In response to the Reserve Bank of India’s (RBI) recent restrictions on Paytm Payments Bank, Paytm CEO Vijay Shekhar Sharma has reassured users that the Paytm app will continue to operate normally beyond February 29.

“Your favourite app is working and will keep working beyond February 29 as usual. I, with every Paytm team member, salute you for your relentless support. For every challenge, there is a solution, and we are sincerely committed to serving our nation in full compliance. India will keep winning global accolades in payment innovation and inclusion in financial services, with PaytmKaro as the biggest champion of it,” said Sharma in a post on X (fromerly Twitter).

The RBI imposed curbs, prohibiting the bank from accepting new deposits or conducting credit transactions after the specified date. However, existing users can withdraw or use their balances without restrictions, and the bank is allowed to credit interest, cashbacks, or refunds into accounts at any time.

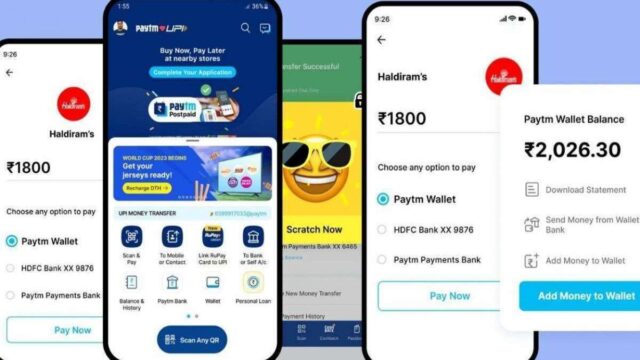

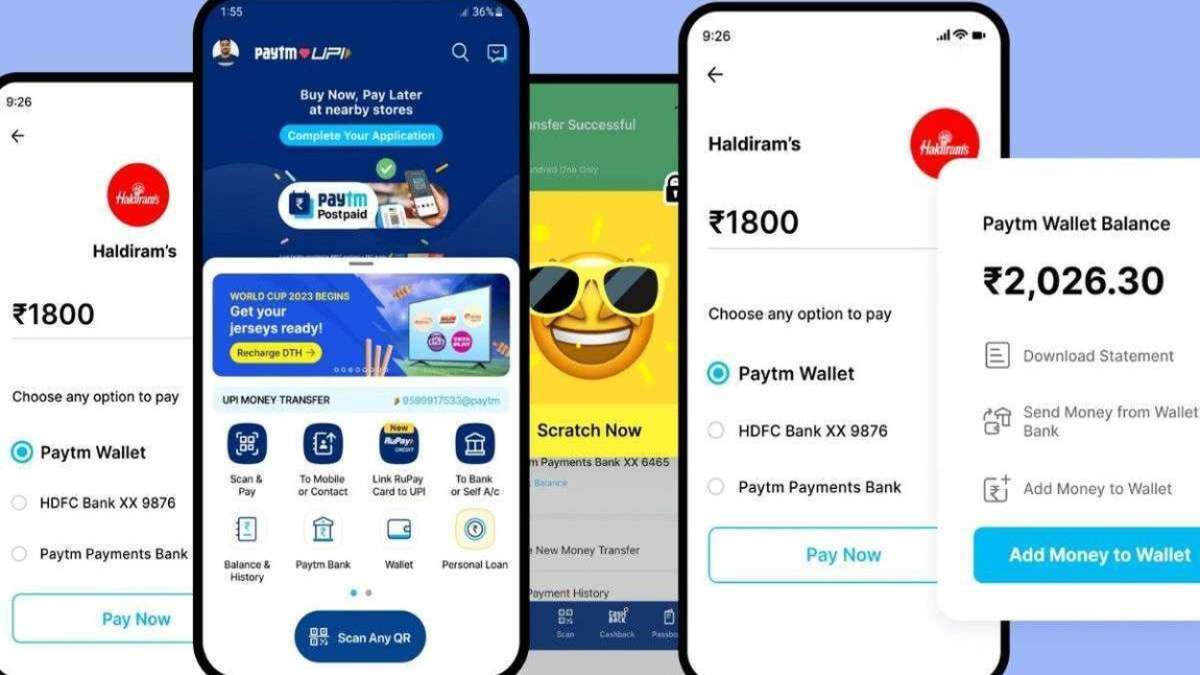

Paytm Wallet Balances

Users can still top up and transfer Paytm wallet balances after February 29, though not through Paytm Payments Bank. Paytm will shift to partnering with other banks for these services.

Deposits

Paytm Payments Bank will not accept new deposits after February 29. Existing users can add funds until the end of February. Services like insurance distribution and loans will remain unaffected.

Paytm remains committed to serving its users and expanding its payments and financial services business in collaboration with other banks. The company is confident in India’s continued success in payment innovation and financial inclusion.

Loans through Paytm

Loans obtained through Paytm from third-party lenders carry no risk, and borrowers must continue making repayments.

“The Paytm Payment Gateway business (online merchants) will continue to offer payment solutions to its existing merchants. Other financial services, such as loan distribution, insurance distribution, and equity broking, are also not in any way related to Paytm’s associate bank and are expected to be unaffected by this direction,” the company said.

Paytm FASTags

Paytm FASTags connected to the Paytm wallet will continue to function normally after February 29, allowing wallet transactions.

Paytm UPI

Paytm Payments Bank users will be unable to make money transfers, bill payments, or UPI transactions through the bank after February 29. Users with UPI addresses linked to other banks can continue transactions as usual.

Stock Trading

The RBI’s directive does not affect stock trading services provided by the Paytm Money app, regulated by SEBI. No changes are anticipated in the sale and purchase of stocks and mutual funds via the app.