Also in this letter:

■ All about Indic LLM Hanooman AI

■ IT majors’ returns to investors

■ Byju’s to vacate several offices

Hunger games: Investors at table with appetite for food startups

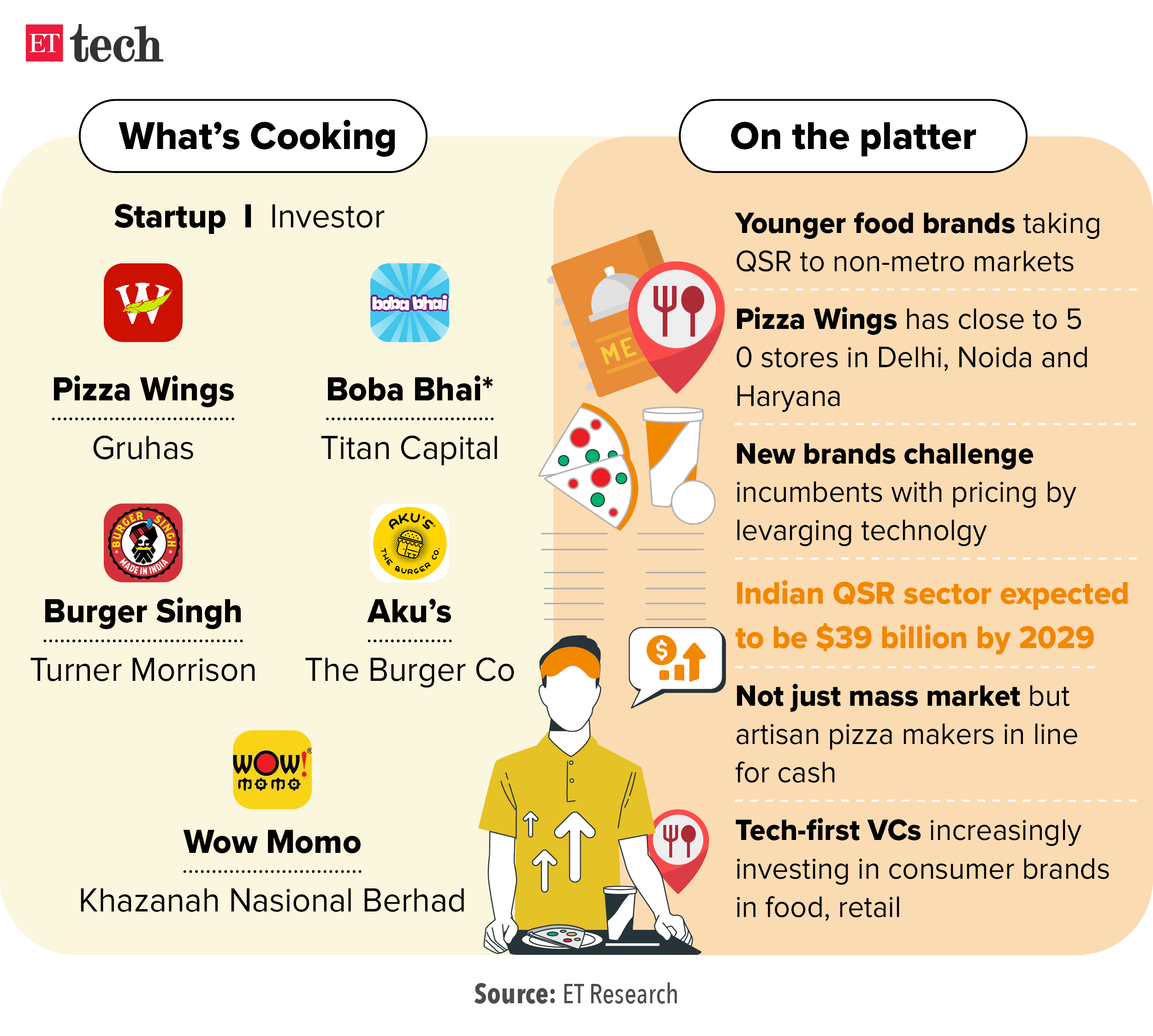

Pizzas, bubble teas, burgers. No, we aren’t talking about a restaurant menu here. New-age food startups selling these products have caught the attention of institutional and angel investors.

What’s on the menu? Pizza Wings and Boba Bhai, which sell pizzas and bubble teas (or Boba tea) are raising fresh capital. Haryana-based Pizza Wings has picked up $4 million from Zerodha cofounder Nikhil Kamath’s Gruhas and Udaan cofounder Sujeet Kumar, while Titan Capital is in talks to back Boba Bhai, sources told us.

Go deeper: Founded by Aditya Dhanda and Rajpal Sangwan, Pizza Wings owns nearly 50 stores and offers products at 10-15% lower price points compared to rivals – this is by leveraging technology. Udaan’s Kumar, an active angel investor, has also been advising the startup on how to scale the venture.

Also read | Tech-first VCs line up for new-age consumer brands, offline businesses

Recent deals: Burger Singh raised its pre-Series B funding led by Turner Morrison Ltd, with participation from Homage Ventures LLP. AKU’s – backed by The Burger Co – has also closed new funding from Vikram Bakshi – former MD of McDonald’s North and East. All-vegetarian pizza chain Cheelizza has raised a small round and is out to get more, while Wow Momo Foods closed a Khazanah Nasional Berhad-led funding in January.

Big picture: “The change in consumption patterns is leading to faster store roll-outs while 4G infrastructure has helped to scale digital footprints and given brands viable business structures,” said Sagar Daryani, who is an investor in Cheelizza. A report from the National Restaurant Association of India estimates the Indian QSR sector at $25.46 billion in 2024, rising further to $38.71 billion by 2029.

Also read | Quick service restaurants’ revenue, margin under severe stress; recovery seems distant: report

Drivers land better incentives in a crowded ride-hailing space

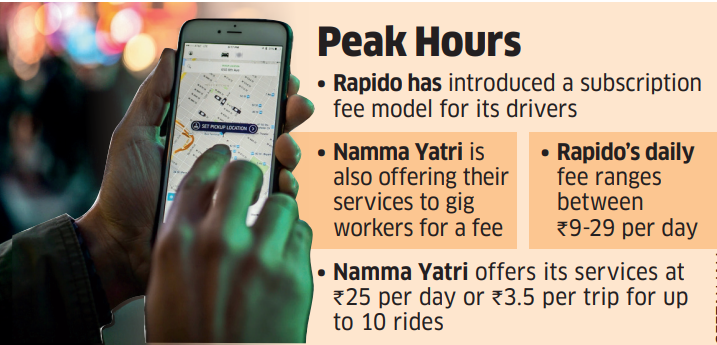

When Uber CEO Dara Khosrowshahi told us last month in an exclusive chat that young upstarts in India’s ride-hailing space were keeping the Silicon Valley giant on its toes, it was for a reason. Newer players in the mobility space are attempting to fix a key gap left unaddressed by larger incumbents — driver commissions. We have details on how cab aggregators have tweaked their models for charging driver partners.

Driving the news: Rapido has introduced a subscription fee model for its driver partners on cabs and autos, doing away with the old structure of commissions on rides. This follows Namma Yatri, a platform which offers services to gig workers for a fee. Indrive is offering commission rates of 10-12% to its drivers in India, lower than 25-30% levied by Uber and Ola. Uber has also started tweaking its commission structure during peak hours to incentivise drivers to stay on the roads.

Intensifying competition: Companies, both old and new, are making attempts to plate up their best offerings to drivers, who are in demand by multiple platforms. Over the last few years, the sector – primarily a duopoly between Ola and Uber – has seen newer players emerge, competing for the same set of customers and drivers. The emergence of rivals such as Rapido, BluSmart and other ONDC-backed players has also made Uber introduce measures to retain its supply.

Also read | While Ola taps new roads, our focus still ride-hailing: Uber CEO Dara Khosrowshahi

Background: Drivers, who are essentially gig workers, have time and again been at loggerheads with larger players like Uber and Ola over their payouts. In 2018, these drivers engaged in wide-scale protests across the country over reducing cash incentives that the platforms initially used to pay.

Also read | New ride-hailing apps racing Uber, Ola for mobility business

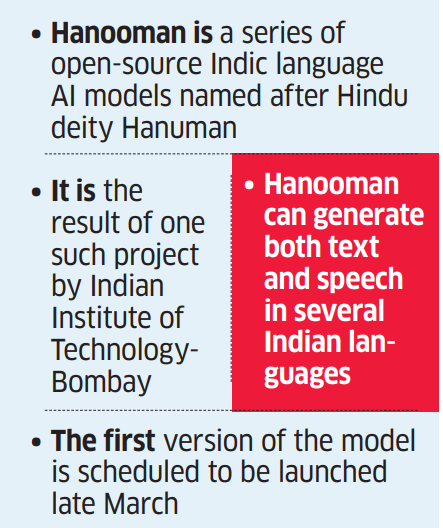

Meet India’s own ChatGPT-style AI model Hanooman

‘Hanooman’, a series of open-source Indic language AI models developed by the Indian Institute of Technology-Bombay in partnership with Seetha Mahalakshmi Healthcare (SML) is scheduled to be launched in late March. Hanooman can generate both text and speech in several Indian languages.

Use cases: Hanooman’s current focus is on addressing challenges faced by healthcare professionals, leveraging automatic speech summarisation to record and summarise conversation of doctors. In the education sector, the model can be used to assist students with their homework and teachers with learning outcome activities. The project has witnessed interest from various other sectors, including banking and finance, and other industries with translational challenges, such as entertainment.

Also read | India to develop its own AI foundational models: MoS IT Rajeev Chandrasekhar

Quote, unquote: “The goal is to build generative AI capabilities for India, marrying Bharatiya linguistic and cultural heritage with technological innovation for catering to the large need for AI in the country,” Ganesh Ramakrishnan, chair professor at the Department of Computer Science & Engineering at IIT-B and the head of the project, told ET in an interview.

Context: The idea of having a homegrown artificial intelligence foundational model gained traction when questions were raised about accuracy and biases against some large language models (LLMs) developed by global tech giants, including Google.

Where does India stand? Indian entrepreneurs have earlier raised questions over the availability of datasets in Indian languages for training of foundational language models. Hanooman’s launch will play into a field of Indian startups such as Sarvam and Krutrim, backed by venture capital investors like Lightspeed Venture Partners and Vinod Khosla’s fund, who are also building open-sourced AI models customised for India.

Also read | Krutrim AI turns unicorn with $50 million funding from Matrix, others

Growth, profitability drive up TCS, HCLTech valuation

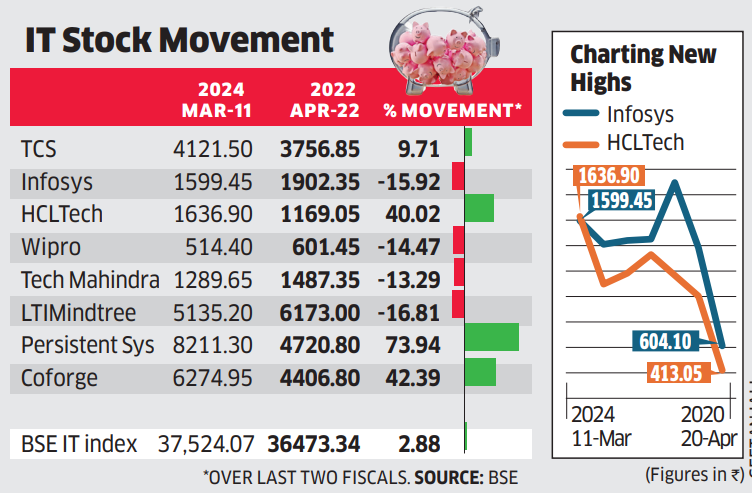

In the past two financial years (since April 2022), only two Indian IT biggies – TCS and HCLTech – managed to deliver positive returns to investors. Infosys, Wipro, and Tech Mahindra, the other major local players, saw negative returns during this period.

Let’s talk numbers: Since April 2022, the IT index has risen by 3%. Here’s how the companies performed in this period:

- TCS’ stock price has increased by 10%,

- HCLTech shares gained 40%

- Infosys, Wipro and Tech Mahindra turned in negative returns in the 13-16% range

Expert take: Despite a tough growth environment in recent quarters, companies demonstrating consistent growth over the past two years have commanded high valuations, experts said. Investors are rewarding businesses that have not only maintained profitability but also managed to increase it even in the face of weak demand, they added.

Also read | Upbeat IT CEOs expecting tech spends to rise in 2024

Other Top Stories By Our Reporters

Byju’s to vacate several offices in cost-cutting drive, may give up HQ partially: Embattled edtech firm Byju’s has initiated a cost-cutting and restructuring drive that includes downsizing some of its smaller assets across the country. To achieve this, the company has identified multiple offices and tuition centers ranging between 500 and 1,000 sq ft across 17 cities.

Hospitality brand Quorum Club secures pre-Series A funding: Lifestyle hospitality brand Quorum Club has secured an undisclosed amount in a pre-Series A funding round led by Gruhas, an investment firm cofounded by Zerodha cofounder Nikhil Kamath and construction equipment manufacturer Puzzolana group president Abhijeet Pai.

Credit platform BlackSoil raises Rs 100 crore: Alternative credit platform BlackSoil has raised Rs 100 crore in equity funding through a rights issue, with participation from its existing Indian investors and family offices.

Battery tech startup Lohum raises $14 million: Battery manufacturing and recycling firm Lohum has raised Rs 119 crore ($14 million) in a funding round led by investment firm Singularity Growth.

Kimbal Technologies secures $5 million: Energy-tech firm Kimbal Technologies has raised $5 million in funding led by investment advisory firm Niveshaay with investors like Ayush Mittal, promoter of Mittal Analytics, and Sandeep Kapadia among others.

Kaynes SemiCon OSAT to move from Telangana to Gujarat | Nearly five months after breaking ground, Kaynes SemiCon is shelving its plans to set up a chip assembly unit in Telangana and is instead moving it to Gujarat, officials aware of the development told ET.

ETtech Explainer: Nvidia hit with AI copyright lawsuit | Three authors are suing Nvidia, a leader in graphics processing units (GPUs), claiming the company used their written works without permission to train its AI platform, NeMo. Read our explainer of what the Nvidia lawsuit says and what these concerns are.

Global Picks We Are Reading

■ AMD’s made-for-China AI chips are too powerful (Bloomberg)

■ Google is getting thousands of deepfake porn complaints (Wired)

■ There is no American Ambani (Rest of World)