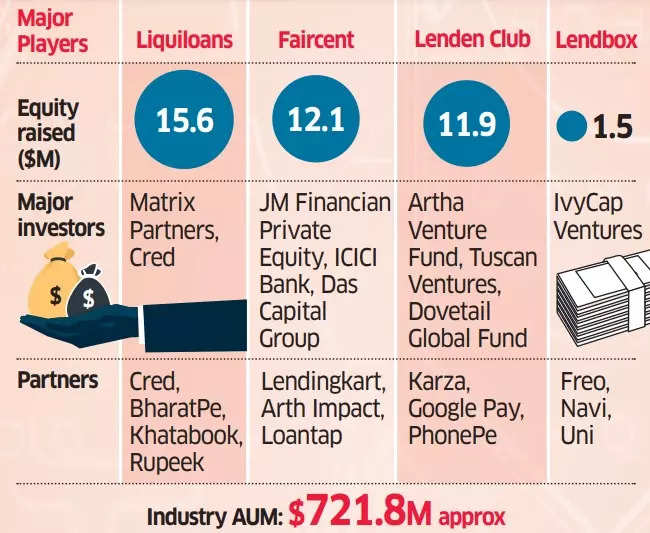

Interestingly, P2P lending startups like Liquiloans and LendenClub had built strong businesses through partnerships with large startups like Cred and BharatPe. ET wrote on February 14 that after the regulatory rap, these platforms had already slowed down on such integrations.

Other Top Stories By Our Reporters

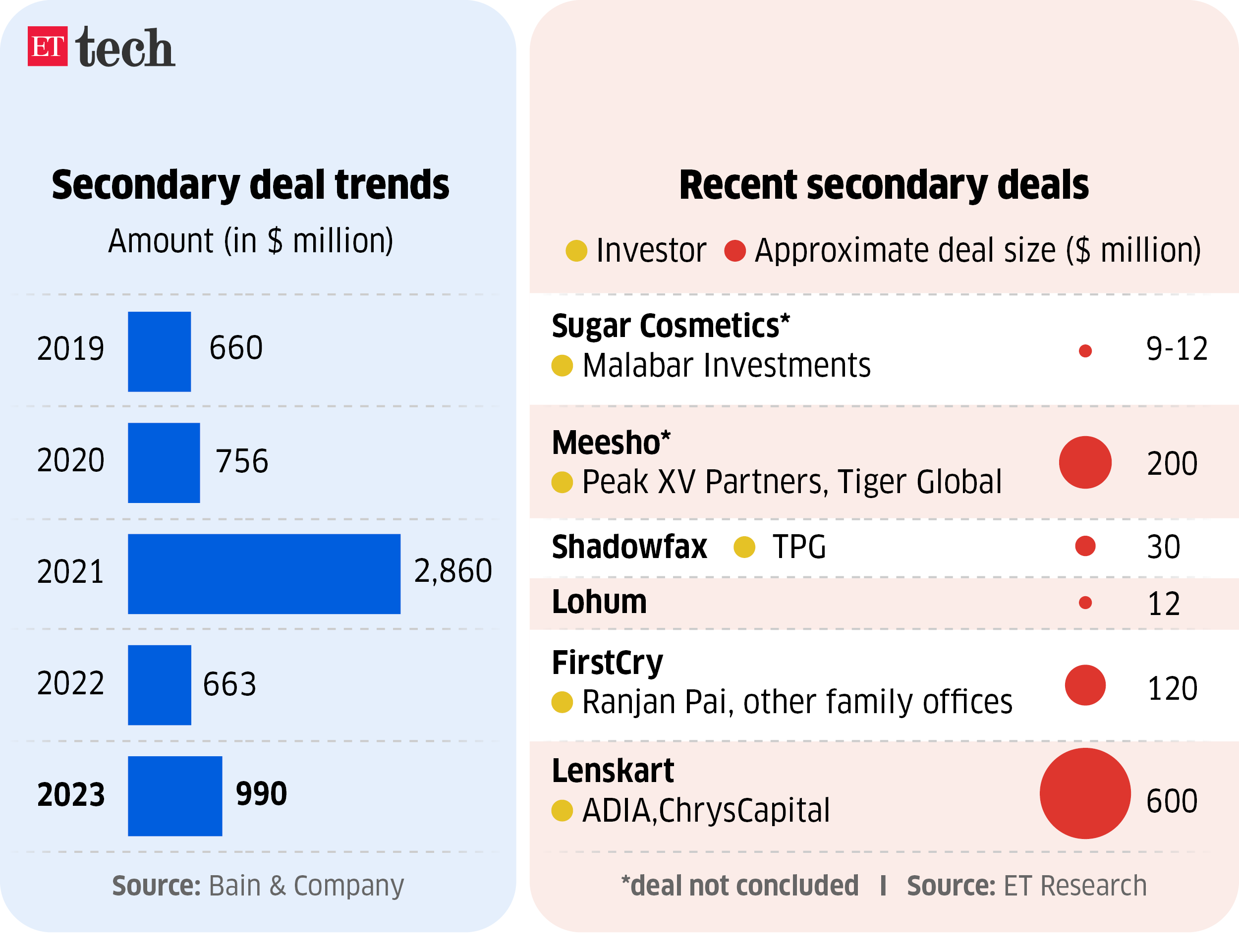

VCs looking for partial exits, investors eyeing IPO-bound firms push up secondary deals: Venture capital investors are demanding exits from late-stage startups with pressure to clock returns amid a prolonged slump in the technology market. In the past year, sizeable investment rounds of $50 million have included a significant secondary component that provides liquidity for pre-existing investors, industry executives told ET.

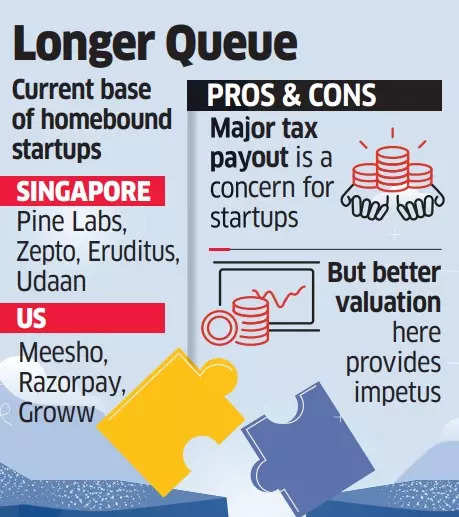

Startups ‘reverse flip’: Pine Labs, Zepto, Meesho in queue for India return: Indian technology startups are now acting on plans to move domiciles to India from overseas. Pine Labs has filed applications for a cross-border merger of its India and Singapore units with the NCLT (National Company Law Tribunal) as well as in Singapore, sources told us.

Quick-commerce firm Zepto, too, is in the final stages of filing a similar application in Singapore, while fellow Y Combinator alumnus Meesho is considering raising new capital to account for tax payouts to flip its parent company to India.

Also read | ETtech Exclusive | In ‘reverse flip’, Razorpay parent entity plans to return to India from the US

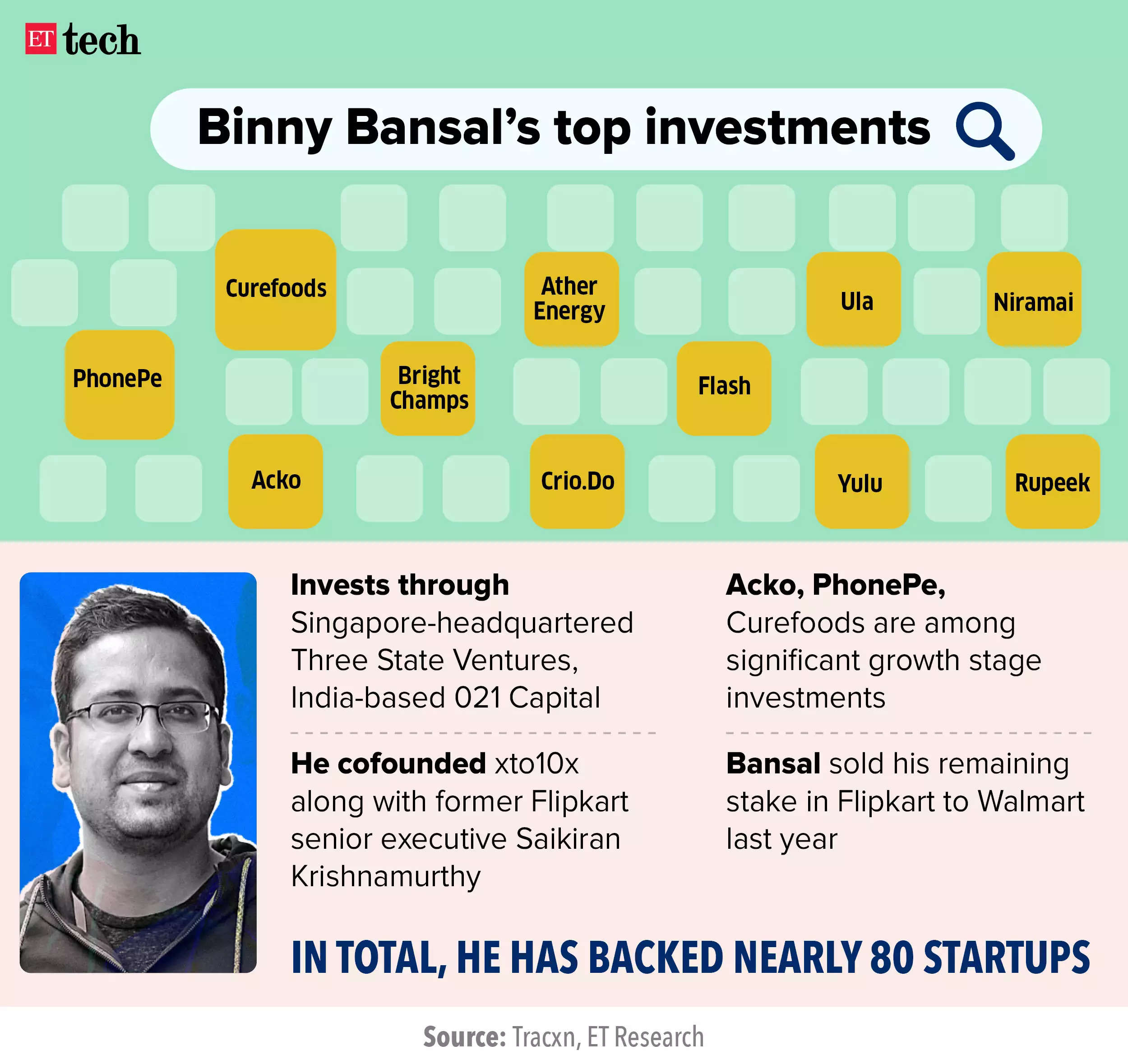

Binny Bansal eyes big game again post Flipkart exit: Flipkart cofounder Binny Bansal exited the Flipkart board in January, but he’s been busy making investments and giving shape to his new startup OppDoor and portfolio companies.

Bansal has increased his stake to around 18% in Curefoods as part of an additional investment of $25 million. The cloud kitchen startup closed the round with $60 million in total funding, including a secondary share sale.

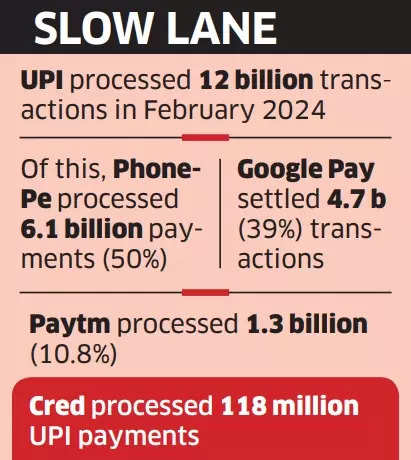

ETtech In-depth: Decoding the UPI growth story through the eyes of a duopoly | While the Indian digital payment story is riding the Unified Payments Interface (UPI) wave, there is a concentration risk building up in the ecosystem. Walmart-backed PhonePe and Google Pay together have a 90% market share among third-party payment apps in the ecosystem.

NPCI has a target to implement a 30% market cap for a single third-party application provider (TPAP) by the end of this year. But looking at the trends, PhonePe and Google Pay are both increasing their share of UPI volumes. The issues faced by Paytm Payments Bank are not helping either.

Also read | NPCI eyes a more evenly sliced UPI pie

Deals & Dealmakers

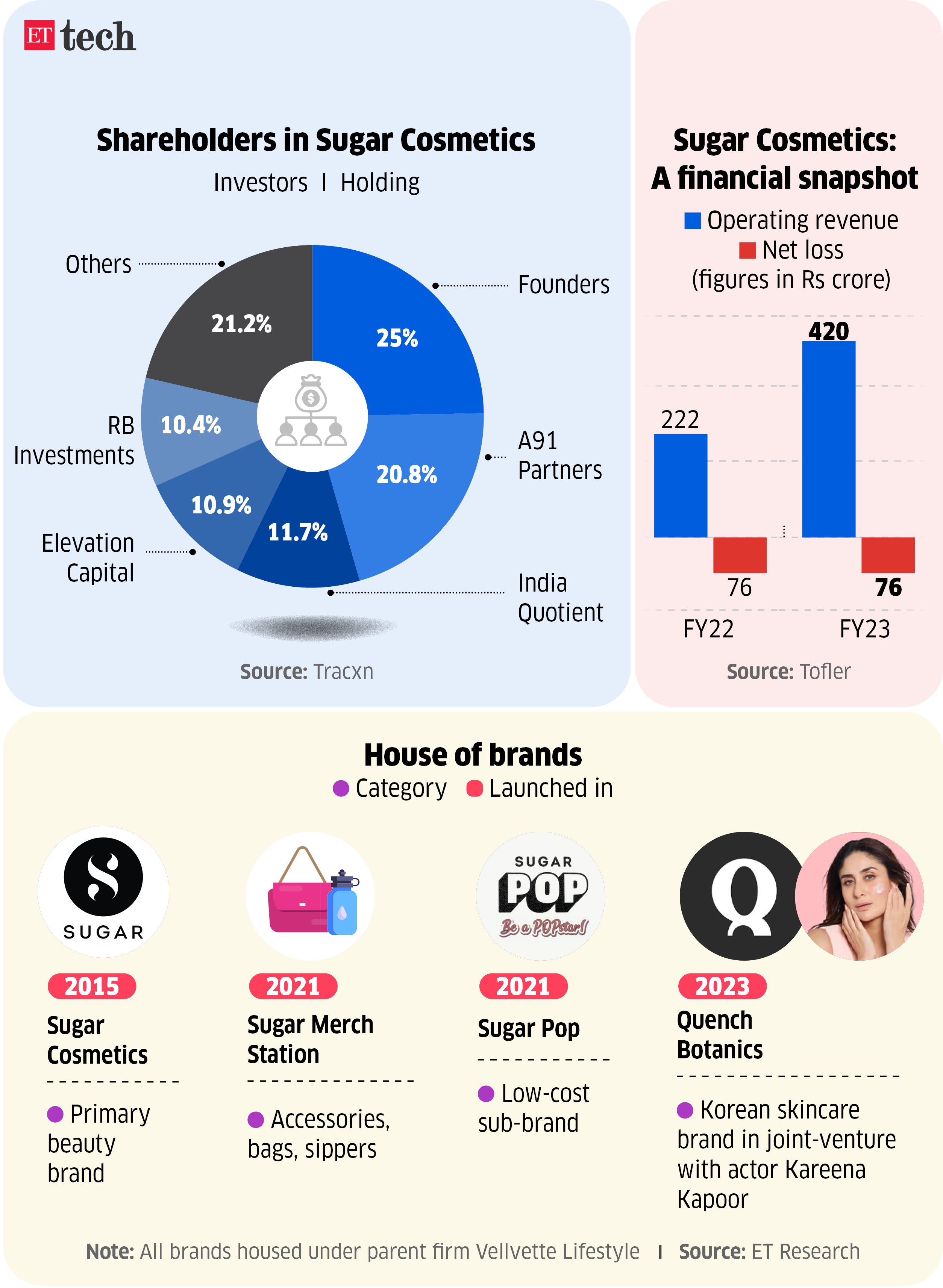

Vineeta Singh, cofounder, Sugar Cosmetics

Exclusive: Malabar may pick up Rs 80-100 crore stake in Sugar Cosmetics | Malabar Investments has held talks with early backers in Sugar Cosmetics for acquiring a stake worth Rs 80-100 crore in the company via a secondary transaction, sources told ET. The firm will be valued at Rs 2,900 crore ($350 million) if the deal goes through, said sources.

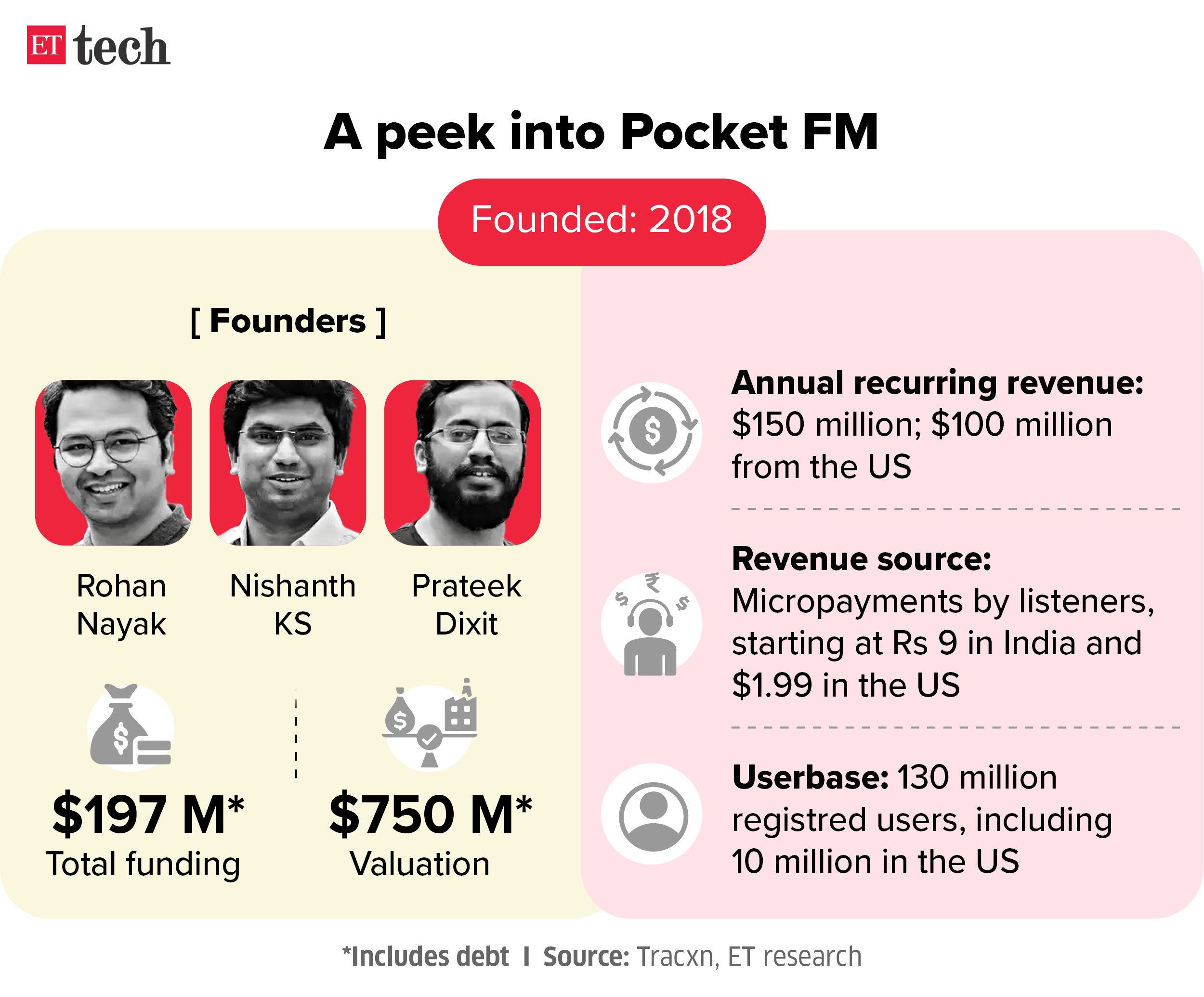

Pocket FM’s fresh fundraise likely to value audio streaming startup at $1.2 billion: Audio streaming platform Pocket FM is in talks for a new round of funding that might value it at $1.2 billion, making it a unicorn, according to sources.

Nexus MD Sameer Brij Verma quits to open multi-stage fund: Sameer Brij Verma, one of the managing directors at Nexus Venture Partners, is likely to leave the VC firm to start his own investment fund, sources told ET.

SoftBank India elevates Sarthak Misra to partner role: SoftBank India has elevated its investment director Sarthak Misra to a partner, sources told us.

IT/Tech News

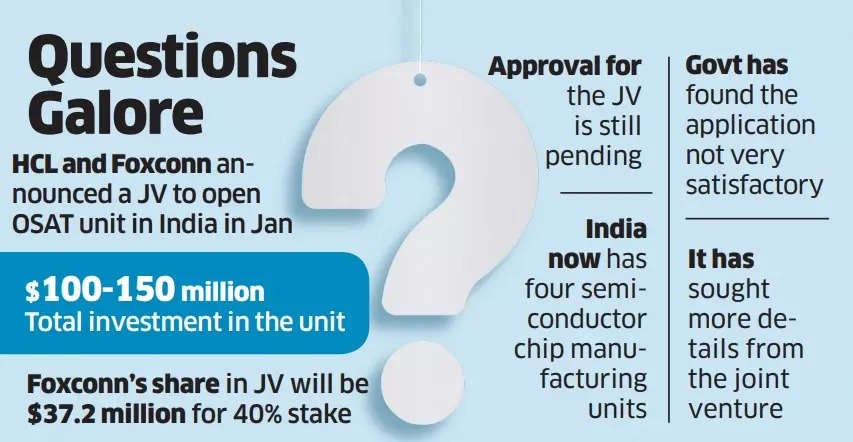

Govt spots missing bits in HCL, Foxconn chip JV, seeks details: HCL Group and Foxconn’s joint venture for a chip assembly unit has hit a speed bump. The government has found their application for the unit unsatisfactory and has sought more details.

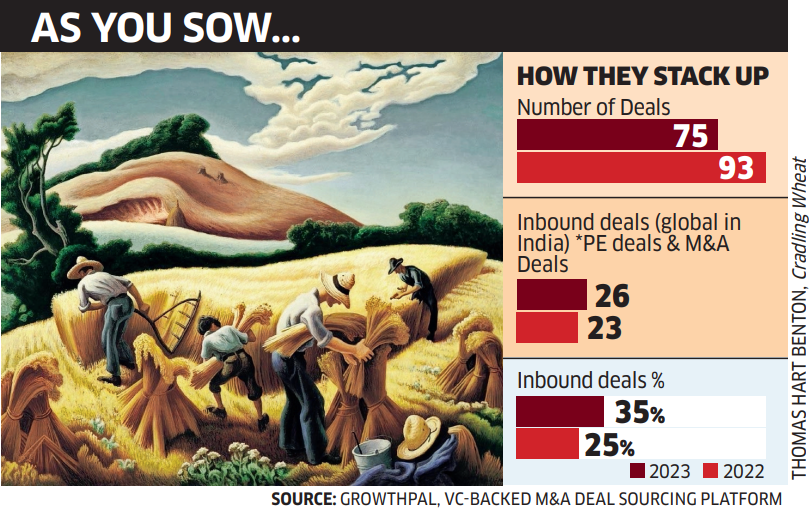

Global PEs eye a bigger pie of India’s software services sector: Global private equity (PE) firms and PE-backed entities are showing more interest now in acquiring Indian information technology (IT) and software services companies.

IT services companies may roll out 8.4-9% salary hikes this year: IT professionals will get average salary appraisals of around 8.4-9% in 2024, close to the average of 8.5-9.1% in 2023, according to data from hiring firm Teamlease Digital.

Media bodies hail SC order on fact-checking unit: Following the Supreme Court’s stay order on operationalising the central government’s fact-checking unit (FCU), the Editors Guild of India and the Association of Indian Magazines said the government can’t be the sole judge, and arbiter of its own affairs.

Startup Mahakumbh

Startup Mahakumbh organising committee members with senior DPIIT officials

The three-day Startup Mahakumbh event took place in New Delhi this week. The gathering was attended by the who’s who of the tech and startup community, along with government officials and Prime Minister Narendra Modi. The government wants to improve India’s global ranking in terms of innovation through events like these.

Conversations revolved around the country’s upcoming deeptech policy where Department for Promotion of Industry and Internal Trade (DPIIT) secretary RK Singh said the policy is in the final stages of inter-ministerial consultations

Further, Prime Minister Narendra Modi lauded the entrepreneurial spirit of Indian youth and asked successful founders to give back to society by supporting young entrepreneurs and academic institutions.

Here’s our detailed coverage of the event: